BOE Gives a Lesson in Honest Central Banking

This article by Mohamed El-Erian for Bloomberg may be of interest to subscribers. Here is a section:

The Bank of England is reminding the world what a politically independent central bank can and should do: act as a “trusted adviser,” willing to share analytically honest views that other more politically sensitive institutions are either unable or unwilling to do.

Of course, this is not a risk-free approach. Such honesty — rather than catalyzing appropriate responses from policy-making agencies that lead to better economic and social outcomes — can provoke household and corporate behaviors that accelerate the bad outcomes. Yet the risks involved are worth taking, especially when the alternative is a central bank that loses institutional credibility, sees the effectiveness of its forward policy guidance erode and becomes even more vulnerable to political interference.

It should also be noted that the UK’s situation differs in some important way from those of other countries. The country’s economic challenges are complicated not only by the energy price catch-up but also by the political transition and the changing nature of the country’s relations with its trading partners.

In the last six weeks gilt yields have pulled back aggressively from 2.75% to test the region of the trend mean around 1.75%. This is the first area of potential resistance and is the point at which traders will begin to question how likely a long-term low interest rate environment is.

The Bank of England is both raising rates quicker than normal and simultaneously plans to reduce the size of its balance sheet. Both those policies are deflationary which means they will hit economic growth, kill off demand and bring prices down. They are not pretending this will be an easy process.

The Bank of England is both raising rates quicker than normal and simultaneously plans to reduce the size of its balance sheet. Both those policies are deflationary which means they will hit economic growth, kill off demand and bring prices down. They are not pretending this will be an easy process.

The wrinkle in implementing this policy is the UK’s preponderance of adjustable rate-mortgages. That accelerates the transmission mechanism of monetary policy and pushes it directly onto consumers. The twin forces of rising energy bills and higher mortgage/ rent payments is not exactly politically palatable.

Andrew Bailey is doing a very good job of talking the market down. The committee is inhibited from being too aggressive because of the idiosyncrasies of the UK economy, so talking in a very bearish manner is helping to get the message across.

The populist tenure of Liz Truss’ campaign for the leadership of the Conversative Party reflects this conflict. If by some miracle she successfully tackles bureaucracy, that would be a great victory for the UK’s growth potential. Sometimes it really is about getting out of your own way.

