Bitcoin Tumbles More than 25% as Sharks "Beginning to Circle"

This article by Samuel Potter and Eddie van der Walt for Bloomberg may be of interest to subscribers. Here is a section:

Bitcoin dropped to as low as $10,776. It last traded below $10, 000 on Dec. 1, when the U.S. Commodity Futures Trading Commission agreed to allow trading in bitcoin futures. For the week, the decline is as much as 39 percent. That follows gains of 13 percent, 44 percent and 32 percent in the prior three weeks.

The losses represent a major test for the cryptocurrency industry and the blockchain technology that underpins it, which have rapidly entered the mainstream in recent weeks. Bears cast doubt on the value of the virtual assets, with UBS Group AG this week calling bitcoin the “biggest speculative bubble in history.” Bulls argue the technology is a game changer for the world of investment and finance. Both will be closely watching the outcome of the current selloff.

the history of bubbles tells us anything it is that the pace of innovation occurs largely independently of the price action. Crowds tend to overshoot in both directions and the merits or otherwise of blockchain technology, as a way of streamlining transactions and verifying contracts, are separate from the vicissitudes of token price action.

This week’s pullback represents a massive reaction against the prevailing trend and therefore a Type-2 top. If a Mid-Point Danger Line stop, as taught at the Chart Seminar, were implemented at $16,300 it would have been triggered. Please see my commentary on the 18th for more on this topic.

This trend lost consistency at the penultimate peak, then posted a massive reaction against the prevailing trend. A Type-2 top formation characteristic is often followed by a period of right hand extension or a 1st step below the peak. Therefore, it is conceivable Bitcoin will now range in a volatile manner between $10,000 and $20,000 before extending the decline later.

.png)

Gold and the other precious metals were somewhat steadier today but not in a dynamic fashion. The yellow metal still needs to demonstrate it can hold a move above the trend mean to confirm a low of more than short-term significance.

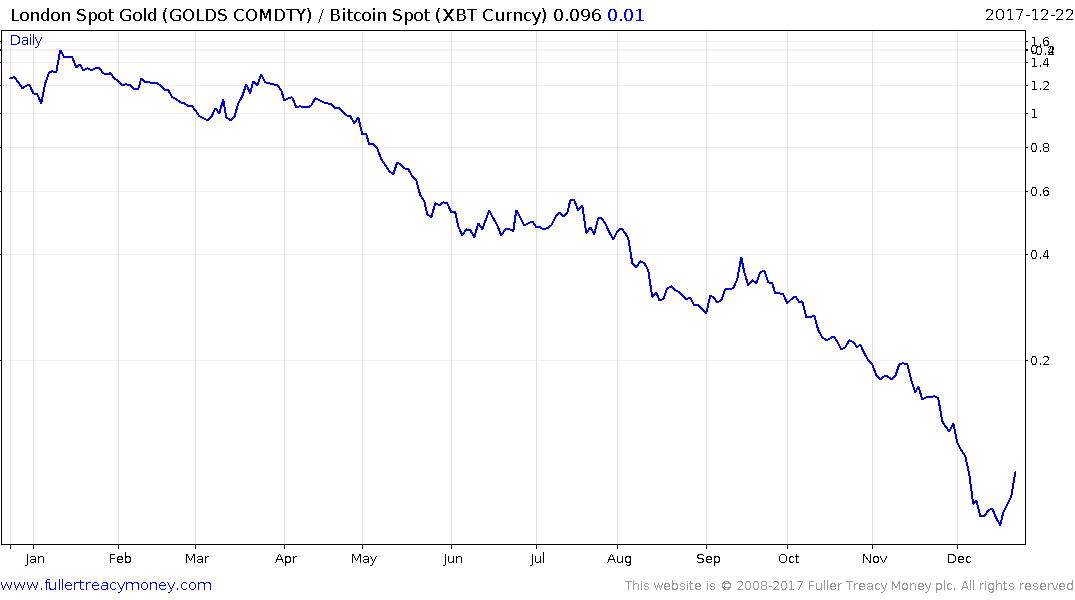

Meanwhile the gold/bitcoin ratio hit a low of at least near-term significance this week.