Brazil Impeachment Vote May Spell Rousseff's Last Day on Job

This article by Raymond Colitt and Anna Edgerton for Bloomberg may be of interest to subscribers. Here is a section:

The scandal and crisis have taken on a quality of endlessness and many here are growing numb to each development.

A decision from Fitch Ratings to downgrade Brazil’s sovereign credit rating yet again was relegated to page 27 of O Globo newspaper. The detention of former Finance Minister Guido Mantega for questioning this week wasn’t even the top story for most papers.

By law, Temer would be in charge for 180 days or until the Senate permanently ousts Rousseff. She is charged with having illegally tapped state banks and taken loans to cover up budget deficits. Most analysts agree it will be very difficult for Rousseff to recover support in the Senate and avert a final ouster, not least because she will no longer have control over discretionary spending for legislators’ public works projects.

Rousseff is expected to remain in the official residence, but the Senate will determine whether she will lose other executive privileges, such as the right to use the presidential plane, or take a cut of her salary.

Temer aides say that as soon as Rousseff is notified of the Senate vote, he will take office and quickly nominate a new cabinet. Former central bank chief Henrique Meirelles is the front-runner to become his finance minister, they said.

While financial markets have rallied this year on the prospect of a more business-friendly Temer taking over, there are also concerns that an ongoing corruption scandal and wide- spread disillusionment with the political establishment could come back to haunt the 75 year-old constitutional lawyer.

A Datafolha poll published last month showed 61 percent of respondents support Rousseff’s removal from office, while Temer fared only slightly better with 58 percent calling for his ouster.

In addition to the corruption charges levelled against her Rousseff was also unlucky that her premiership occurred during a lengthy decline in commodity prices. With her ouster the potential for reform is still cloudy considering how much of the political establishment are embroiled in the corruption scandals. As a result the makeup of a new cabinet will have a significant bearing on how well the new administration is received by investors. The fact commodities prices have in all likelihood bottomed should act as a tailwind for the economy and leave some room for manoeuvre as the budget deficit is tackled.

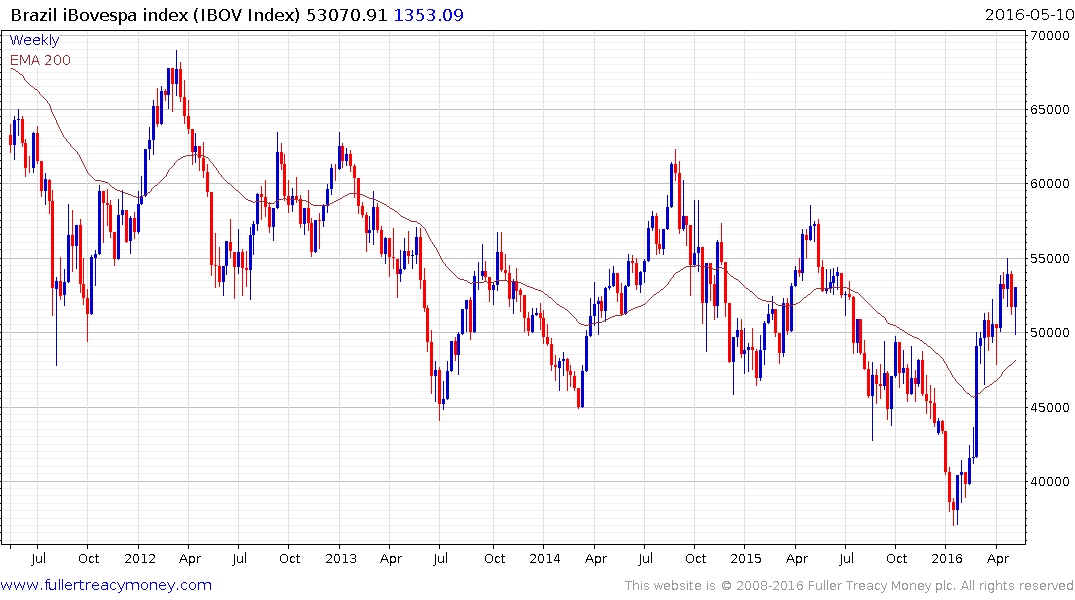

The iBovespa Index has rallied in nominal terms to test the six-year progression of lower major rally highs and will need to continue to hold the region of 50,000 if potential for additional upside is to continue to be given the benefit of the doubt.

The Dollar encountered resistance in the region of the trend mean this week against the Real, suggesting at least some international investors are willing to give the new administration the benefit of the doubt.

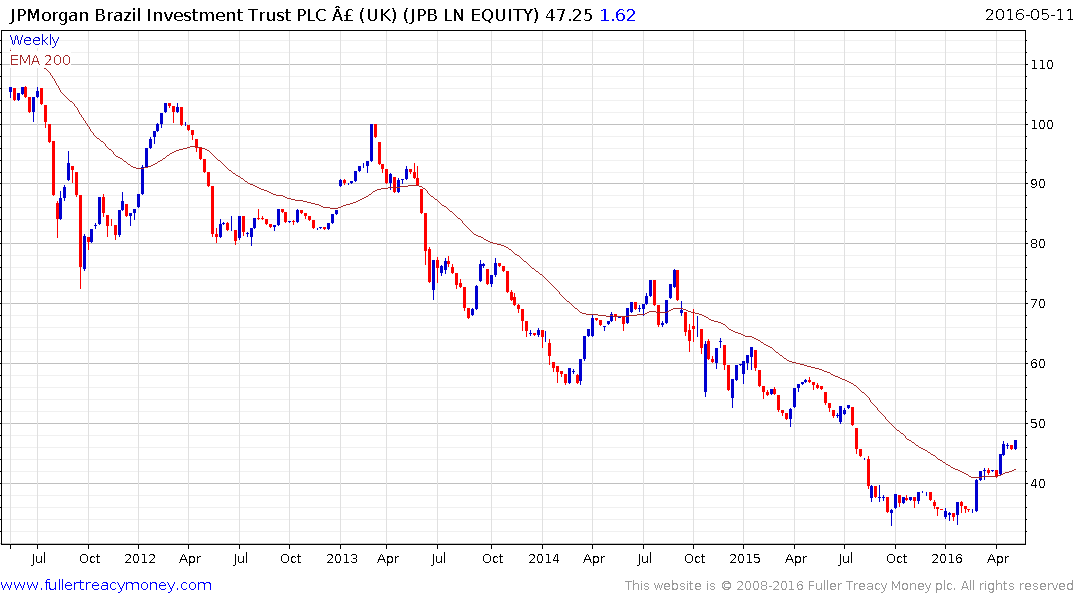

The JP Morgan Brazil Investment Trust (AUM $23 million) trades at a discount of NAV of 8.34% and continues to hold a progression of higher reaction lows. A sustained move below 42.50p would be required to question recovery potential.