BOJ Jolts Financial Markets But Risk of a Bigger Shock Remains

This article from Bloomberg may be of interest. Here is a section:

The Bank of Japan’s decision to keep its settings unchanged Wednesday gave global investors a modest jolt, leaving markets from the yen to Treasuries at risk from a potentially larger shock if officials opt to shift policy in the future.

Standing pat caught some traders by surprise, but it’s unlikely to douse speculation that the BOJ will normalize policy as inflation in Japan accelerates and Governor Haruhiko Kuroda nears the end of his term. It suggests just a temporary setback to bets on a stronger yen and a bond selloff as analysts say it’s still a question of when — not if — the central bank exits its yield-curve control policy.

Indeed, while Japan’s currency at one stage slumped more than 2% against the dollar in the wake of the decision, it clawed back some ground as the session proceeded, helped by a swath of US economic data that dented the greenback. Japanese government bonds surged as traders covered short positions and stocks pushed higher. US Treasury yields declined.

There were fireworks in Japanese markets this morning as the BoJ demurred from the tampering with its yield curve control policy. However the rebound in bonds and weakness in the Yen were short lived. Traders don’t see yield curve control lasting beyond Kuroda’s tenure.

The Yen rebounded to unwind all of its early weakness and remains in a recovery trend.

JGB yields rebounded emphatically from the 0.40%.

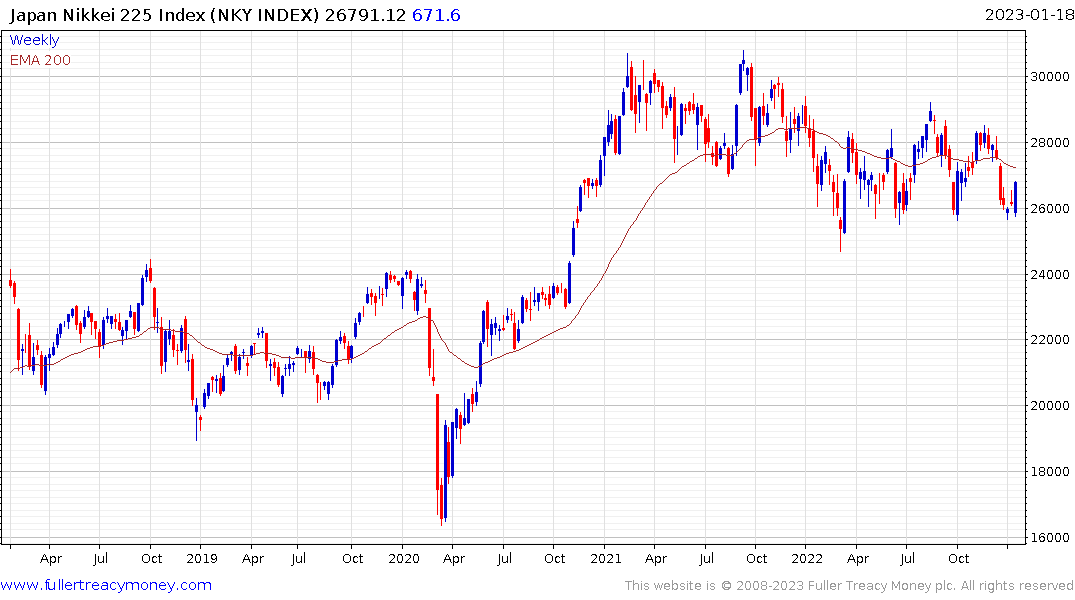

The Nikkei-225 is likely to unwind today’s upward dynamic tomorrow.

The Nikkei-225 is likely to unwind today’s upward dynamic tomorrow.