Bond Selloff Shows Risks of China's Efforts to Restrain Credit

This article by john Lyons and Rachel Rosenthal for the Wall Street Journal may be of interest to subscribers. Here is a section:

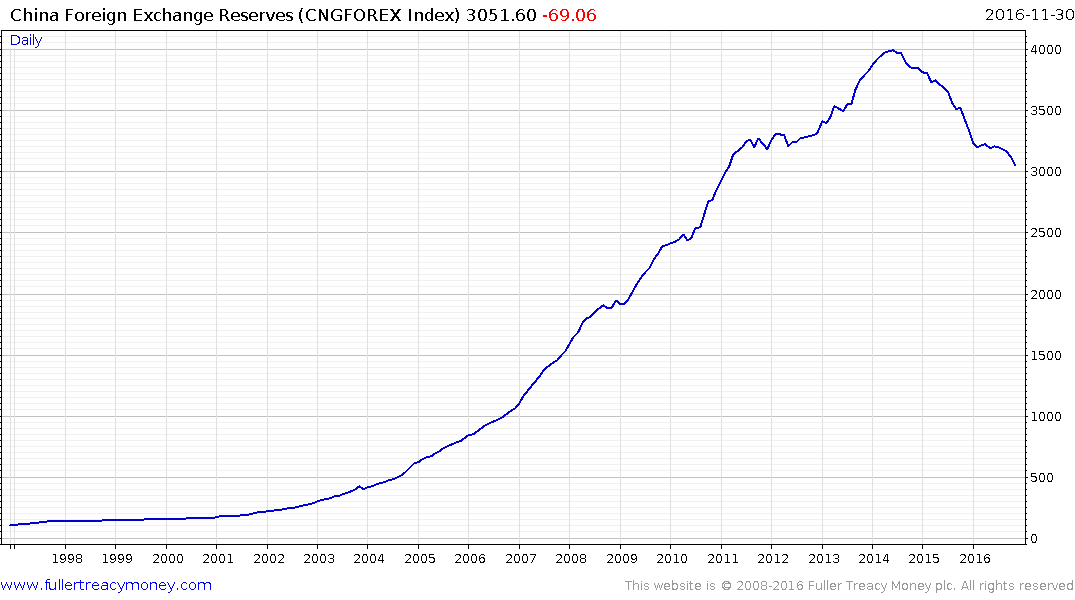

The clearest sign that many Chinese are worried is the amount of money flowing out of China despite strict measures to stop it. China’s foreign reserves have dropped by 21% to $3.05 trillion in the past two years.

Chinese authorities are aware of the risks. On Friday, a senior Chinese government economic working group said for the first time that controlling financial risk and reducing asset bubbles had become a priority, according to a statement reported by Chinese state media. The country’s top decision-making body, the Politburo, issued a similar warning earlier this year.

As much as 15% of the value of bank loans to Chinese companies may go unpaid, researchers at the International Monetary Fund estimate. Even riskier are an estimated $8.5 trillion in off-balance sheet “shadow” finance issued by a matrix of banks and lightly regulated institutions.

A key question now is how much of China’s bond market is owned outright, and how much was bought with money borrowed under murkier circumstances such as shadow finance, raising risks. Analysts estimate leverage in the system overall is between 1.2- and 5-times assets, a relatively low figure, although in pockets of the market it can go much higher.

But since much of the financial system is lightly regulated, the true amount of leverage in the system is unknown. Market experts say asset managers routinely use bonds as collateral to buy more bonds, repeating the process many times over.

Here is a PDF of the full article.

Chinese citizens are allowed to hold foreign currency accounts domestically and there is an annual $50,000 limit per person that can be exchanged. With January 1st swiftly approaching and the Yuan still weak, the potential for even more selling pressure simply based on this legitimate desire to hedge domestic exposure is nontrivial considering the size of China’s population.

Spending any time looking at flatleak.com leads one to the conclusion bitcoin prices are trending higher for no other reason than China represents the vast majority of demand. That could result in one of the cryptocurrency’s periodic pullbacks in early January when the annual exclusion rolls over.

I find it interesting the above article quotes Chinese reserves as $3 trillion while this chart, last updated at the end of November claims $3.5 trillion. It is hard to get a handle on just what the figure is but there is no doubt China is spending a great deal of money attempting to slow the pace of the Yuan’s decline.

Confidence in the ability of the administration of deliver a stable currency is an important consideration. However at some point the rationale for allowing a sharp one-off devaluation in an effort to preserve reserves rather than that the piecemeal but expensive slow decline needs to be weighted. Therefore hedging renminbi even after an almost three-year decline still makes sense.

Another point that is worth highlighting is the lukewarm reception of the Shenzhen Hong Kong Connect earlier this month. The Shenzhen B Shares Index has rolled over. Having encountered resistance in the region of 1200 a clear upward dynamic will be required to check potential for additional downside.

With trillions in government reserves and trillions more in private accounts China has ample capital to tackle the outstanding issues of bad loans, zombie enterprises and leverage. That is not the question. The bigger issue is what price sufficiently discounts the risks posed to the system when the Dollar is rallying and the USA represents an increasingly attractive investment destination. That’s an issue for many emerging markets not just China and suggests 2017 will be a year where nimble trading will probably perform better than buy and hold.