Bigger U.S. Auctions in Shorter Time Seen Boosting Yields

This note by Brian Chappatta for Bloomberg may be of interest to subscribers. Here is a section:

Bond traders have to contend with both larger auction sizes and a condensed schedule when the U.S. Treasury sells $28 billion of three-year notes and $21 billion of 10-year notes on March 12. To JPMorgan Chase & Co. strategists, that combination signals a weak reception. Last month’s offerings, the first since 2009 to increase in size, priced at yields higher than the market was indicating heading into the sales. The 3- and 10-year auctions are usually spaced out over two days, but when they came on the same day in December, yields also missed higher.

Bull markets don’t often end because demand evaporates. They usually end because the surge in prices encourages supply into the market and that eventually overwhelms demand. There is no shortage of new supply, in fact the USA’s decision to double its deficit is the latest in a long line of issuers who have been locking in low rates. The fact that one of the biggest buyers, the Fed, is now a net seller, should be giving investors pause when thinking about the value represented by bonds at close to 3%.

Moderating wage growth figures, down to 2.6%, were widely reported today but these ignore the effect of the tax cuts on take home pay. Here is a section from an article from CBS marketwatch on the topic:

Take-home pay for a person claiming single status and one withholding allowance, with gross annual income of $50,000 paid biweekly, would increase by about $55 per pay period, or approximately $1,440 per year.

For a person claiming single status and one withholding allowance, with gross annual income of $75,000 paid biweekly, net take home pay would increase by about $84 per pay period, or approximately $2,190 per year.

For a worker claiming married status and two withholding allowances, with gross annual income of $75,000 paid biweekly, net take home pay would increase by about $61 per pay period, or approximately $1,590 per year.

For a worker claiming married status and two withholding allowances, with gross annual income of $100,000 paid biweekly, net take home pay would increase by about $107 per pay period, or approximately $2,777 per year.

2.88%, 2.92%, 2.1% and 2.77% respectively for the four scenarios represent one-time income boosts for US consumers that began with the January paychecks. That’s enough to keep wage demand growth under wraps for a quarter or two but not indefinitely.

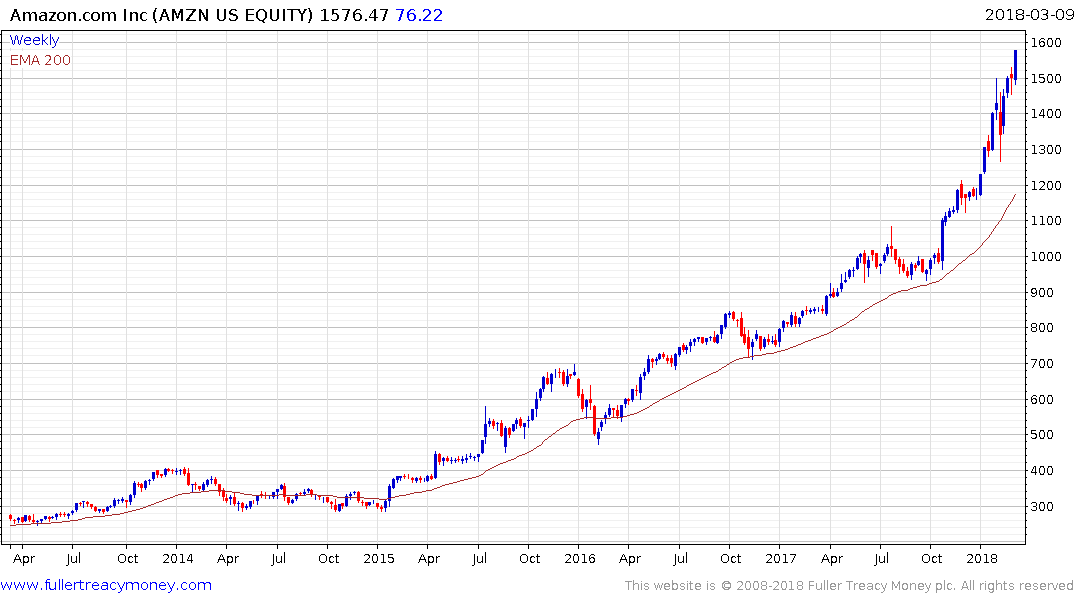

Mrs.Treacy’s business has seen a considerable jump in the first two months of the year with demand from Amazon, Ebay, Etsy and Wal-Mart all up in the order of 30%. She is doing nothing differently and no new SKUs have been added in the last six months. What is particularly interesting is that higher value items are now selling quicker than before. All other factors being equal that corresponds with my intuition that people are spending their tax windfall.

