Brazil Frost Risk Highest in South Parana Cane Area, MDA Says

This article by Marvin G. Perez for Bloomberg may be of interest to subscribers. Here it is in full:

Southeastern fringes of Parana cane and coffee areas face coldest threat on morning of June 12, Kyle Tapley, meteorologist at MDA Information Services in Gaithersburg, Md., says in telephone interview

Temperatures also to fall below freezing in Santa Caterina, Rio Grande so Sul

“The whole weekend will be pretty cold” with temperatures gradually rising by middle of next wk

NOTE: Parana suffered sugar-cane losses from frost in 2013

Most of threat this weekend remains south of Center-South w/temperatures forecast to drop below avg into 30s degree Fahrenheit, not low enough to hurt coffee, cane or oranges

Citrus trees can be damaged if temps. drop below 28 degrees F (minus 2 Celsius) for several hours w/ coffee at greatest risk below 32 F, and “I certainly don’t see that happening”

NOTE: In recent decades, coffee farms in Parana were moved norrthward, away from high frost-risk prone areas.

The risk of frost to crops that depend on warm temperatures is a non- trivial consideration and helps to explain the recent run up in prices for sugar, coffee, orange juice and soybeans. Perhaps the more important point is to highlight how dependent the global soft commodity sector has become on bumper crops. The after effects of the El Nino and the potential for a La Nina to develop could continue to exacerbate volatility in these markets.

Sugar remains on a recovery trajectory, having broken a five-year downtrend in September. However the advance is now accelerating and the first clear downward dynamic is likely to signal a peak of at least near-term significance and increase the potential for mean reversion.

Arabica coffee surged over the last week to post new 12-month highs but pulled back sharply today. At least an unwind of the short-term overbought condition is now looking likely but a sustained move below the trend mean, currently near 125¢, would be required to question medium-term recovery potential.

.png)

Orange juice hit a new four-year high this week and has so far held the majority of the gain. While there is scope for some additional consolidation in the region of the upper side of the medium-term range, a sustained move below the trend mean, currently near $136, would be required to question medium-term recovery potential.

Soybeans has now rallied for 15 of the last 16 weeks. During that time reactions have been limited to pullbacks of approximately 50¢ so a reaction of greater than that would be required to question the consistency of the move.

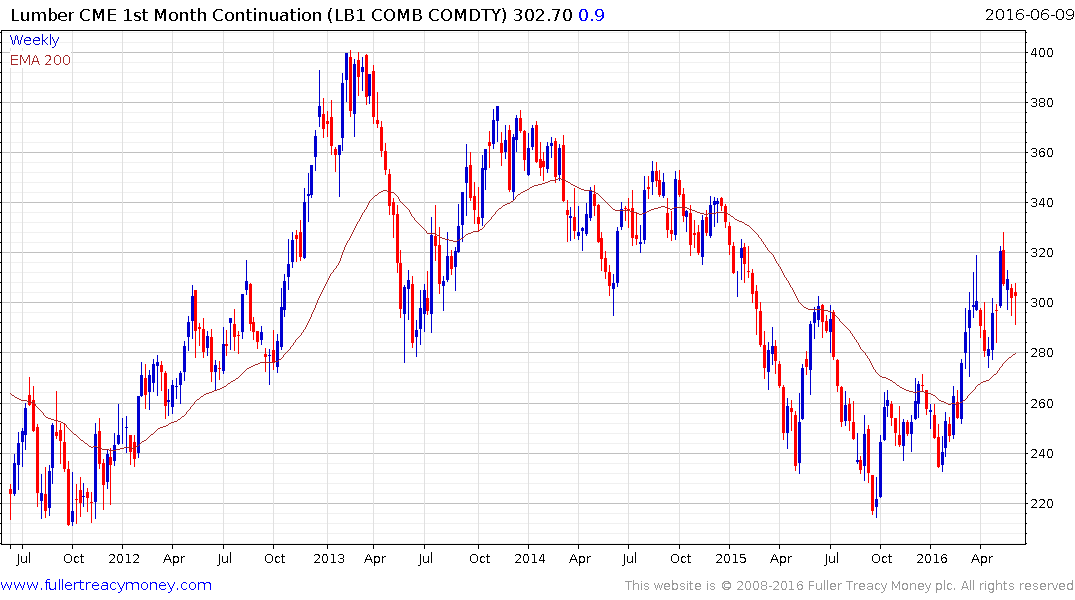

Though not Brazil related both cotton and lumber are also worthy of mention.

Cotton is testing the upper side of an almost two-year base and a sustained move above 68¢ would confirm a return to demand dominance beyond the short term.

Lumber has been moving its limit with surprising regularity of late and rallied today to hold the progression of higher reaction lows by finding support in the region of the trend mean.