BOJ's Ueda Gains Flexibility After Scrapping Guidance on Rates

This article from Bloomberg may be of interest to subscribers. Here is a section:

The central bank also called for a long-term review of its policies and issued new price forecasts that show inflation below 2% again in the fiscal year ending March 2026.

The decision to keep stimulus in place in pursuit of stronger inflation keeps the BOJ in a very different place to its price-fighting global peers for now.

While the wave of policy tightening around the world to weaken inflation appears close to peaking, the Federal Reserve still looks set to push up borrowing costs further when it meets next week.

That possibility still seems a long way off for the BOJ, given a reiterated commitment in Friday’s statement to continue easing with yield curve control. Still, Ueda later clarified that policy could be changed including a normalization during the review process.

“We’re not starting the review with the aim of normalizing,” Ueda said. “But it’s not zero chance we begin normalizing during the review period.”

For now, the risk of a premature tightening move stopping the BOJ from achieving its price target is greater than the cost of a delayed move, he said.

The message from the BoJ is clear. They are not going to begin normalising policy until they are certain deflationary forces have been banished. That could entail waiting until inflation returns to trend internationally so they have a benchmark to compare against.

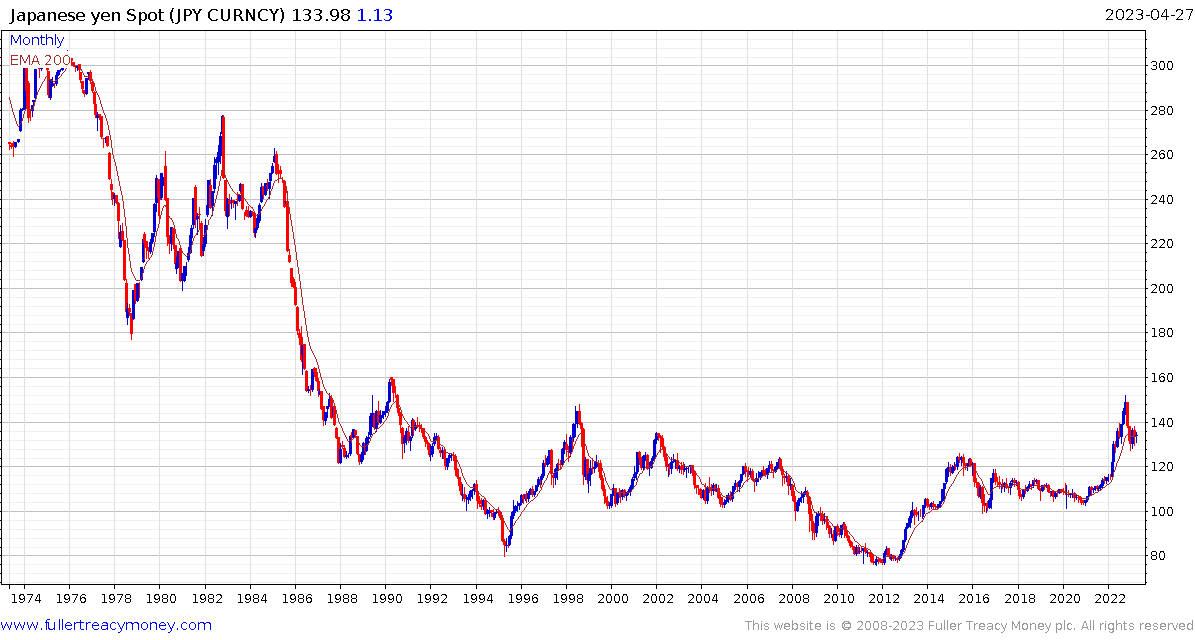

The Dollar jumped against the Yen today and a sustained move below ¥130 would be required to question medium-term scope for continued upside.

The Dollar jumped against the Yen today and a sustained move below ¥130 would be required to question medium-term scope for continued upside.

The Euro is on the cusp of hitting a new 15-year high against the Yen. That’s a significant tailwind for Japanese exporters.

The Euro is on the cusp of hitting a new 15-year high against the Yen. That’s a significant tailwind for Japanese exporters.

The Nikkei-225 has a rounding characteristic consistent with accumulation. A sustained move below 26600 would be required to question recovery potential.

The Nikkei-225 has a rounding characteristic consistent with accumulation. A sustained move below 26600 would be required to question recovery potential.

The Topix Index has first step above the base characteristics and looks more likely than not to break higher.

The Topix Index has first step above the base characteristics and looks more likely than not to break higher.

The willingness of the Bank of Japan to run easy monetary policy represents a much needed source of liquidity for global carry trades.

Back to top