BofA Is Bearish on Stocks, Sees 'Mother of All Bubbles' in Tech

This article by Nikos Chrysoloras for Bloomberg may be of interest. Here is a section:

Rates shock” in 2022 to follow “inflation shock” of 2021 and “growth shock” of 2020

Financial conditions set to tighten, short rates to rise, QE to end, inverted yield curve a threat, and EPS growth to slow sharply; GDP growth to remain robust with China as outlier

Base case for strategists is low or negative and volatile asset returns in 2022, after “18 months of fat (latterly frothy) returns in crypto, credit and U.S. equities”

2021-2022 investment backdrop is similar to early stagflation of late-60s

Stock market upside could continue if it becomes clear in 1H that Fed is determined to keep real rates deeply negative, “the-mother-of-all bubbles in crypto & tech remains a fat tail”

Biggest downside risk is Fed staying hawkish even if Wall Street corrects, because fears of wage-price spiral grow; more extreme downside risks include a crypto-derivatives crash, geopolitical events related to China and Taiwan, and that a receding liquidity wave exposes credit-events to the detriment of a private or public equity

I have seen a noticeable uptick in talk of a crash over the last couple of weeks. It might be early to think about this is as a consensus view, but it certainly suggests some investors are wary of chasing successive new highs in steep uptrends.

Crashes occur from overvalued levels, when overleveraged players get a sudden dose of reality as liquidity evaporates. Bull markets thrive on liquidity so anything that questions the flow of new money needs to monitored.

Financial conditions remain close to record lows, high yield spreads are also close to record lows, the advance-decline lines for major indices are still trending higher, government spending is still accommodative. Major sources of new liquidity, particularly from China, are lining up. Oil prices are steady to rising, they are not surging higher.

The Nasdaq-100’s downside key day reversal will lend some credence to the risk of a mean reversion from a short-term overbought condition. Downside follow through tomorrow would confirm a near-term peak.

The FANGMANT shares continue to exhibit relative strength. This bull market cannot end without the leaders turning to underperformance.

The announcement that Jay Powell will remain as Fed chair suggests less dovishness than a Brainerd leadership. That was cause for a significant drawdown in gold, bitcoin, Treasuries as well as the Nasdaq-100 today.

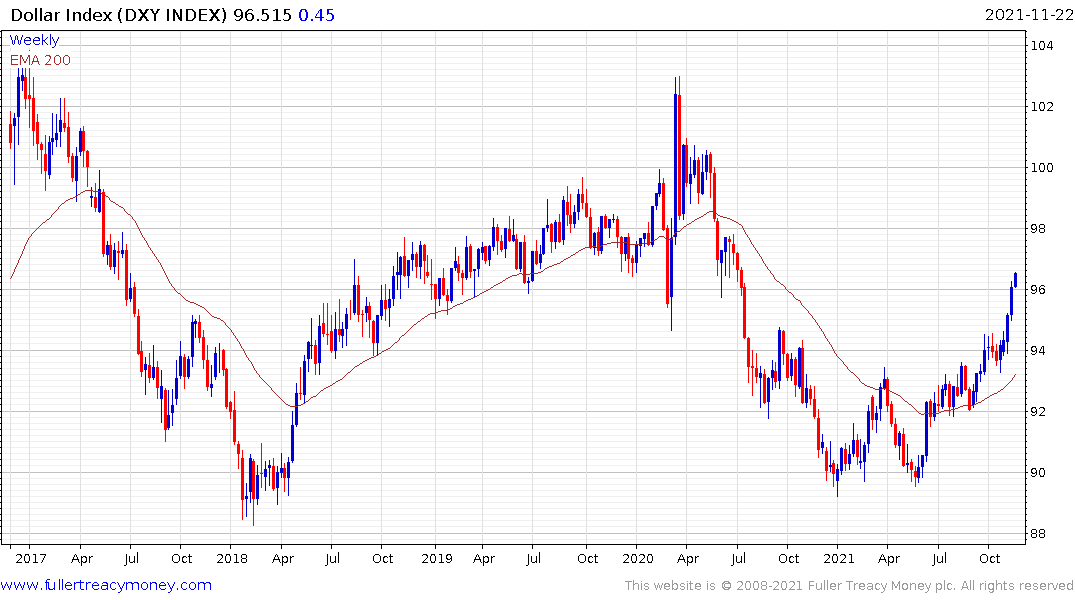

Meanwhile, the Dollar's rebound continues to be extended.

Headline inflation continues to make sensational headlines. Germany’s potential for a 6% rate at this week’s print is a good example. Loopy statistics were inevitable following the 2020 crisis and the subsequent rebound. It’s going to take another year for them to settle down.

The pandemic has resulted in a demand shock to accompany the earlier supply shock. Everyone now wants to live their best life and are impatient for results. That kind of mentality is going to put further upward pressure on prices. The pandemic resulted in a step higher for prices, central banks are still waiting to see if that is a trend or a one-off event. That suggests a very slow pace to normalisation which is good for risk assets despite near-term scope for some consolidation.

Back to top