Barclay's $600 Million Blunder Follows Years of U.S. Run-Ins

This article from Bloomberg may be of interest to subscribers. Here is a section:

Barclays Plc’s $600 million structured products blunder has little precedent on Wall Street. But the bank’s past misconduct may have set the stage for the paperwork fail it revealed this week.

A key issue at the heart of the regulatory breach appears to be its loss of the so-called well-known seasoned issuer status in 2017, a right granted by the U.S. Securities and Exchange Commission that allows banks to sell notes in the U.S. with fewer filing requirements.

Since 2007, Barclays had faced the risk of losing this right at least five times in the aftermath of issues from dark pool disclosures to foreign exchange manipulation, an analysis by Bloomberg News shows. The bank had to repeatedly engage with the SEC over it and apply for waivers, so it didn’t lose this classification.

Barclays isn’t the only bank to have engaged in such back-and-forth with regulators, and the loss of the WKSI approval explains how a limit breach could happen. But the years-long battle to keep that status raises ever more questions over how it could have overlooked one of the most expensive clerical errors ever.

The oversight is landing the bank with about 450 million pounds ($600 million) in expected expenses from buying back unregistered securities the bank sold, a halt to a booming U.S. business, possible regulatory fines that will deepen the pain, and a delay to a highly anticipated stock buyback.

The raft of additional regulatory hurdles imposed on banks following the credit crisis necessitates having an army of personnel on hand to make sure every “i” is dotted and every “t” crossed. It surprising how few banks have come in for active censure for failing to comply fully with regulations. Barclay’s is certainly being punished for its transgression by investors.

The share failed to hold a move above the 1000-day MA and was down in a dynamic manner this week to extend the downtrend.

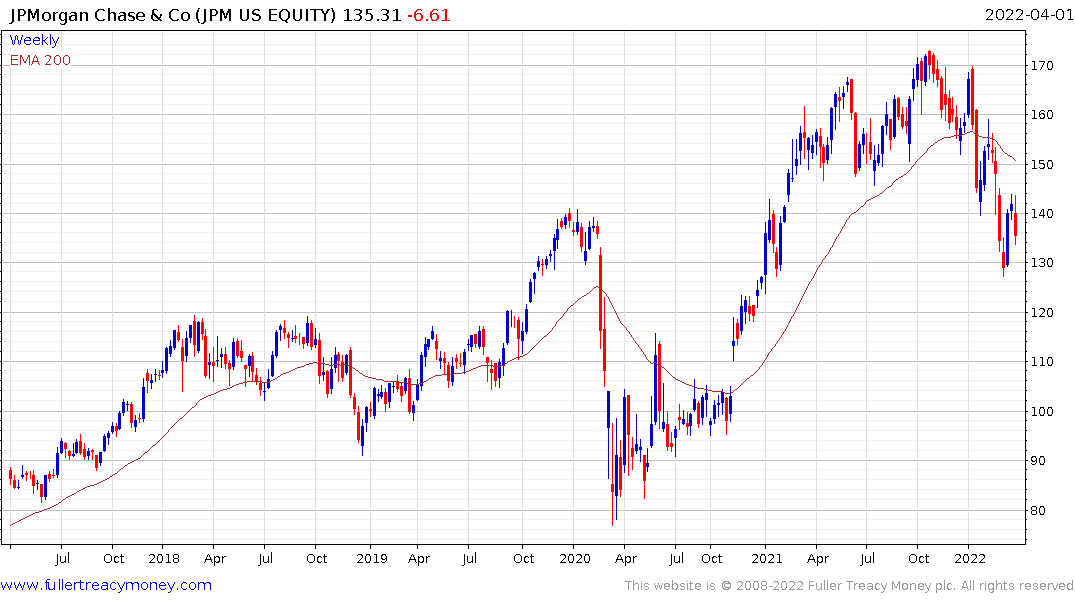

I did an extensive click through of stocks last night and one of the sectors that stood out for its weakness is banking. All the US money centre banks are now trending lower.

Citigroup, JPMorgan, Goldman Sachs have clear downtrends.

Bank of America, Wells Fargo and Bank of New York Mellon have all posted lower highs and mostly failed to sustain moves back above their 200-day MAs.

European money centre banks like Deutsche, Santander, CaixaBank, and HSBC continue to hold up reasonably well but BNP Paribas, Societe Generale, Intesa Sao Paolo share similar patterns with the above US banks.

Banks are an important lead indicator. As liquidity providers they should do well in a bull market. When they underperform it is a warning that liquidity conditions are tightening. The inverted yield curve weighs heavily on banks’ ability to profit.

This article, kindly forwarded by a subscriber, by Ambrose Evans Pritchard shares my view that the countdown clock to the next recession has started.

Back to top