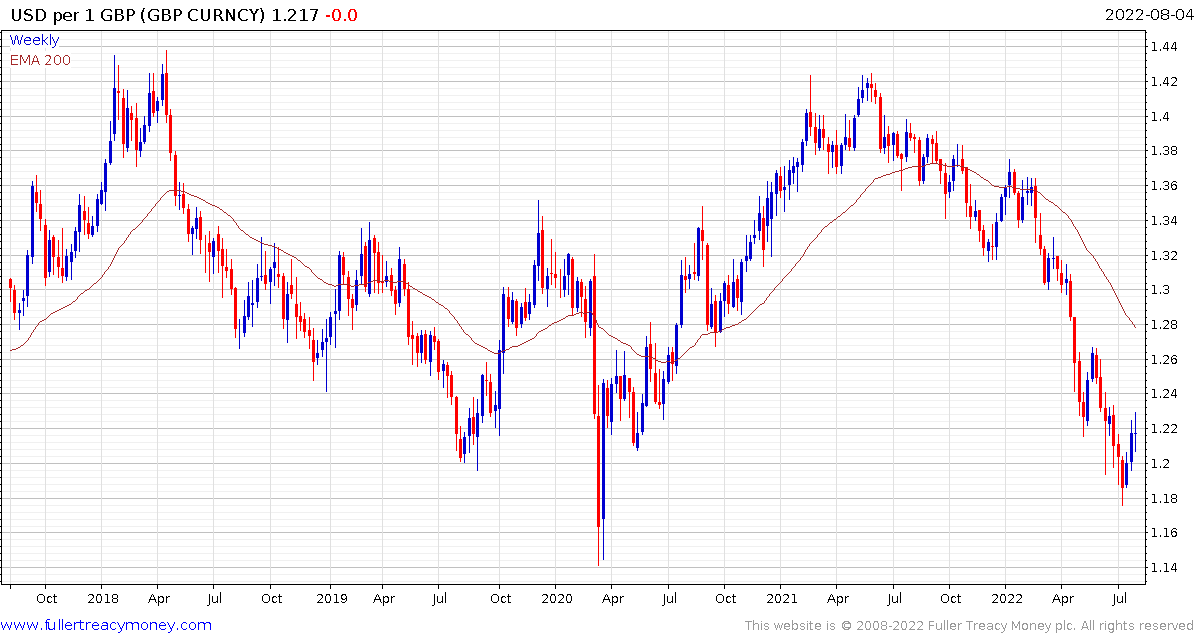

The Pound unwound the short-term oversold condition, but the medium-term downtrend is still in play.

The Pound unwound the short-term oversold condition, but the medium-term downtrend is still in play.

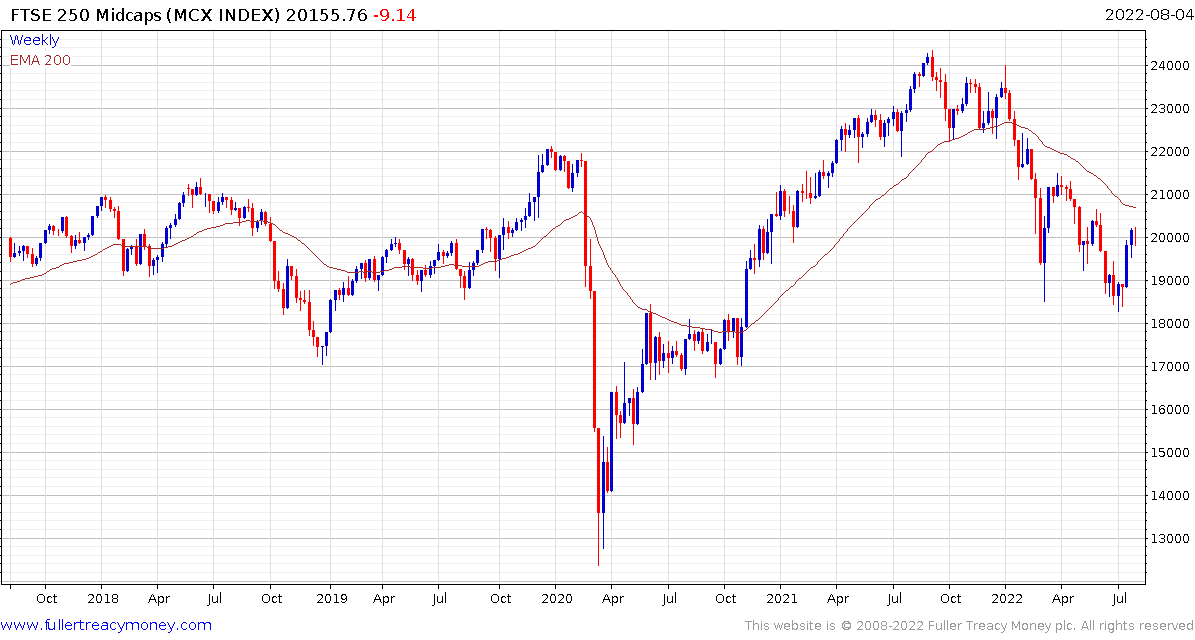

The FTSE-250 is at the first area of potential resistance, in the region of the 1000-day MA and the sequence of lower rally highs. A sustained move above the June high at 20,700 would signal a return to demand dominance beyond short-term steadying.

The FTSE-250 is at the first area of potential resistance, in the region of the 1000-day MA and the sequence of lower rally highs. A sustained move above the June high at 20,700 would signal a return to demand dominance beyond short-term steadying.

In just the same way that inflation has been global phenomenon, tightening financial conditions have been global too. That suggests there is scope for slowing global growth to take the edge off inflationary pressures in several countries without the need for aggressive hiking. Slowing Chinese growth for example could significantly reduce commodity price strength.

Back to top