Bitcoin Economy Widens as Parents Pay Digital Allowance

This article by Olga Kharif for Bloomberg may be of interest to subscribers. Here is a section:

“Bitcoin makes a lot more sense in emerging economies like Brazil and Argentina and Russia,” said Nicolas Cary, CEO of Blockchain.info, a payment service. “The number of new sign-ups we see in Latin America is increasing. You are moving beyond the people placing bets to people seeing value.”

The pace of global adoption will depend on regulation, bitcoin’s price moves and addressing security concerns. Price volatility is a major worry because the price can be influenced by a relative small group of owners. While programmers build services such as insurance into the system, bitcoin may be less secure than more established forms of payment. Once a bitcoin changes hands, there are few means to get it back.

Meanwhile, hackers are on the prowl. Earlier this year, Japanese bitcoin exchange Mt. Gox lost 650,000 bitcoins to cyber criminals. This summer, a hacker stole 1,270 bitcoins from Androklis Polymenis, a software developer in Greece. Polymenis posted a 500-bitcoin bounty to track down the perpetrator and says the hacker returned 462 bitcoins in exchange for having the bounty lifted.

“The problem with bitcoin is security and user friendliness,” said Polymenis. “How can you expect mass adoption when I get hacked so easy?”

That’s not deterring Greg Abbott, 35, who sells fried pies from a food truck in Portland. Sure, only four or five customers a month use bitcoin. That’s not the point, he says.

“The disruptive nature is what I like so much about it,” Abbott said. “This is a real opportunity to look at how money systems are formed. It’s a real-world experiment of how these things work in the beginning of currencies.”

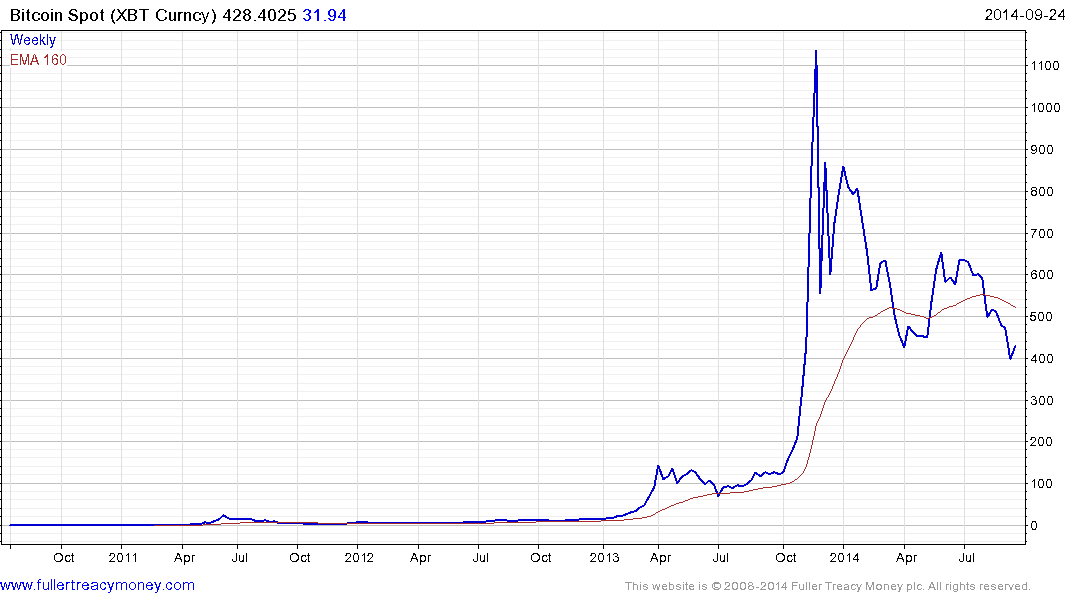

Bitcoin represents an innovation in transferring funds more than any other single factor. Its value has stabilised near $400 since the abrupt drop from its accelerated advance late last year, This stability may be lending some confidence to people seeking to use it but some considerable hurdles need to be addressed before it can be more widely adopted, not least security.

Anyone’s computer is susceptible to hacking but if you make credit card purchases you benefit from insurance on the card and if you make bank transfers the internet portal used by banks benefits from enhanced security measures. There are security features one can use with Bitcoin but the risk of someone raiding your wallet remains non trivial.

The continued growth in mobile connectivity, e-tailing, online banking and bitcoin represents a considerable growth story for internet security firms. However the sector is very competitive and there are clear winners and losers.

I’ve recreated the constituents of the cyber security section of my Favourites in the Chart Library.

Intel (owner of McAfee) broke out of a lengthy range in the summer but is now overextended following an impressive rally and susceptible to mean reversion.

