Bonds are the sentinels in the sequence of recovery

Thanks to a subscriber for this report from Amundi. Here is a section:

Phase 2: things have to get worse before they get better, and this means there are aggressive policies to come (more so if Biden wins). This bodes well for a recovery that should further support a rotation towards cyclical themes as we enter 2021. This should favour equities, which could have more upside potential vs HY credit, which could be less appealing on a risk/return basis at current valuations. A rotation from super-high-growth stocks into more cyclical and quality value areas will likely materialise. Commodity-related trades could also benefit from this cyclical rebound. The availability of a vaccine would be part of this recovery: markets are pricing in availability in mid-2021 and then an economic reacceleration. Any delay could generate volatility, putting the virus cycle once again at the top of market concerns. Investors should look at opportunities from rotation, while also being mindful of possibly higher volatility. Bonds will be the key sentinels for the next phase. The market will likely start pricing in higher inflation and reflation, leading to the next sequence.

Phase 3: from improving to sustained growth. The next part of the sequence embeds a new round of policy mix and a slow exit from the extreme accommodation seen so far. The measures introduced to fight the pandemic will be very difficult to withdraw, and governments and CBs will probably have to do more. Fiscal and monetary policies will be even more intertwined, making the possibility of further debt monetisation to finance the recovery a likely scenario. Some EM with weak CB credibility could see inflation rise faster amid their recoveries which could trigger higher commodity prices. This might overheat the economy, ultimately leading to some inflation. This could de-anchor the system, which is based on the assumption of low rates forever, and real rates could become more volatile. This phase will be challenging for risk assets and could favour further rotation into equity value, commodities and real assets.

There is really one question to occupy the minds of investors. What is the Federal Reserve going to do about rising long bond yields? All other investment themes flow from the answer to that question.

There is no way the US government can tolerate the additional interest expense that comes with higher yields. There is no appetite for the kind of fiscal austerity that would be required to contain the trend of rising deficits. That’s doubly true following such a tight Presidential election race. Regardless of political wrangling, the supply of debt is going to increase.

That is putting downward pressure on the Dollar which makes Treasury debt less attractive to foreigners. All other factors being equal yields should rise but the Federal Reserve can’t allow that to happen. The only to stop a run-up in yields is to buy at both ends of the yield curve in an outright attempt at yield curve control. Once embarked upon that is a difficult strategy to unwind. That’s why investors are coming around to the conclusion that the modern monetary theory/debt financialisation will have to be accompanied by concurrent financial repression where yields are not allowed to rise.

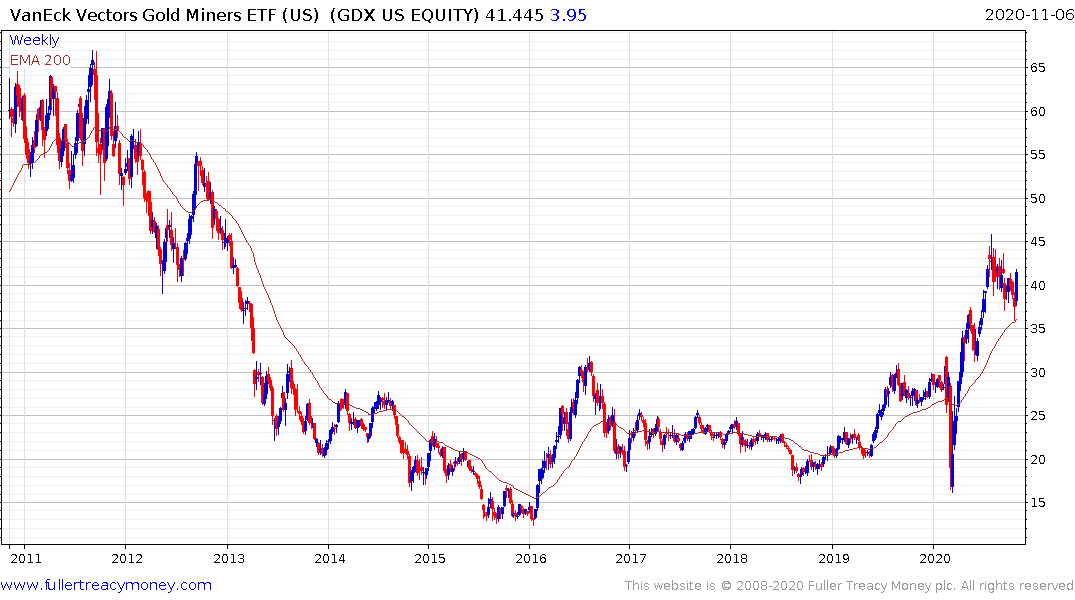

That is why bitcoin, gold and emerging markets have all recently turned to outperformance.