Bond Traders Focus on Uptick in Inflation as Treasuries Decline

This article by Eliza Ronalds-Hannon for Bloomberg may be of interest to subscribers. Here is a section:

Treasuries declined, reversing earlier gains, after data showed a measure of inflation climbed in the first quarter by the most since 2012 even as the U.S. economy expanded at the slowest pace in two years.

Benchmark 10-year note yields rose as a bond-market gauge of consumer-price gains, known as the break-even rate, climbed to the highest on a closing basis since July. A Commerce Department measure of inflation tied to personal spending and excluding volatile food and fuel costs advanced 2.1 percent, the most in four years and in line with the Federal Reserve’s 2 percent target.

Fed officials have been looking for signs of accelerating price growth as they seek to tighten monetary policy as peers including the Bank of Japan and the European Central Bank maintain or increase stimulus. Policy makers on Wednesday kept interest rates unchanged and signaled they were in no rush to act. The Fed removed a reference to global risks from its policy statement and emphasized concerns about U.S. economic progress, saying growth in household spending “has moderated” since its previous meeting even as labor-market conditions have improved.

“The various inflation and price trend data are all hovering at or above the 2 percent ‘price stability’ mandate,” said Russ Certo, a managing director at Brean Capital in New York. “You saw a marginally steeper curve,” he said, as “the market is choosing to first shorten duration based on the perception of this data print on overall interest-rate outlook.”

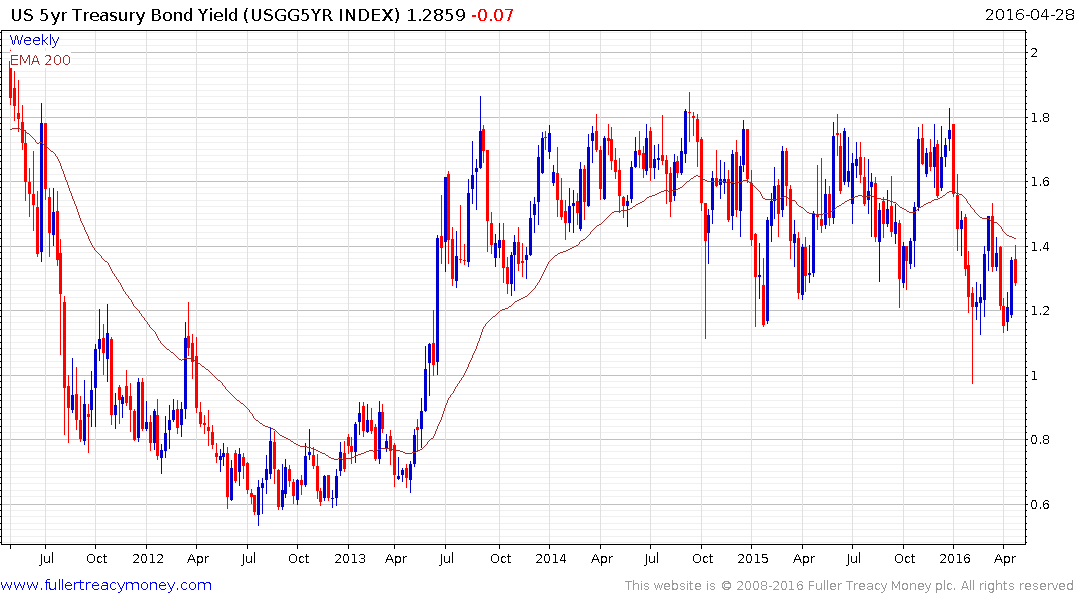

The US 5-year yield is perhaps the best measure of where the most risk lies in the debt markets, since so much of the Fed’s holdings of Treasuries mature within that timeframe. The yield has been rangebound for most of the last three years but has held a progression of lower rally highs since early January. It is now trading in the region of the trend mean once more and a sustained move above 1.4% will be required to confirm more than temporary supply dominance.

With inflation at around where the Fed might be prompted to act, attention will likely next focus on wage growth which was static last month and will next be updated on May 6th. An uptick in wage growth was what prompted the Fed to hike rates for the first in almost decade last December so what happens with this figure is likely to have a significant bearing on the June decision.