Bond king Jeffrey Gundlach says any year-end stock market rally is going to be derailed by intense tax-loss selling

This article from Business Insider may be of interest to subscribers. Here is a section:

So most investors, whether they own stocks or bonds, should have plenty of opportunities to harvest losses between now and the end of the year. And that means there will be more selling pressure ahead.

"There will be pretty high tax loss selling I would think. I even got a white paper from somebody saying this was the greatest tax loss selling opportunity of a generation. I would say it might be two generations," Gundlach said.

Tax-loss selling is a tax optimization strategy that investors and financial advisors often take advantage of in taxable accounts heading into year-end. The strategy involves realizing losses by selling out of losing positions, and then buying back those portfolio positions 31 days later to avoid the tax wash-sale rule.

The strategy allows investors to realize losses that can offset future realized gains, ultimately helping reduce tax liabilities in the long term.

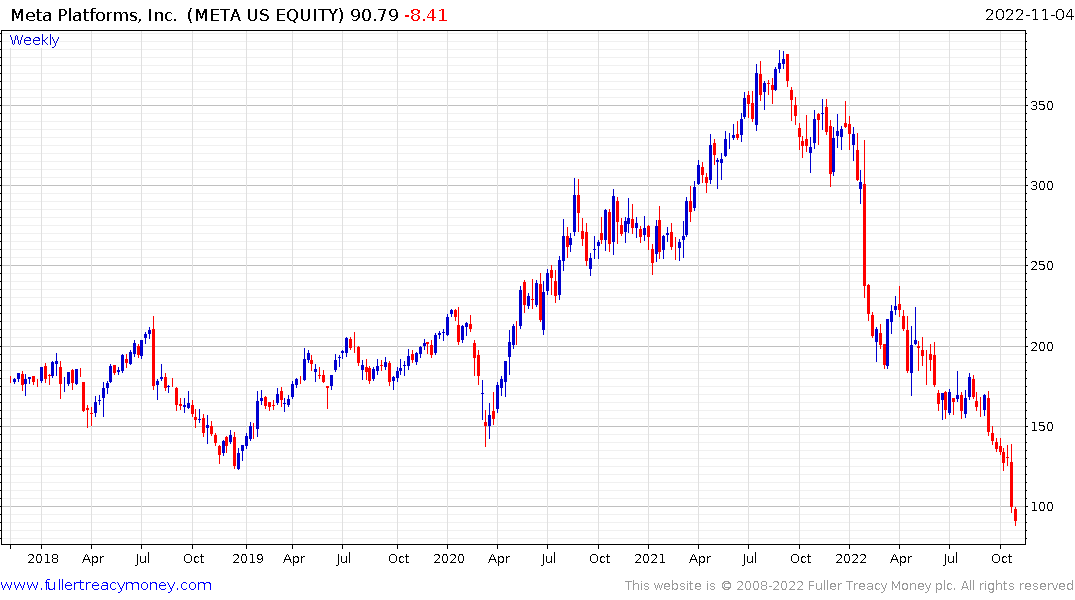

In a year where most people were unprepared for the severity of declines in popular shares like the mega-caps and the innovation sector, investors will be eager to preserve what benefit they can. Realising a loss reduces the tax payable on gains and stores up losses to write off on gains in the future too.

Carvana thrived during the pandemic because the shortage of new vehicles. The share broke below the 200-day MA in December and collapsed in 2022. It is now down 97% from its peak and the share continued to make new lows. This recent weakness is driven by tax selling because not only can investors harvest the tax loss but no one wants to be seen holding the share at the end of the year when annual reports are written.

Opendoor is in a very similar position.

This kind of phenomenon is evident in many volatile years. The worst performers accelerate lower into the end of the year but stage powerful rebounds for a few weeks at the beginning of the next year because everyone who wanted to sell will have done so to harvest the tax loss.

This logic is equally applicable to companies like Meta Platforms and Amazon. They are accelerating lower now but have scope for significant reversionary rallies in the new year.