BOE Gold Trades at Rare Discount in Sign of Central Bank Selling

This article from Bloomberg may be of interest to subscribers. Here It is full:

Gold stored at the Bank of England has been trading at an unusually low price, in a sign that central banks may be shedding some of their holdings.

The Bank of England’s vaults contain 5,676 tons of bullion, one of the largest stockpiles in the world, which it holds on behalf of other central and commercial banks. Gold held by central banks is typically bought and sold between large institutions in bilateral trades at prices usually within a few cents of the market rate.

In recent days, however, gold at the BOE traded as much as a dollar an ounce beneath benchmark London prices, according to traders familiar with the matter. Such a big discount usually indicates a big institution like a central bank selling a sizable amount of reserves to raise US dollars or other currencies, one of the traders said.

Central banks expanded their gold holdings by almost 456 tons in 2021, according to the latest World Gold Council data, in a long-running trend driven by emerging markets diversifying their reserves away from foreign currencies. Notable buyers included Brazil, Thailand and Ireland, which made its first purchase since 2009.

Buying may slow during 2022, with financial institutions looking to hold more interest bearing dollars as the Federal Reserve gears up for aggressive monetary tightening. The greenback is on track for its biggest annual increase in seven years, putting pressure on the currencies and borrowing costs of emerging market nations.

The BOE gold discount has narrowed since the dollar-an-ounce margin, but remains large by normal standards, said the people, who asked not be identified discussing private information. Bullion has slipped more than 12% since peaking in March, leaving it close to unchanged this year.

A spokesperson for the BOE declined to comment on the discount.

Central bank gold selling is a clear sign of distress at the strength of the US Dollar. The rising cost of importing commodities and dearth of new Dollars following the end of QE and impending QT mean countries are scrambling to source Dollars.

That’s likely been a contributing factor in the weakness of gold despite the inflationary backdrop. The tide may be turning for the Dollar. Most of the big run up over the last six months has been supported by interest rate hike expectations.

Today’s biggest concern is about growth and stagflation. If central banks are inhibited from raising rates as much as they would like because growth and interest expense are insurmountable pressures, there is no reason to continue to be long Dollars. At a minimum, the short-term overbought conditions could be unwound.

Gold continues to firm from the $1800 area. That means it is also holding the yearlong sequence of higher reaction lows. If growth concerns continue to trump worries about higher rates, there is significant scope for reignited interest in gold.

10-year yields broke below the psychological 2.8% level today to trigger a midpoint danger line stop. That suggests bond investors are betting growth is dent the Fed’s appetite for raising rates.

10-year yields broke below the psychological 2.8% level today to trigger a midpoint danger line stop. That suggests bond investors are betting growth is dent the Fed’s appetite for raising rates.

The Yen is now also strengthening and rallied today to post a new recovery high. An unwinding of the oversold condition relative to the 200-day MA appears likely.

The Yen is now also strengthening and rallied today to post a new recovery high. An unwinding of the oversold condition relative to the 200-day MA appears likely.

Since rising UK inflation is a major topic of conversation I was reminded of this comment by David and I was also surprised to find it was so long ago. (August 2010)

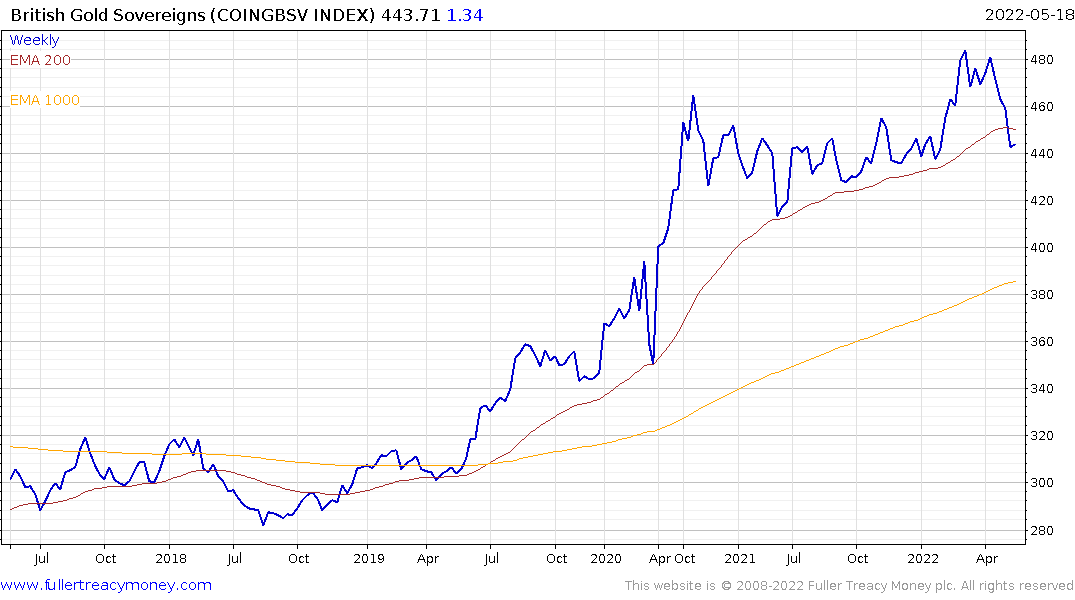

Julian Baring - a splendid character who founded what is now the BlackRock Gold and General Fund, loved to value bullion on the basis of whether or not a gold sovereign would pay for dinner for two at the Savoy. Basically, gold was undervalued if a sovereign would not cover the cost of dinner, and overvalued when the price exceeded the cost of a good dinner. Today's price for a gold sovereign is £185, just enough perhaps to buy dinner for two at the Savoy, including a glass of champagne and a carafe of house claret.

