Bitcoin Guns for $10,000 as Cryptocurrency Mania Defies Skeptics

This article by Julie Verhage, Eric Lam and Todd White for Bloomberg may be of interest to subscribers. Here is a section:

Bitcoin blew past $9,700 just a week after topping $8,000 and approached its closest ever to five figures, gaining mainstream market attention as it defies bubble warnings.

The biggest price jump since August consolidated during Japanese trading hours and vaulted the largest cryptocurrency’s value in circulation above the market caps of all but about 30 of the S&P 500 index members. The increase also buoyed its 10-day volatility to more than 15 times the level of the euro-dollar, the most traded currency pair.

What I find interesting about the bitcoin market is how fervent the bulls are and how skeptical the bears are. It represents a perfect example of the sharp discrimination evident in a crowd as the polarization in performance between the winners and losers grows progressively wider.

For example, I have friends who are about as close to zealots in the cryptocurrency world as one can imagine. They are doing well from their investments and there is nothing like making money to improve your perception of the validity of a bull market.

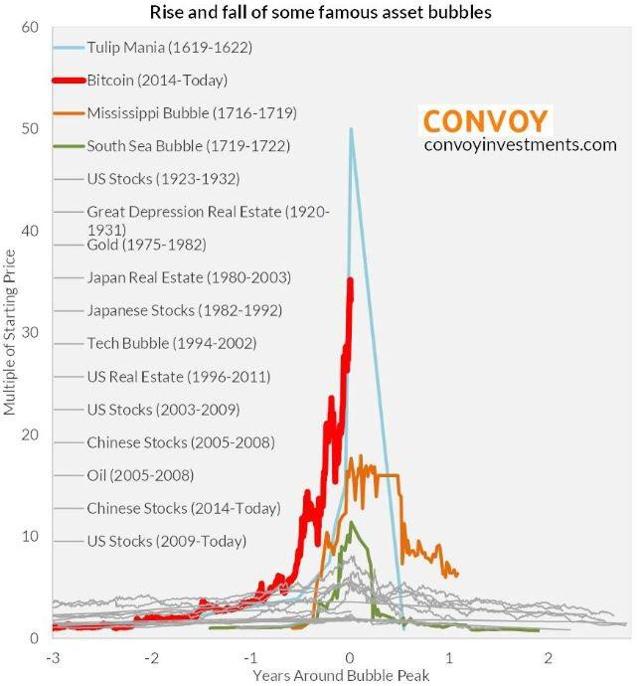

Meanwhile this illustration of the trajectory of historic bubbles is akin to a warning that it will all end in tears.

The most important point about bitcoin right now is that it is unleveraged. Futures and options have not yet started trading so log scale charts are most appropriate because they illustrate percentage gains.

Bitcoins consistency characteristics are:

It is prone to spikes higher. Today was another example of that tendency.

It is also capable of pulling back even more sharply.

When it pulls back it tends to find support in the region of previous peaks.

That last characteristic has contributed to a staircase step sequence uptrend this year. As long as it is trending higher in this manner we can give the benefit of the doubt to the upside. When the consistency characteristics change then we will have evidence that the imbalance between supply and demand driving this bull market has changed.