Big Tobacco Will Eventually Be Big Marijuana

This article by Leonid Bershidsky may be of interest to subscribers. Here is a section:

More than 19 million Americans aged 12 and older reported using marijuana in 2012. If recreational marijuana is ever legalized beyond the four states where it's currently permitted, the tobacco companies will be perfectly positioned to capture this vast market. They already have distribution systems (licensed tobacco sellers already dispense medical marijuana in a number of states), marketing machines, industrial facilities to make marijuana cigarettes and package cannabis for use in vaporizers, patented designs for the vaporizers themselves, research laboratories (and possibly even a head start on commercial product development) and, last but not least, cash resources.

"Marijuana legalization advocates," Barry and her colleagues wrote, "have not considered the potential effects of the multinational tobacco companies entering the market (or other corporations such as the food and beverage industries), with their substantial marketing power and capacity to engineer marijuana cigarettes to maximize efficacy as drug delivery systems, in the way that modern cigarettes are designed, whose primary objective is maximizing profits through higher sales."

?I'm not sure that's true: The legalization advocates probably wouldn't mind Big Tobacco's participation in developing the market.

After all, these corporations can do it better than the tiny companies that have attracted the early marijuana investment into their penny stocks. Companies listed on Marijuanastocks.com may survive on the fringes of the post- legalization industry, but many of them will be put out of business or acquired by the big league players who have survived all the upheavals of the last 115 years while producing top returns for their investors. For those not overly worried about the moral strings attached to investing in companies that pander to addictions, a greener future for Big Tobacco may be one of the biggest opportunities of a lifetime.

Following the legalisation of cannabis sales in Colorado last year, the nascent sector experienced a surge in interest. At a talk I gave in Scottsdale Arizona late last year one of the delegates told me how he is investing in the sector by providing services to start-ups in terms of business consultancy. A number of reality TV shows have sprung up to cater to the increased interest in the sector, profiling it as a new gold rush. Vermont is considering adopting similar laws to Colorado in order to tap into potential tourist traffic within the densely populated Northeast.

Searching on Bloomberg the largest company with an interest in the cannabis sector has a market cap of $117 million. Its share performance has been inert following an initial surge and decline last year which highlights just how niche the sector is. I tend to think of cannabis as in the microbrewery stages before large players become active.

There are a number of obstacles to this happening. The first is that cannabis is still classified as a Class A by Federal government. Transporting it across state lines can be considered a felony, depending on your interpretation so people travelling home from Colorado to Nevada or Arizona have run into trouble. The second is that companies cannot gain access to banking services if they are in the cannabis business which obviously constrains their ability to grow (pun intended : ).

This article from the LA Times dated December 16th carries some additional data on the path to full legalisation. It is reasonable to assume that big tobacco will become active in the production of cannabis products in the event that cannabis sales become legal. We do not know when that will occur but the long-term trend is clear.