Etsy breaking up out of its base formation is another representation of this trend where relatively higher value items are selling better.

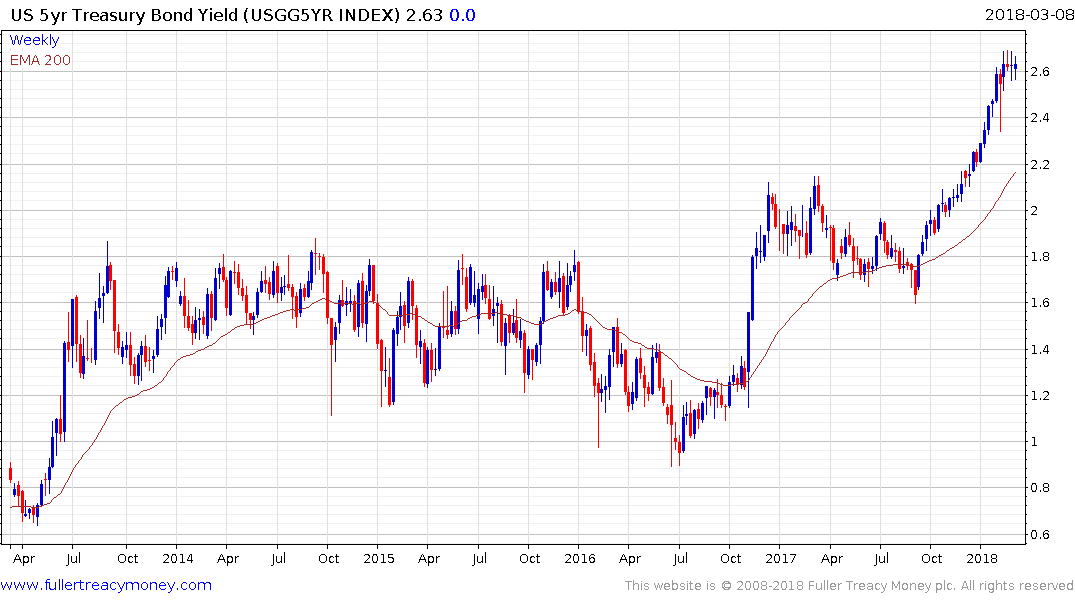

US 10-year and 30-year yields are testing the upper side of their respective ranges.

The 5-year has already broken out.

