Breakfast with Dave November 13th 2017

Thanks to a subscriber for this report by David Rosenberg for Gluskin Sheff. Here is a section:

Indeed. And what we’re referring to is the High Yield bond market which tends to lead equities. Junk bond spreads have widened out to a two-month high of 380 basis points. That is over a 40 basis point widening in barely more than two weeks (and the selling have been taking place on rising volume too…to nearly a two-year high in junk bond ETFs.

As the weekend WSJ aptly pointed out, the bubble hit its peak a couple of months ago when “money losing” Tesla offered up an eight year $1.8 billion with a puny 5.3% yield – which was so oversubscribed in an income starved world that the issue was boosted by $300 million. We are talking about a B3 rated company here. And now in a classic signpost of late cycle behavior, these bonds are trading at 94 cents on the dollar (from par in August).

For the first time in years, planned bond sales are being pulled. And we also are seeing some big redemptions - $2.5billion have withdrawn in the past month.

Here is a link to the full report.

The rally from the 2009 lows was liquidity fueled as central banks flooded the market with new money and bought up bonds to depress yields. That allowed companies to refinance debt at highly accommodative rates and buy back shares with borrowed money. This trend suggests the equity market is uniquely sensitive to credit flows so high yields spreads are worth watching.

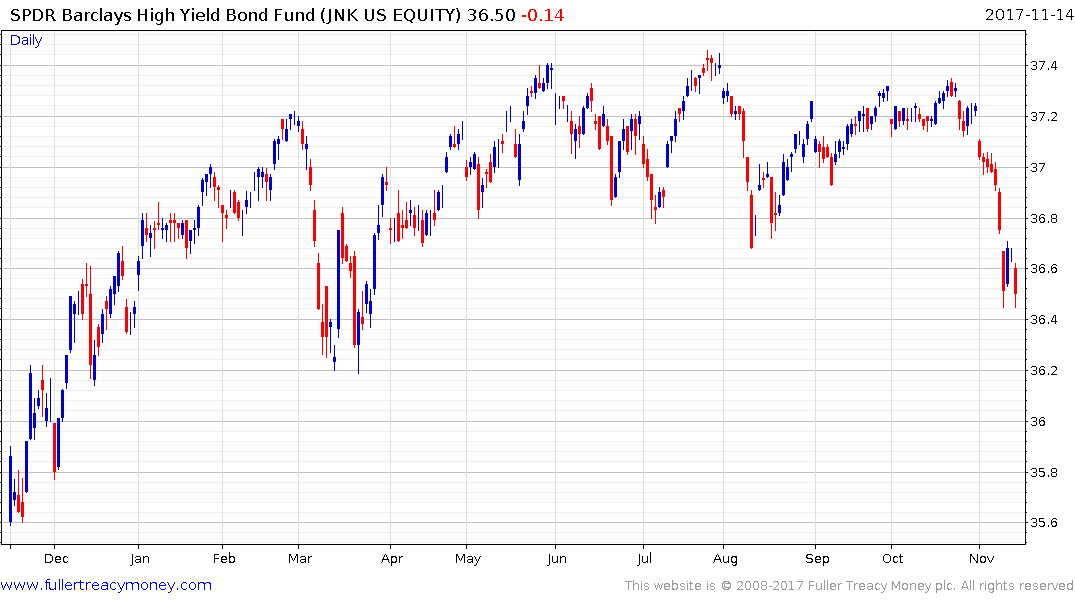

The Barclays High Yield Spread is back testing the region of the trend mean and a sustained move above it would signal a change of trend and return to pricing in more than short-term risk.

The SPDR High Yield ETF pulled back against today to test its lows to retest last week’s low. A clear upward dynamic will be required to question potential for a further test of underlying.