Gordon Ramsay has since taken over the restaurants at the Savoy and the price of a sovereign today is £443. From a perusal of the menu, the food would cost about £200 so the cost of a glass of champagne and house claret suggests a sovereign is still about fair value.

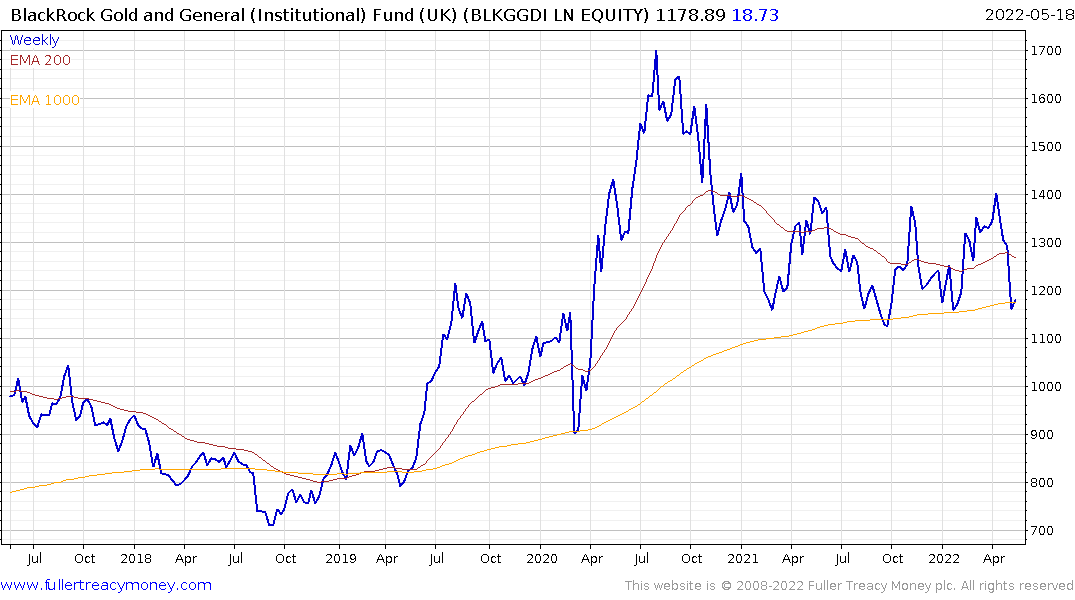

The BlackRock Gold and General Fund is currently steadying from the region of the 1000-day MA.

The BlackRock Gold and General Fund is currently steadying from the region of the 1000-day MA.

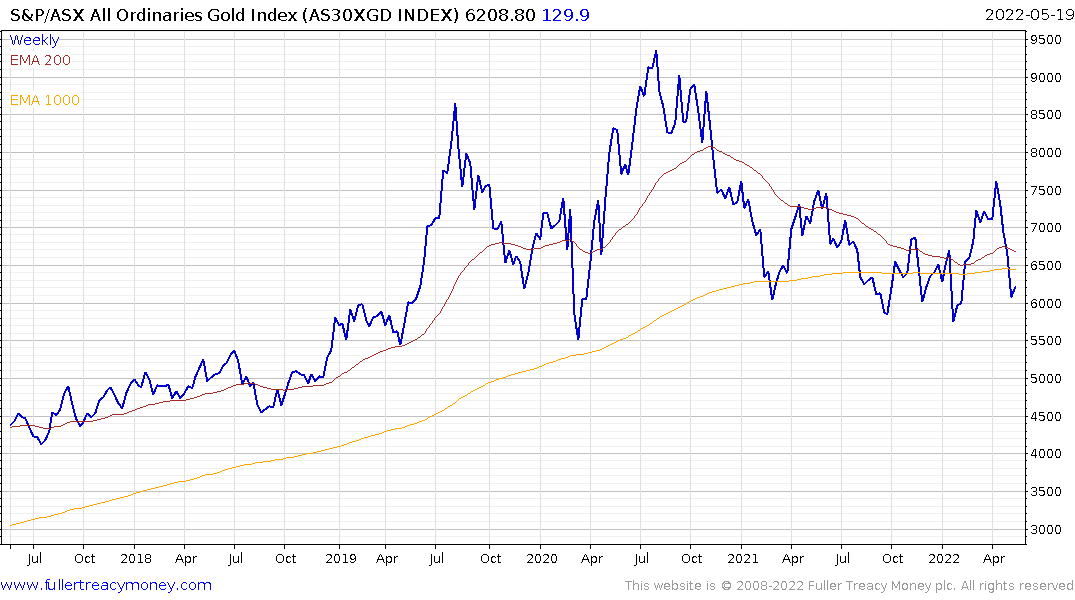

Interestingly, the fund shares a high degree of commonality with the S&P/ASX All Ordinaries Gold Miners Index despite the currency differences.