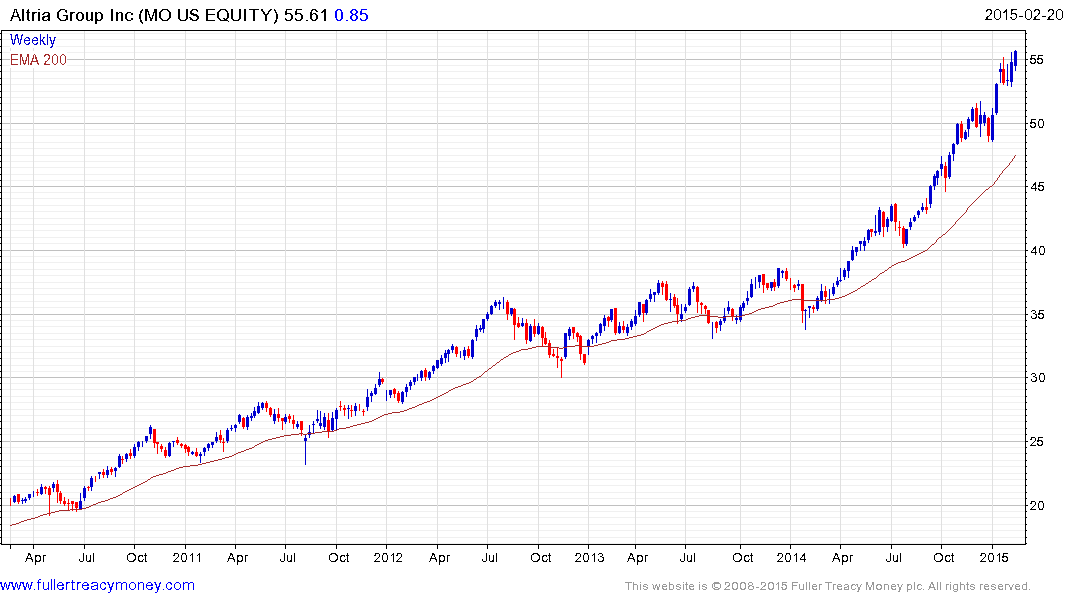

The pace of Altria’s (Est P/E 19.83, DY 3.75%) consistent uptrend has picked up since early 2014 but it remains a trend in motion with a succession of ranges one above another.

Reynolds American’s (Est P/E 19.59, DY 3.65%) uptrend has also picked up pace and it is becoming increasingly susceptible to mean reversion.

Lorillard (Est P/E 18.59, DY 3.86%) found support in the region of the 200-day MA from October and rallied this week to post a new all-time high. The benefit of the doubt can continue to be given to the upside provided its finds support in the region of the trend mean following reactions.

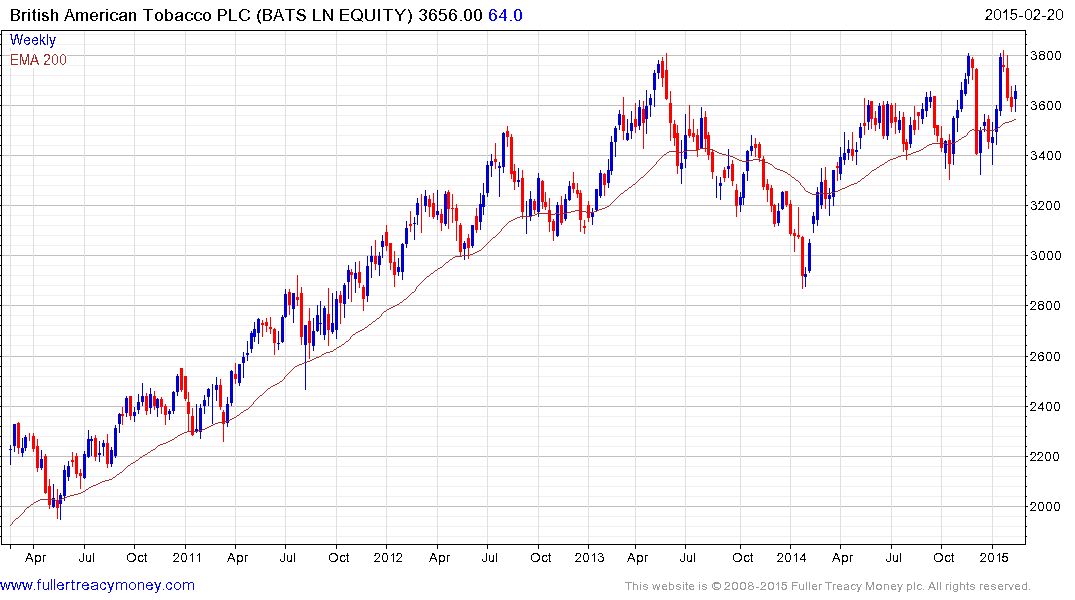

The machinations of the US market will also be watched closely by London listed British American Tobacco considering its cross holdings in so many global tobacco companies not least Reynolds (42%) The share (Est P/E 17.64, DY 4.4%) has been largely rangebound since early 2013 but is currently trading towards the upper side of this congestion area. A sustained move below 3400p would be required to question potential for additional upside.

David's comment on the trend in acceptability of cannabis was:

That said, I have always been uncomfortable about tobacco shares and would never invest in one because of the damage smoking causes. Worse still, I knew several educated, ambitious and intelligent people in the 1960 and 1970s, who destroyed their lives by smoking pot on a frequent basis. marijuana is even worse that tobacco because it can seriously damage the brain.

I would add that I watched my grandfather live in constant pain for a decade ollowing the amputation of five toes due to lack of blood supply caused by a lifetime of smoking cigarettes and a pipe. The evolution of edible products is a response to this concern but there are moral considerations to investing in the sector nonetheless.

Back to top