Billionaire investor Howard Marks paints grim view of economic outlook: stimulus alone won't cure 'down-cycle'

This article from MarketWatch may be of interest to subscribers. Here is a section:

Marks credits the Federal Reserve’s decision to cut its benchmark interest rate to a range of 0% to 0.25% and the signalling of its intention to keep uber-low levels in place for the foreseeable future for providing the most significant stimulus for financial markets in this pandemic era.

That said, investment return expectations, he insists, will be also be hurt by the current state of economy and economic policy over the longer run.

Marks explains the investment return outlook like this:

So the lower the fed funds rate is, the lower bond yields will be, meaning outstanding bonds with higher interest rates will appreciate. And lower yields on bonds means they offer less competition to stocks, so stocks don’t have to be cheap to attract buying. They, too, will appreciate. And if high-quality assets become high-priced and thus offer low prospective returns, then low-quality assets will see buying – implying rising prices and falling prospective returns – because they look cheap relative to high-quality assets.

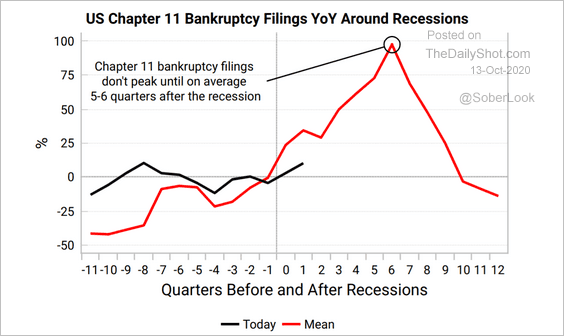

The default cycle during a recession tends to a long tail because businesses do not all fail at once. The supply of liquidity supported many businesses and partial re-openings will have generated some income. However, the longer reduced activity persists the greater the burden debt will have on companies. Generally, the peak of insolvencies occurs 18 months after the recession begins. That suggests continued ample sources of additional liquidity are essential to support recoveries.

That’s true of every country because previously unimaginable low rates are a global phenomenon today. The USA has been the most aggressive in printing money and tolerating a massive deficit. That has weighed on the Dollar but increasingly other central banks are acting to arrest the advance of their currencies against the greenback.

China’s removed the penalty for shorting the Renminbi right after the Mid-Autumn Festival holiday. Taiwan’s central bank acted to weaken its currency today. The ECB have been jawboning the Euro lower. Since every country has an incentive to slow the appreciation of their respective currencies, we are potentially looking at the pace of competitive devaluation picking up as we approach 2021.

That remains the primary medium-term tailwind for precious metals. The short-term influence of an absence of immediate additional liquidity infusions is contributing the ranging environment. It does nothing to question the motivation for competitive currency devaluation.