Being Tesco Stinks, but Shopping at Tesco Is Great

This article by Mark Gilbert for Bloomberg may be of interest to subscribers. Here is a section:

The two discounters are chipping away at the market share of their bigger competitors. Aldi's market share is now 4.9 percent, up from 3.9 percent a year ago; Lidl is up to 3.5 percent from 3 percent. Tesco, meantime, is down to 28.7 percent from almost 30 percent 12 months ago. Asda, which is owned by Wal-Mart Stores, is unchanged at 17.2 percent, while J Sainsbury has slipped to 16.4 percent from 16.8 percent.

Overall grocery sales are down 0.2 percent in the past year, which Kantar says is the first contraction since it began surveying the market in 1994. Kantar also tracks a basket of 75,000 products; it says shoppers are paying 0.4 percent less for their groceries than they did a year ago.

U.K. food prices have declined for four consecutive months, according to the Office for National Statistics, dropping at an annual pace of 1.4 percent in both September and October:

Lewis, who's been at Tesco since Sept. 1, is unlikely to be looking forward to Christmas. The race to the bottom in prices will make it hard to generate yule-time profit, and his company is still under investigation by the U.K. Serious Fraud Office for fiddling its accounts in recent years. Only five of the 26 analysts who cover the company recommend that investors buy Tesco shares, with 14 holds and seven saying sell.In a report published this week, Goldman Sachs analysts said the only way for U.K. supermarkets to make money is to close stores and cut capacity. They're correct; Internet shopping and delivery-to-home services are making edge-of-town superstores increasingly anachronistic, while town centers are flooded with smaller stores that are indistinguishable from the supermarket chains. As well as ending some of its overseas adventures, Tesco needs to shrink more than its prices.

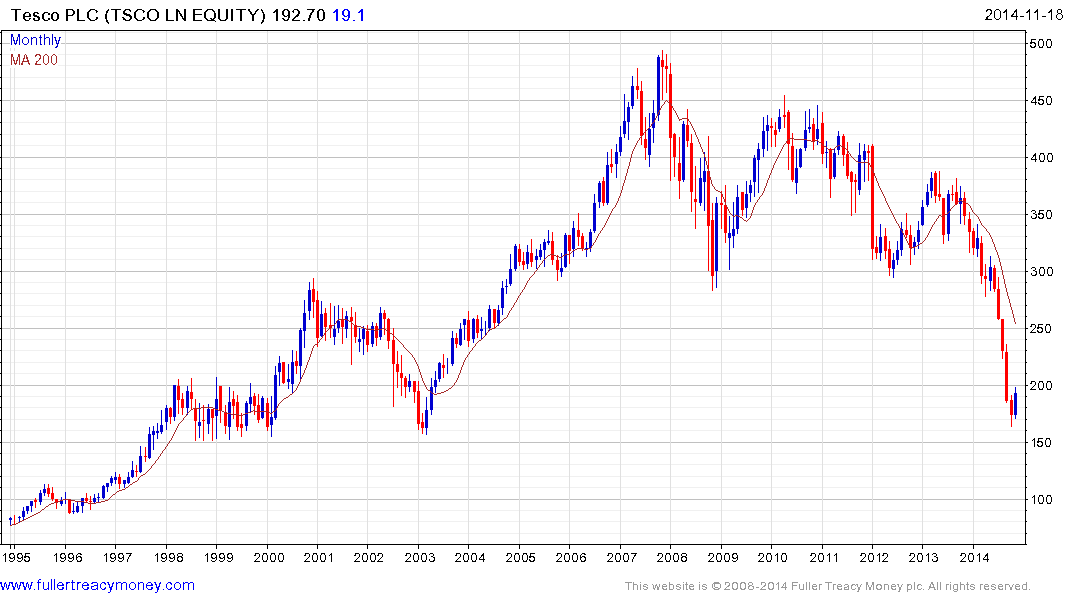

A share doesn’t more than halve in value without there being some reason. The issues with Tesco business model at home, accounting irregularities and difficulties with its overseas operations have garnered a great deal of media attention as the price accelerated to the September low. The commonality evident with shares such as Sainsbury and Morrison highlight that Tesco is not the only company feeling the pinch from the entry of discounters to the market.

The share dropped from 300p to 160p between July and September in a decline that has climactic characteristics. Following such a swift move there is room for some additional short covering and possibly a reversion towards the mean. However, some meaningful plans to create shareholder value from the new management will be required before recovery potential can be considered realistic.

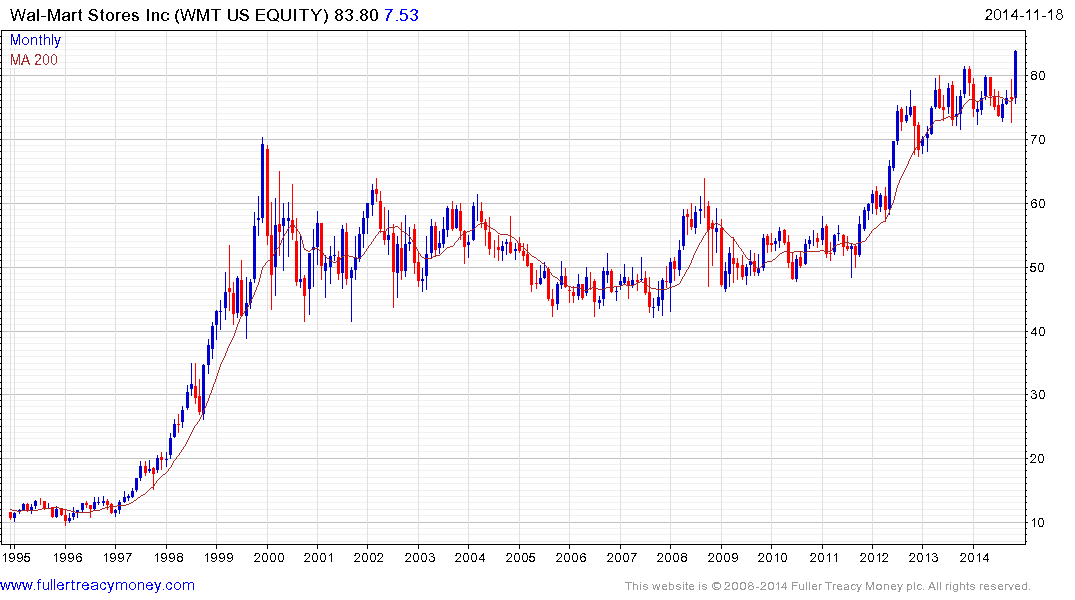

Wal-Mart has long experience with competing on price and is likely to follow a similar strategy with its UK Asda chain. The share formed a first step above the 13-year base between October 2012 and October 2014 before breaking out. A sustained move below the $72.50 area would be required to begin to question medium-term scope for additional upside.

Back to top