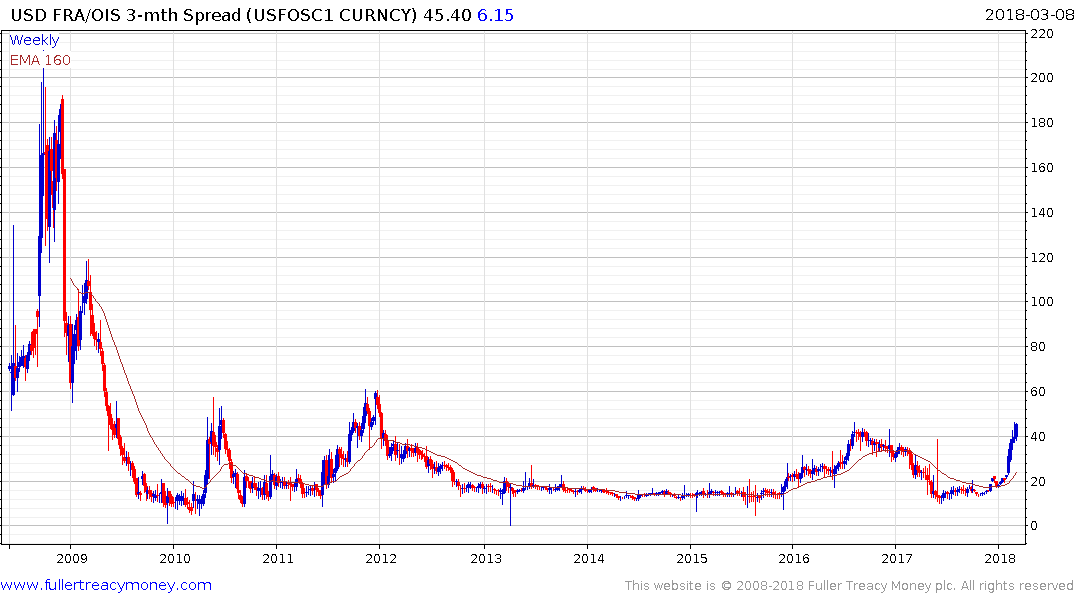

Most of issuance to date has been at the very short end of the curve so liquidity measure such as the Swap spread and OIS spread have expanded.

.png)

The 10-year Swap Spread was negative from late 2015 until January of this year and is bouncing this week from above the zero bound.

The 10-year OIS Spread cleared the 40-basis points level this week for the first time since 2011 and while somewhat overextended in the short, a clear downward dynamic would be required to check momentum.

This article from Bloomberg highlights some of the additional reasons why we are seeing upward pressure on short-term paper rates which include less demand because overseas cash piles are being redeployed.

