BOJ Ramps Up Yield Control Defense Against Global Debt Rout

This article from Bloomberg may be of interest to subscribers. Here is a section:

The jacked-up moves reflect the BOJ’s commitment to protect its yield-curve control policy even if it prompts further slides in the yen as the Federal Reserve accelerates its rate hike pace. Worse-than-expected inflation data from the US has been a catalyst behind the global market rout this week.

Governor Haruhiko Kuroda insists it’s too early for Japan to step back from keeping rates ultra low, with the economy still recovering from the pandemic and inflation stemming largely from higher energy prices. The vast majority of surveyed economists expect the bank to stick with its policy settings this week.

Still, as the pressure continues to build on the BOJ’s easing framework, speculation smolders on that changes will have to come eventually.

“There’s growing market concern over possible adjustments in yield curve control given the yen is weakening so rapidly,” said Hiroshi Miyazaki, senior economist at Mizuho Research & Technologies.

“The BOJ is likely to be able to keep yields low for 10-year yields, but it remains to be seen whether it can control longer maturities.”

Japan has been trying to ignite inflationary forces for years. Arguably, it was impossible to succeed in that objective because the world was in a secular disinflationary trend. Now that inflationary pressures are ramping higher at the fastest pace in decades, Japan is not about to miss the opportunity to change the population’s psychology.

However, the efforts to influence the yield curve as focused on the 10-year. This chart of the curve highlights how the 7yr through 9yr maturities are higher than the 10-year and the 15-year is more than double those yields. This is creating a significant distortion in the bond market which is only possible because the bank of Japan already owns most of the market.

However, the efforts to influence the yield curve as focused on the 10-year. This chart of the curve highlights how the 7yr through 9yr maturities are higher than the 10-year and the 15-year is more than double those yields. This is creating a significant distortion in the bond market which is only possible because the bank of Japan already owns most of the market.

The Yen closed at a new low today as it continues to extend its downtrend.

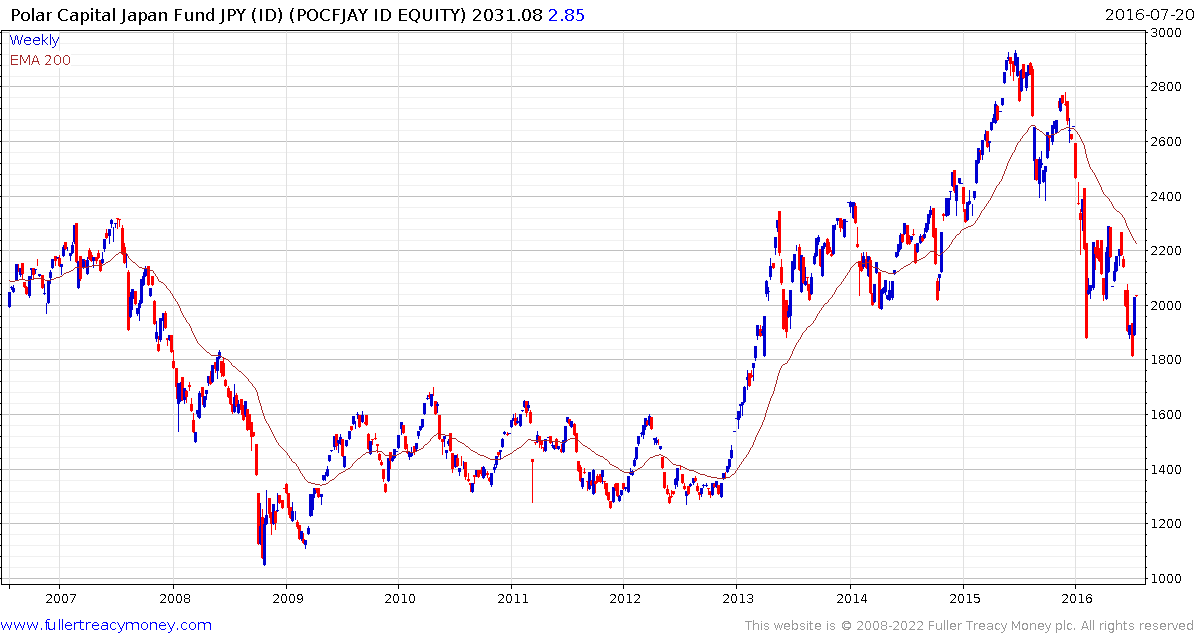

The weakness of the currency has shielded the nominal price of Japanese stocks, but foreign currency investors are bearing the full brunt of devaluation. In US Dollar terms the Nikkei-225 is down 32% from the peak while in nominal terms the decline is only 13%.

In a normal market environment this would create demand for carry trades. The challenge is fixed income securities that would normally attract those kinds of flows are selling off hard.

We don’t see that kind of action very often. There is a central bank that is willing to depress its currency to seed inflation and is holding rates at zero. Its free money in a depreciating currency, but traders have limited options, other than the oil markets, to deploy it.

Back to top