Bolivian Bonds Jump After Senate Approves Bill to Monetize Gold

This article from Bloomberg may be of interest to subscribers. Here is a section:

The country has burned most of its international reserves and recently faced difficulties to pay for fuel imports. The central bank stopped publishing reserves data in early February, when they stood at about $3.5 billion, out of which $2.6 billion was gold, suggesting only the precious metal is left.

While the Arce administration says the ability to operate with its gold in markets will halt the “low liquidity” Bolivia is going through, opposition lawmakers criticized the bill by saying it’s not a structural solution to the current economic crisis.

Senator Silvia Salame called it a “patch” to allow Arce’s administration to stabilize the country’s situation until the 2025 presidential elections.

Finance Minister Marcelo Montenegro said the gold reserves will be replenished by buying the commodity from local producers

in bolivianos.

Bolivia is not a big holder of gold so that is unlikely to be behind today’s weakness. Instead the prospect of continued rises in the Fed Funds Rate, in response to a stronger than expected jobs report, takes that mantle.

Gold rebounded from the psychological $2000 level intraday. If that level holds during this consolidation, it could be considered the best possible outcome.

Sovereign demand for gold has been surging this year but stress among frontier markets is an evolving issue. Countries don’t generally sell their gold reserves until they absolutely have to, which suggests Bolivia’s Dollar peg is likely to come under strain.

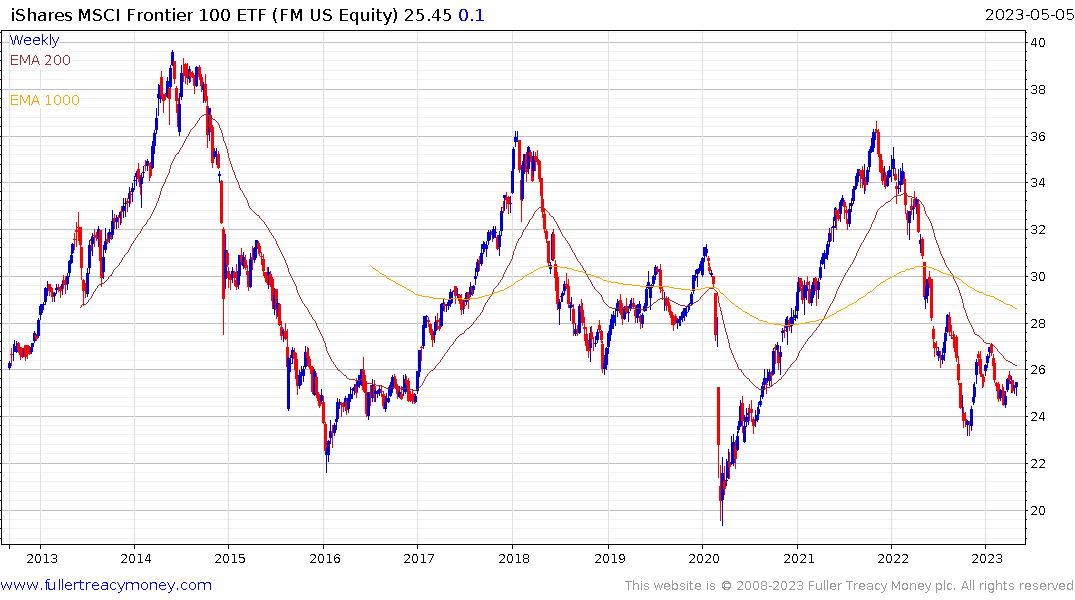

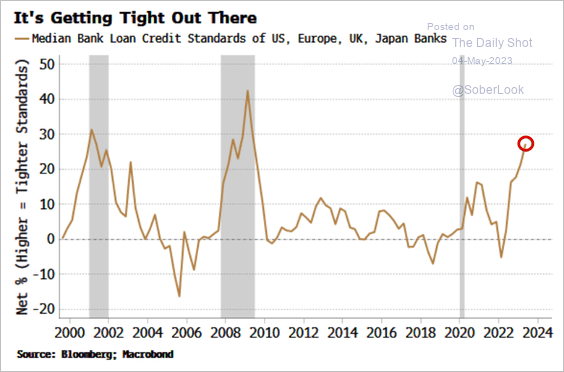

Global credit conditions are tightening and the number of developing markets running into financial difficulty continues to rise. The iShares MSCI Frontier and Select EM ETF’s weightings have largely avoided Latin America. It has a 30% weighting in Vietnam and that is influencing the shape of the pattern. The ETF continues to firm in the region of its lows.