Battered Safe Credit Is Now a 'Screaming Buy' After Yield Jump

This article from Bloomberg may be of interest to subscribers. Here is a section:

After historic losses this year, high-quality corporate debt has flipped the script to become one of the hottest asset classes in the market.

Investors are increasing allocations to investment-grade corporate bonds as the yield they can get just by holding the debt to maturity has reached its highest level since the global financial crisis. At 5.6%, global high-grade yields now exceed where junk-rated debt was trading at the start of the year, according to Bloomberg indexes.

It’s a major shift for the $10 trillion global high-grade market, which has suffered massive losses this year amid aggressive central bank rate hikes. The steep losses in investment-grade bonds, despite their near-zero probability of default, has created one of the most favorable entry points in years for some investors.

“High quality is a screaming buy,” said Eric Vanraes, head of fixed income investments at Banque Eric Sturdza SA. “The big difference between high yield and investment-grade is that in high yield you have to cope with default rates.”

There is a point where higher yields will be a good buying opportunity in fixed income. To buy at today’s levels is certainly preferable to paying all-time highs and many investment managers have a mandate to hold some fixed income so they don’t have much choice.

In order for it to be a good investment, one has to assume we are close to the peak of the interest rate cycle, and that rates will fall significantly subsequently. The bond market is pricing in the potential that the Fed Fund’s rate will peak in March.

My concern is that prime investment grade is only trading at 100 basis points over Treasuries. For example the 2045 4 3/8% Apple bullet bond is trading at a yield of 5.34% and the 20-year Treasury is 4.37%.

That’s not pricing any risk into investment grade. Looking at the five-year average default rate is not enough back history when the last five years were characterised by a bull market and a moratorium on defaults. Significantly higher default rates have to be assumed if one is taking on credit risk and that implies higher spreads.

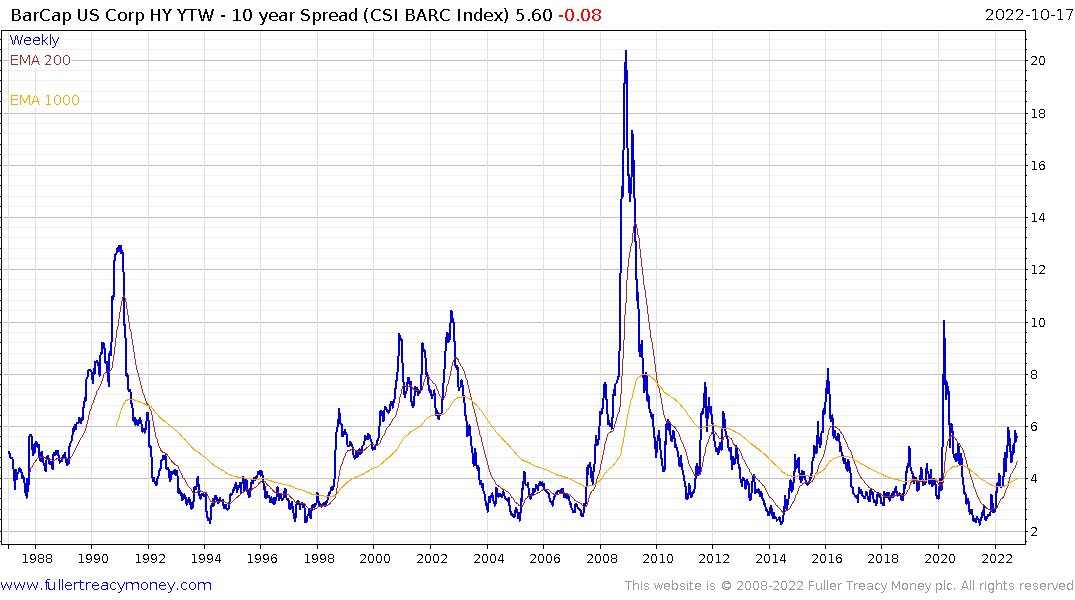

High yields spreads of between 800 and 1000 basis points have been coincident with major market bottoms and at present they are only at 544.

High yields spreads of between 800 and 1000 basis points have been coincident with major market bottoms and at present they are only at 544.

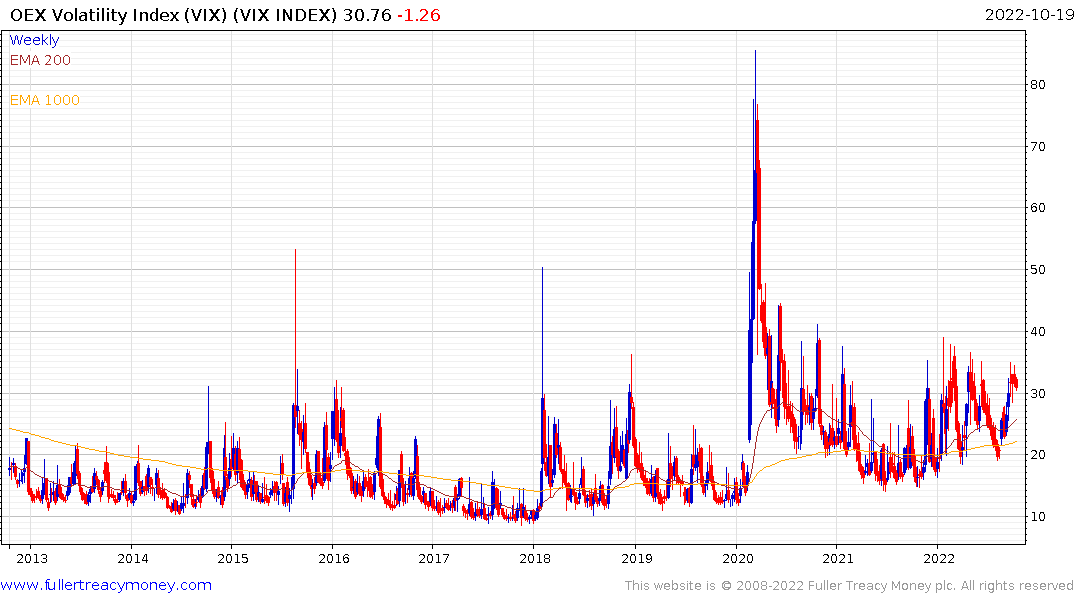

This year has been notable for weak markets but no spike in volatility. It has been a very orderly decline and that is unlikely to last. Just like with high yield spreads, VIX spikes above 50 have been coincident with significant stock market bottoms. This suggests to me it is still a little early for bottom fishing.

This year has been notable for weak markets but no spike in volatility. It has been a very orderly decline and that is unlikely to last. Just like with high yield spreads, VIX spikes above 50 have been coincident with significant stock market bottoms. This suggests to me it is still a little early for bottom fishing.