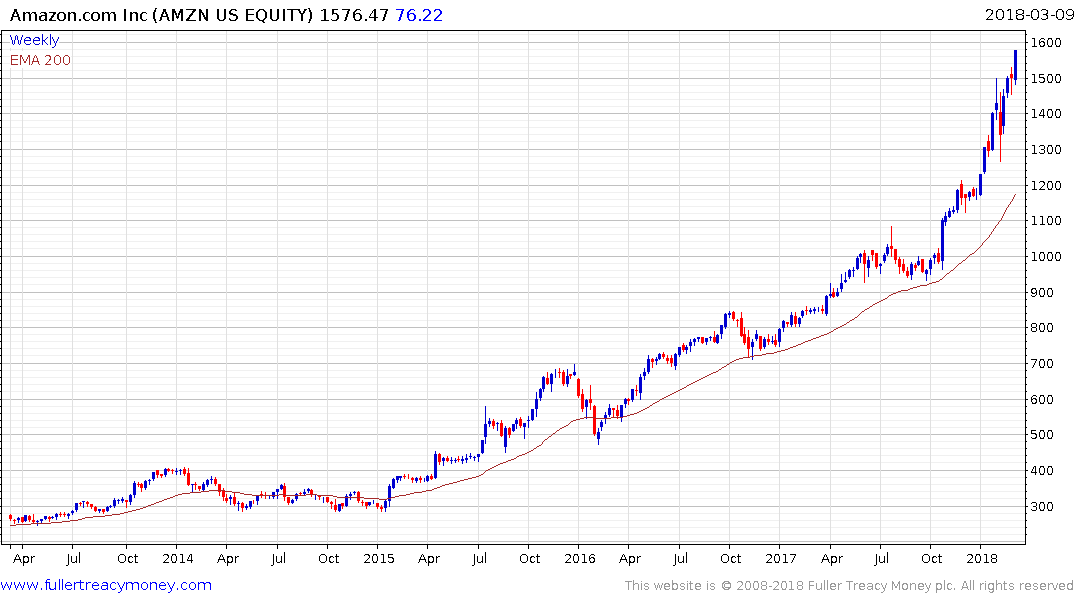

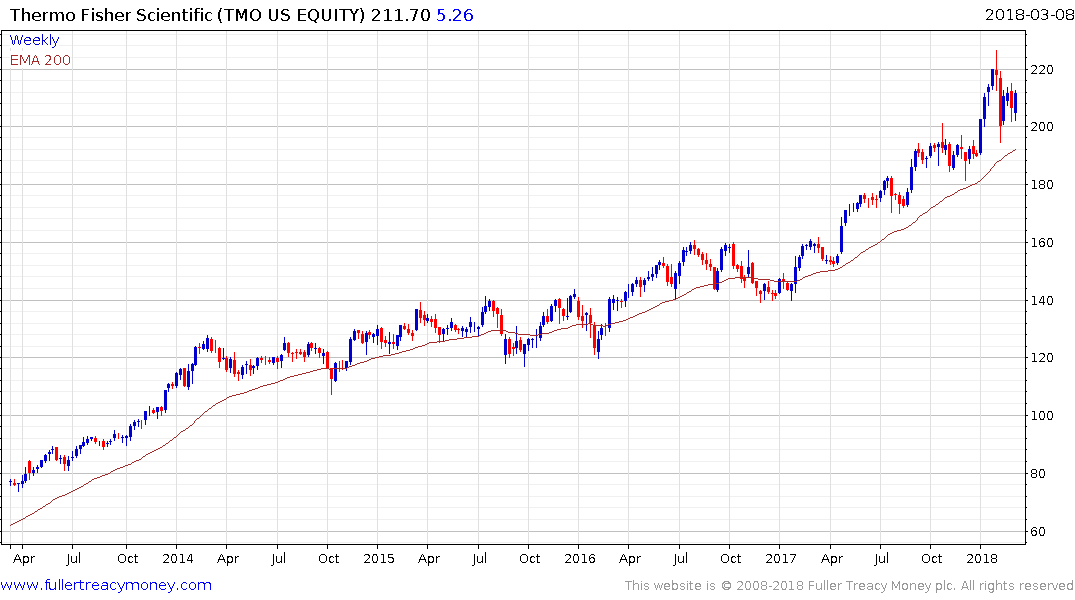

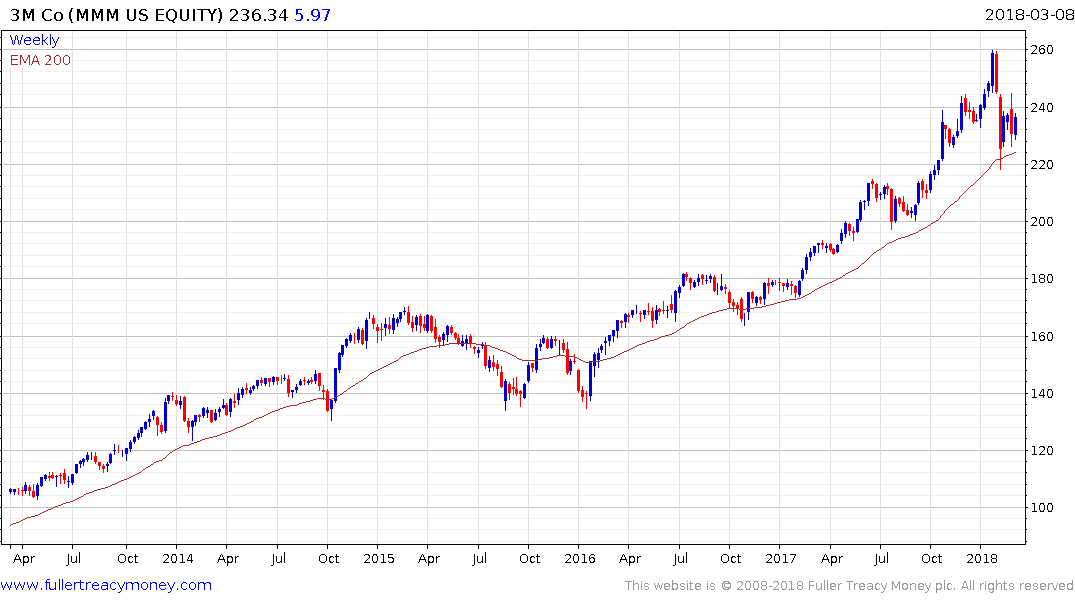

With the Nasdaq-100 hitting new highs and money market spreads breaking higher, there is the real possibility that we are now in the mania stage of this bull market with concentration of positions in subscription-oriented business and potentially also the shares of the “makers of machines that make machines” such as LAM Research, 3M, Thermo Fisher, Taiwan Semiconductor etc.

![]()

The Philadelphia Semiconductor Index broke out to new all-time highs as well this week. These represent the leaders in this bull market and positions appears to be further concentrating in these kinds of names following the rotation initiated by the decline seen in early February.

![]()