Blackstone Says Private Credit Is Coming for Asset Based Debt

This interview of Blackstone’s co-head of asset-based finance maybe of interest. Here is a section:

As the cost of private capital is higher and there’s just less of it around, will consumers end up struggling?

Something that deserves acknowledgment is how smooth this volatility has been for consumers. In 1994, when interest rates spiked, there was a lack of credit that made the Fed cut rates by July of ’95. This year, we’ve had both bank failures and rapid interest rate increases. And now we are seeing a symbiotic relationship between banks and private credit, where lending gaps are being filled instantaneously.

From my perspective, it’s been remarkable that we haven’t had a larger contraction of credit at the consumer level. That’s probably one of the things encouraging a lot of people to change their calls to a soft landing – if credit was unavailable and with the consumer being two-thirds of the economy, we might have a different outcome.

The volatility of the asset backed securities markets this year and last year also contributed to more companies turning to private lenders. But is the trend here to stay?

The public ABS market is a great option for originators to distribute risk and raise capital. But we are talking with companies and banks who use ABS about how to diversify their funding models. We’ve bought loans from these firms, be it consumer or other types of loans, when the securitization markets were active.

The volatility in the ABS market last year reinforced what we’ve supported for a long time: The importance of having a diversity of funding sources such as securitization, forward flow and balance sheet. Partnering with private credit managers that can provide capital from longer-dated insurance liabilities is a great way to achieve this, where there isn’t the dynamic of demand deposits that can disappear overnight. We believe that every originator should be thinking this way.

Two primary factors tend to drive a bull market in financial companies. These are new product offerings and the absence of regulation. Together, enterprising salespeople have the capacity to grow the leverage in a sector to unimaginable scale.

In the early 2000s credit derivatives were a new product and securitisation was not well understood. That allowed leverage to reach dizzying heights. It was not until the global financial crisis that the risk inherent in these structures became obvious. The focus of subsequent regulation focused on ensuring banks would not be able to take those kinds of risks again.

Into that void stepped private equity groups. They have the same access to liquidity as banks but avoid the regulatory burden. Developing private credit and deploying it in the same kind of securitisation deals as prevailed in the early 2000s is a proven money maker for as long as it lasts.

Blackstone continues to rebound. It has broken the downtrend, bounced from the region of the 200-day MA and make a new recovery high today.

That is spectacular relative strength compared to the wider bank and regional bank sectors.

Blackstone’s recovery is much more in tune with the S&P500 Insurance sector.

The outstanding question is how robust the business model will be when faced with a struggling consumer. That has not happened yet, but the price action suggests investors are convinced a soft landing is inevitable. The benefit of the doubt can be given to the upside provided the sequence of higher reaction lows remains intact.

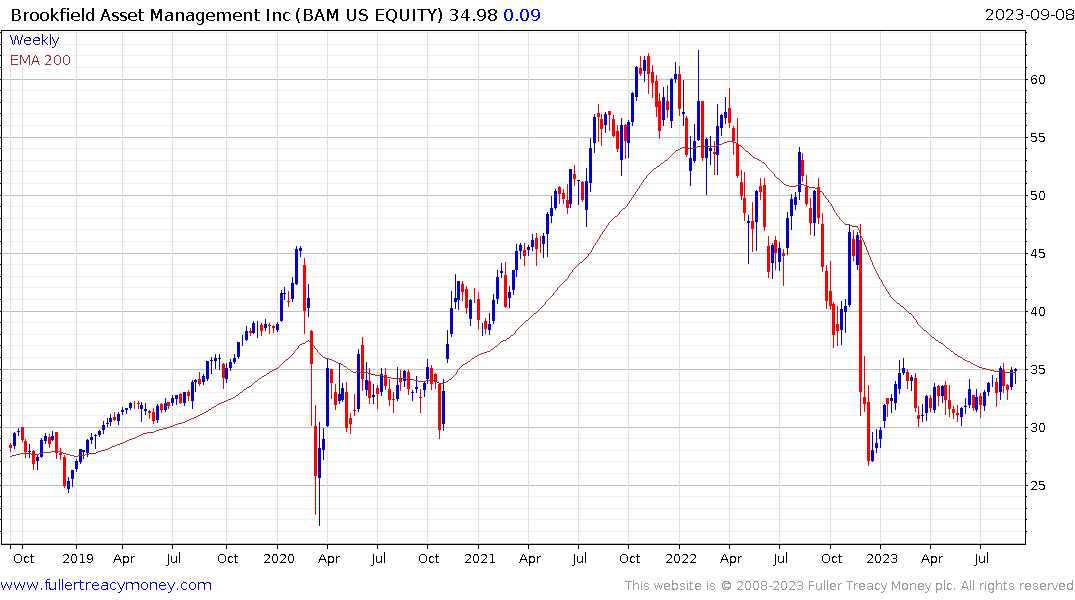

Brookfield has a more pronounced focus on commercial property. It is firmed in the region of the 200-day MA and has held a sequence of higher reaction lows since March.

WeWork announced earlier this week that it has renegotiated leases in many of its locations. The company has been engaged in a game of chicken with landlords and it looks like they have prevailed with at least some of their primary creditors. The share is still trending lower, so it needs some solid good news soon if it is to survive.

WeWork announced earlier this week that it has renegotiated leases in many of its locations. The company has been engaged in a game of chicken with landlords and it looks like they have prevailed with at least some of their primary creditors. The share is still trending lower, so it needs some solid good news soon if it is to survive.

The primary saving grace of the commercial estate sector is the loans tend to be renegotiated and maturities are stretched in times of duress. WeWork may or may not survive but Brookfield and Blackstone appear to have insulated themselves at least for the moment.

Back to top