EMC Corp encountered resistance today in the region of the upper side of a three-year range; posting a downside weekly key reversal. Some additional consolidation of recent gains appears likely.

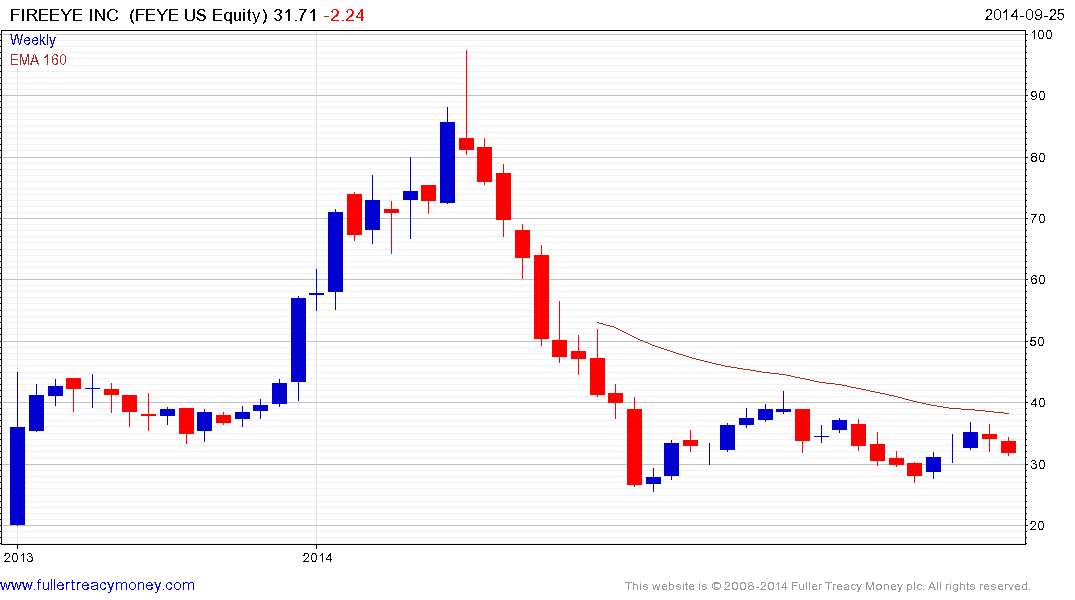

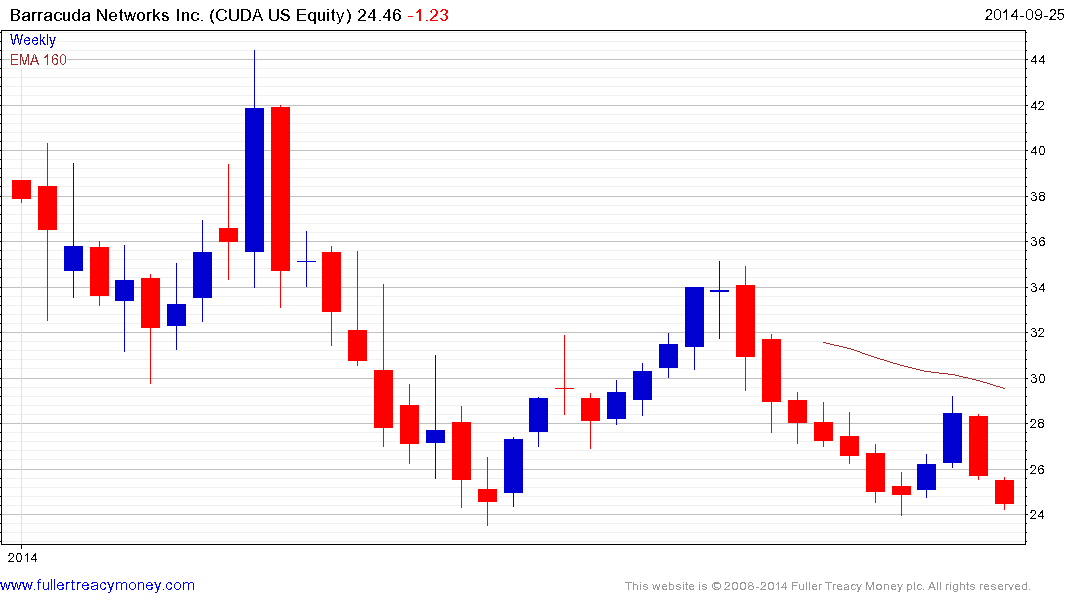

High profile IPOs such as Barracuda Networks and Fireeye have returned to test their respective lows and clear upward dynamics will be needed to demonstrate a return to demand dominance in this area.