Big Ideas 2022

This aspirational report from ARK Invest highlights the arguments they have been making for the last couple of years about the promise of the innovation sector.

When has investing not been about the future? Change appears to happen slowly and then all at once. Over time, innovation should displace industry incumbents, increase efficiencies, and gain majority market share. With the right understanding of disruptive innovation and a long-term time horizon, we believe investors will capture exponential growth opportunities, which deserve a strategic allocation in their portfolios. For this reason, ARK focuses on opportunities likely to scale as technologies converge, transforming entire industries.

To enlighten investors on the impact of breakthrough technologies we began publishing Big Ideas in 2017. This annual research report seeks to highlight our most provocative research conclusions for the coming year. We hope you enjoy our Big Ideas for 2022.

Here is a link to the full report.

I’m not going to spend the time required to poke through the holes and validity of the arguments laid out in this report. It would take too much time and I’m not sure if it would add any value.

From an investment perspective innovation and momentum are analogous. Investors are willing to give the benefit of the doubt to incredibly optimistic visions of the future, provided the discount rate is close to zero. When rates rise the duration of optimism shortens and potential for profits comes back into focus.

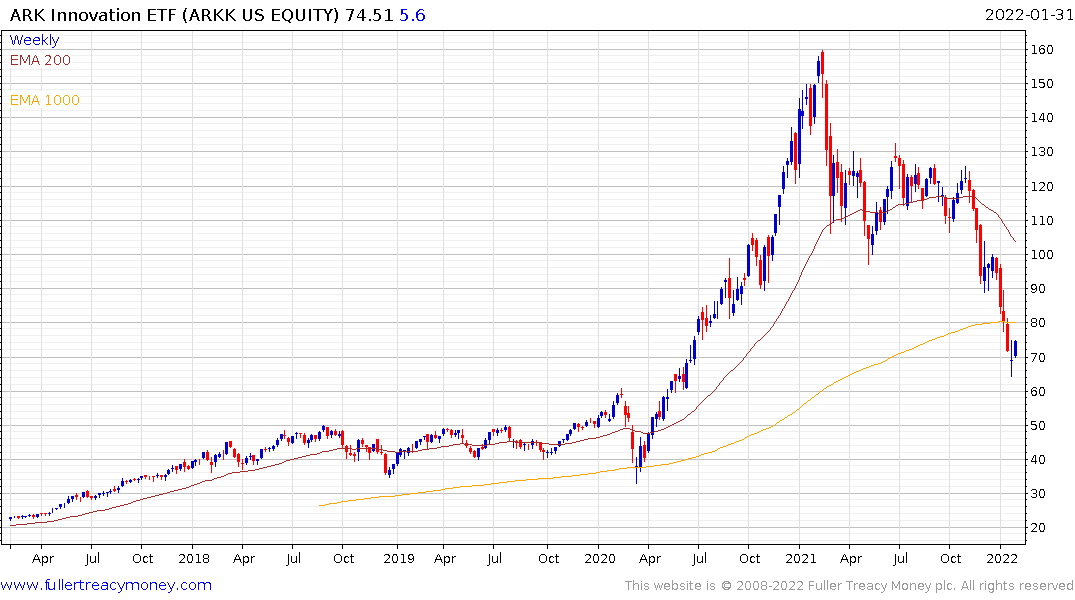

The ARK Innovation ETF lost 60% of its value by last week’s low. It has almost fully unwound its pandemic surge. It’s very short-term oversold so it is due a bounce. However, the interest rate question remains outstanding. That suggests a period of support building will be required so the more realistic growth opportunities can be sifted from the more aspirational arguments.

The ARK Innovation ETF lost 60% of its value by last week’s low. It has almost fully unwound its pandemic surge. It’s very short-term oversold so it is due a bounce. However, the interest rate question remains outstanding. That suggests a period of support building will be required so the more realistic growth opportunities can be sifted from the more aspirational arguments.

Large cap tech stocks are also rebounding from a deep short-term oversold condition. Dip-buyers are conditioned to habitually buy following a 10% pullback so a bounce is underway. Some consolidation following this bounce will likely be required before the uptrend can be reasserted. That’s the bullish scenario and assumes the path of interest rate hikes will be modest which appears likely.

Ultimately, it remains the base case that the Fed does not wish to slow growth enough to cause a recession, so they will be measured in how quickly they raise rates.

Back to top