Ben Bernanke: Aiding the economy: What the Fed and why

Two years have passed since the worst financial crisis since the 1930s dealt a body blow to the world economy. Working with policymakers at home and abroad, the Federal Reserve responded with strong and creative measures to help stabilize the financial system and the economy. Among the Fed's responses was a dramatic easing of monetary policy - reducing short-term interest rates nearly to zero. The Fed also purchased more than a trillion dollars' worth of Treasury securities and U.S.-backed mortgage-related securities, which helped reduce longer-term interest rates, such as those for mortgages and corporate bonds. These steps helped end the economic free fall and set the stage for a resumption of economic growth in mid-2009.

Notwithstanding the progress that has been made, when the Fed's monetary policymaking committee - the Federal Open Market Committee (FOMC) - met this week to review the economic situation, we could hardly be satisfied. The Federal Reserve's objectives - its dual mandate, set by Congress - are to promote a high level of employment and low, stable inflation. Unfortunately, the job market remains quite weak; the national unemployment rate is nearly 10 percent, a large number of people can find only part-time work, and a substantial fraction of the unemployed have been out of work six months or longer. The heavy costs of unemployment include intense strains on family finances, more foreclosures and the loss of job skills.

Today, most measures of underlying inflation are running somewhat below 2 percent, or a bit lower than the rate most Fed policymakers see as being most consistent with healthy economic growth in the long run. Although low inflation is generally good, inflation that is too low can pose risks to the economy - especially when the economy is struggling. In the most extreme case, very low inflation can morph into deflation (falling prices and wages), which can contribute to long periods of economic stagnation.

David Fuller's view It is unusual for the Fed Chairman to explain his policy in this manner, but as he receives plenty of criticism in the global financial press, it is not a bad idea. Ben Bernanke did not create the Fed's mandate which has been in place for decades. Unlike the rest of us he is not free to carp about the mandate, at least not publicly, which he undertook to honour when appointed to the Fed. Consequently, in trying to lower unemployment he is doing his job.

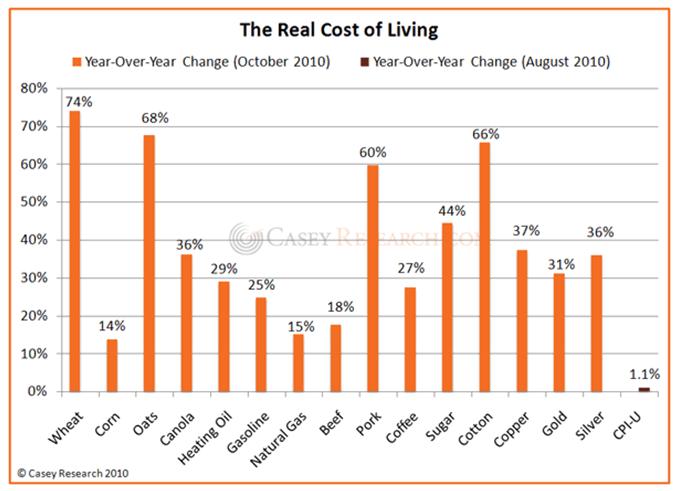

What Fullermoney has criticised is the way the Fed reports, or more accurately disguises the true level of inflation, basically by removing all the sensitive measures of price increases. For this reason, I have often said that central bankers are closet inflationists. Ben Bernanke is no exception and although he did not determine the current CPI criteria, he has certainly not chosen to speak out against it.

Inflation has always been and remains a government stealth tax on savings. In this manner governments willingly reduce their contractual obligations, such as state pensions for retired citizens. Inflation also enables countries to pay back government borrowing, mainly in the form of long-dated government bonds, with a currency which they know they will continue to devalue. People may not be aware of this in the short term but they will certainly notice when they consider cost increases over a decade or more.

Fullermoney has often mentioned over the last decade that we would experience upward pressure on commodity prices in a secular, albeit volatile, trend. This is certainly not entirely the fault of Ben Bernanke and his printing press. Among other contributing factors are rising populations in many regions of the world, rising global GDP, scarcity and adverse weather conditions more recently which have affected crop yields for agricultural commodities. However the debasement of paper currencies continues to fuel investment and speculation in many commodities, from gold to grains.

In writing about "low and falling inflation", you can be sure that Mr Bernanke will not mention, let alone illustrate the commodity price inflation which quantitative easing has helped to create. You can see it in prices for dozens of individual commodities found in the Fullermoney Chart Library, a few of which are in the reviews below. You can also see it in this unweighted Continuous Commodity Index showing the last 10 years of price rises, interrupted but not ended by the 2008 meltdown. You can also see it in this startling percentage graph: The Real Cost lf Living, courtesy of Casey Research. Prices for these commodities are still rising.