Brazil's New Fiscal Plan Is Cautiously Welcomed by Markets

This article for Bloomberg may be of interest to subscribers. Here is a section:

“The broad ideas are orthodox and the government does agree with the idea of stabilizing debt,” said Katrina Butt, a senior economist at AllianceBernstein LP. “Still, there are some unanswered questions and the government seems to bank on economic growth to be able to achieve the targets, given an increase in the tax burden doesn’t look feasible at this moment.”

The proposal is crucial for President Luiz Inacio Lula da Silva to win over investors, who have been worried about the health of public finances since the leftist leader obtained congressional authorization to boost outlays, bypassing current spending rules that will be replaced by the new fiscal framework. Since then, concerns about swelling debts have helped to fuel inflation expectations keeping, in turn, borrowing costs high.

Brazil was very early in raising rates and now has some of the highest real rates of any country. That begs the question, what will be required for rates to begin coming back down? The fiscal agreement announced today is a step toward placating hawks at the central bank who are reluctant to ease up while the government is talking about major giveaways.

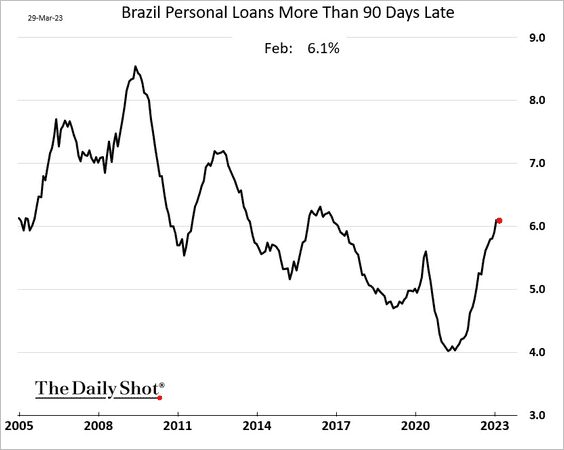

Brazil’s defaults on personal loans are at least a five-year high and have broken the 15-year downtrend. That’s a clear sign of stress in the economy. It’s reasonable to expect Brazil to be among the first countries to cut rates because they were so aggressive in combatting inflation initially.

The Real continues to firm within its base formation and has held a sequence of higher reaction lows for three years.

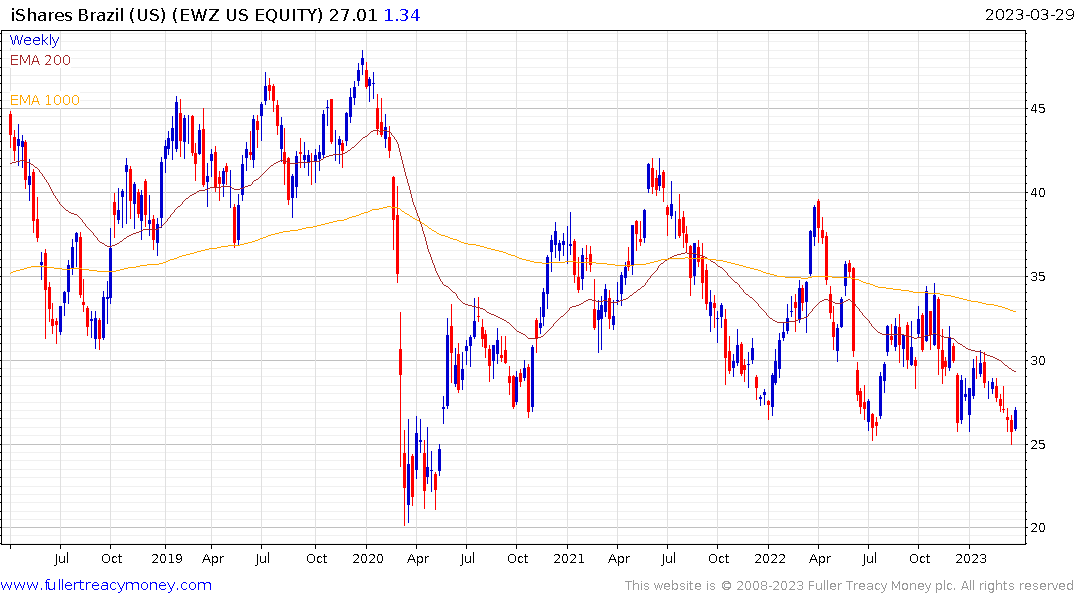

The iShares Brazil ETF continues to firm from the lower side of a yearlong range.