BOJ Wades Into Bond Market After YCC Tweak Triggers Yield Spike

This article from Bloomberg may be of interest. Here is a section:

The purchases are another reminder that Japan’s slow retreat from ultra-loose monetary policy brings a heightened risk of volatility and intervention across multiple asset classes globally. It also underscores the challenge in interpreting a rates regime that is built on gray lines to let the BOJ be flexible rather than clarity for markets.

“That flexibility is obtained with opaqueness on when they intervene,” said Calvin Yeoh, portfolio manager at hedge fund Blue Edge Advisors Pte in Singapore. “Flexibility is another word for optionality, which potentially manifests as volatility. No one knows exactly when, between 0.5 to 1%, does the BOJ step in meaningfully, which is an awfully wide range.”

Japan has been engaged in a version of modern monetary theory for decades. They have been issuing oodles of debt with no real plan to pay it back because deflation prevailed and there was no urgency. While inflation is the stated desired outcome, it does not come without risk.

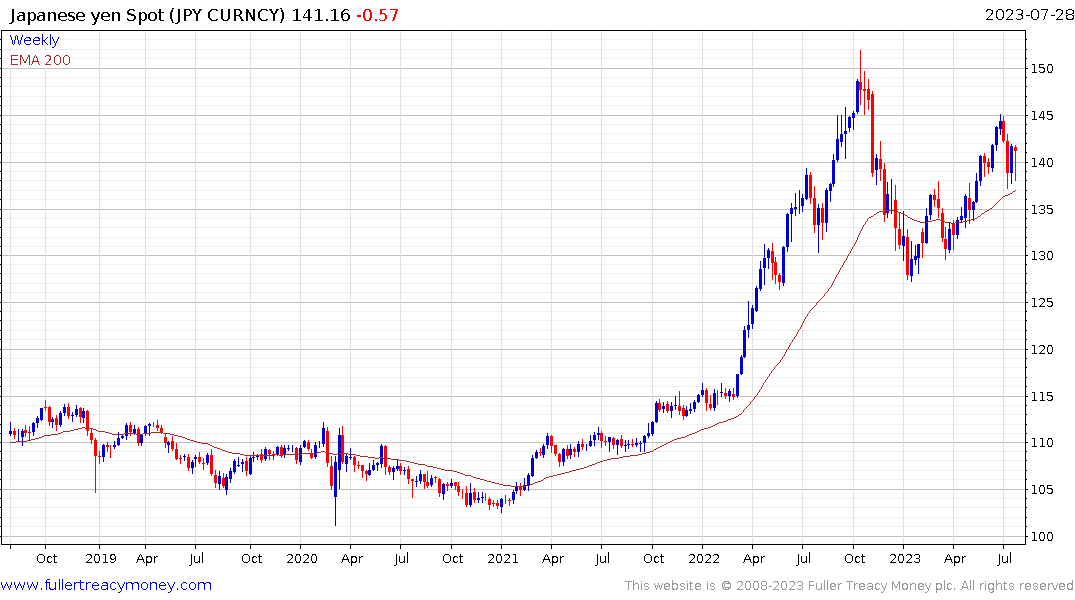

The Bank of Japan is being deliberately obtuse with its new yield curve control policy. The only rational conclusion is they want to raise the level at which they intervene, but do not want a run on the currency. Nevertheless, the 10-year yield extended its breakout today to reassert supply dominance.

The Bank of Japan is being deliberately obtuse with its new yield curve control policy. The only rational conclusion is they want to raise the level at which they intervene, but do not want a run on the currency. Nevertheless, the 10-year yield extended its breakout today to reassert supply dominance.

The Yen followed through on the downside today following Friday’s downward dynamic.

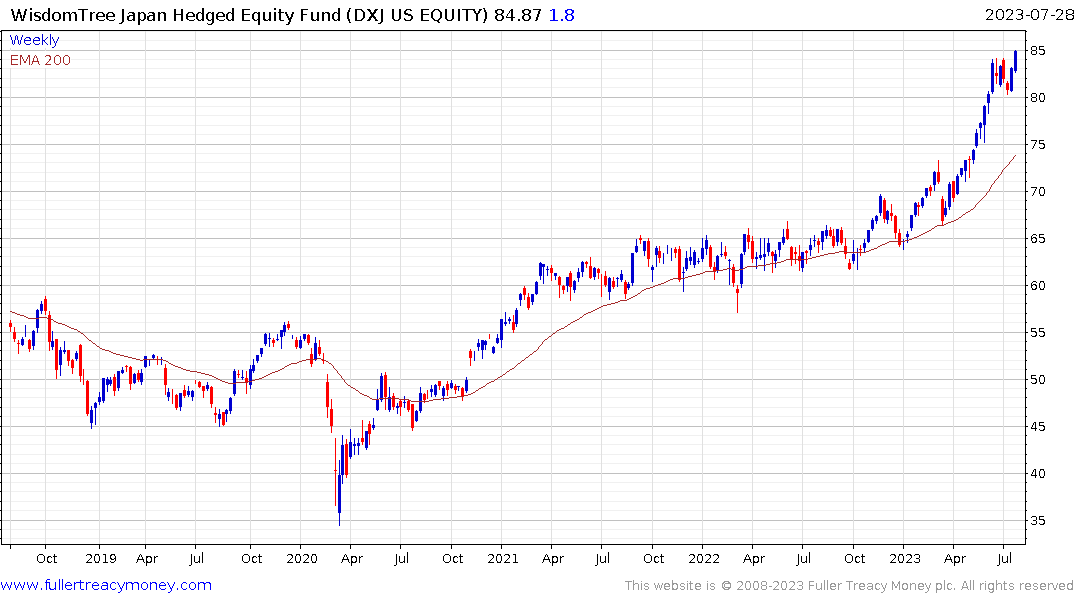

Hedged exposure to Japanese equities is likely to become even more popular as a result. The WisdomTree Japan Hedged Equity Fund continues to extend it uptrend.