Brazil's Annual Inflation Eases to Lowest Since March 2021

This article for Bloomberg may be of interest to subscribers. Here is a section:

Still, central bankers are now focused on medium-term inflation expectations. “What matters now are estimates for 2024 and 2025, which are much more impacted by fiscal concerns than inflation,” said Laiz Carvalho, an economist at BNP Paribas.

Spending Bill

Indeed, some of President-elect Luiz Inacio Lula da Silva’s cabinet picks have fanned investor concerns over a rise in public debt during his administration.This week, congress approved a proposal that gives the 77-year-old leftist leader an additional 168 billion reais ($32 billion) to spend in 2023. The bill was watered down from a previous version that would have cleared the way for extra spending for two years, providing some relief to financial markets.

Brazil’s central bank has warned that possible changes to fiscal rules may fuel inflation by diluting the impact of its aggressive cycle of interest rate increases. Analysts surveyed by the monetary authority see consumer prices above target through 2025.

In an interview with Bloomberg News this week, former Brazilian central bank chief Arminio Fraga said injecting a large fiscal stimulus at a time of tight labor markets and high inflation “makes no sense.”

Brazil has some of the highest real interest rates in the world with Selic overnight rate at 13.65% and inflation at 5.9%. The central bank is reluctant to declare victory because they are wary of what the new Lula-led government is going to do with spending.

In many respects, Brazil is a case study for what to expect from the rest of the world. Restive populations are in no mood to tolerate austerity or additional cuts to living standards. At the same time, sustaining pandemic spending without a meaningful uptick in productivity and growth is impractical. Then there are the myriad challenges every country is facing with heightened geopolitical stress and climate activism.

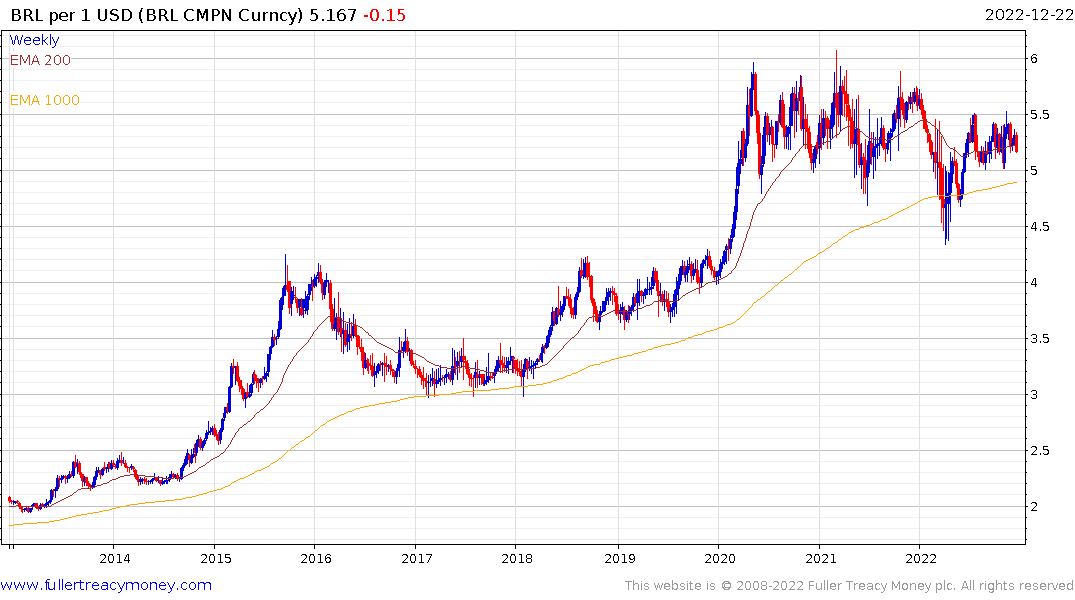

For now at least, the central bank is holding tough against political pressure to ease policy. The Real continues to hold a sequence of higher reaction lows against the Dollar.

The iBovespa Index is rebounding from the region of the 1000-day MA to hold support at the psychological 100,000 level.