Banks in Germany Tell Customers to Take Deposits Elsewhere

This article from the Wall Street Journal may be of interest to subscribers. Here is a section:

Interest rates have been negative in Europe for years. But it took the flood of savings unleashed in the pandemic for banks finally to charge depositors in earnest.

Germany’s biggest lenders, Deutsche Bank AG and Commerzbank AG, have told new customers since last year to pay a 0.5% annual rate to keep large sums of money with them. The banks say they can no longer absorb the negative interest rates the European Central Bank charges them. The more customer deposits banks have, the more they have to park with the central bank.

That is creating an unusual incentive, where banks that usually want deposits as an inexpensive form of financing, are essentially telling customers to go away. Banks are even providing new online tools to help customers take their deposits elsewhere.

Banks in Europe resisted passing negative rates on to customers when the ECB first introduced them in 2014, fearing backlash. Some did it only with corporate depositors, who were less likely to complain to local politicians. The banks resorted to other ways to pass on the costs of negative rates, charging higher fees, for instance.

The pandemic has changed the equation. Savings rates skyrocketed with consumers at home. And huge relief programs from the ECB have flooded banks with excess deposits. Banks also have used the economic dislocation of the pandemic to make operational changes they have long resisted.

There are two big questions that arise from charging depositors to hold funds in their bank accounts. The first is the benefit banks receive from now being able to pass on costs to customers. The second is the quandary savers are put in.

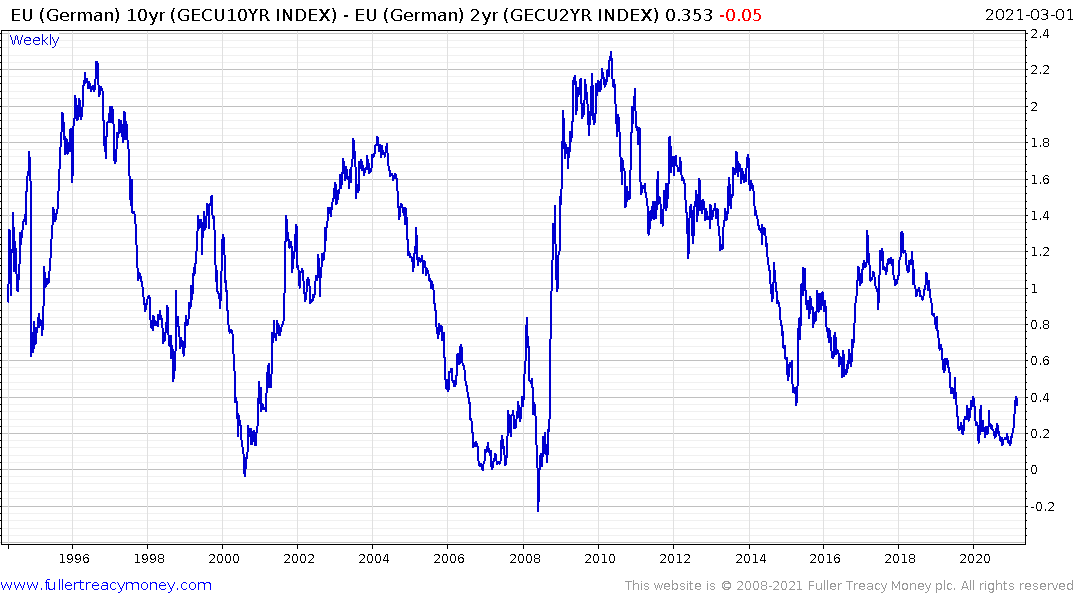

Banks are reducing headcount, closing branches, further exploring online alternatives, charging high fees and continue to benefit from a widening yield curve spread. The 10-year - 2-year spread has risen 33 basis points since late December and is testing the upper side of the yearlong base formation.

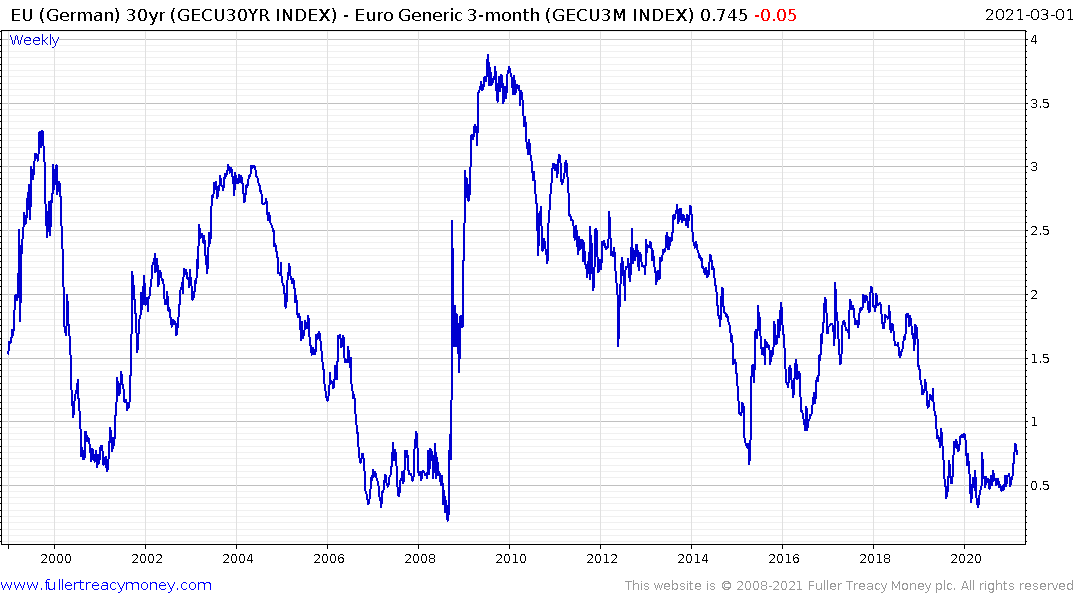

The 30-year - 3-month spread has a similar pattern but the nominal spread is higher at 74 basis points. The margins European lenders are making are certainly slimmer than what is available in the USA or elsewhere but the conditions under which they operate are improving.

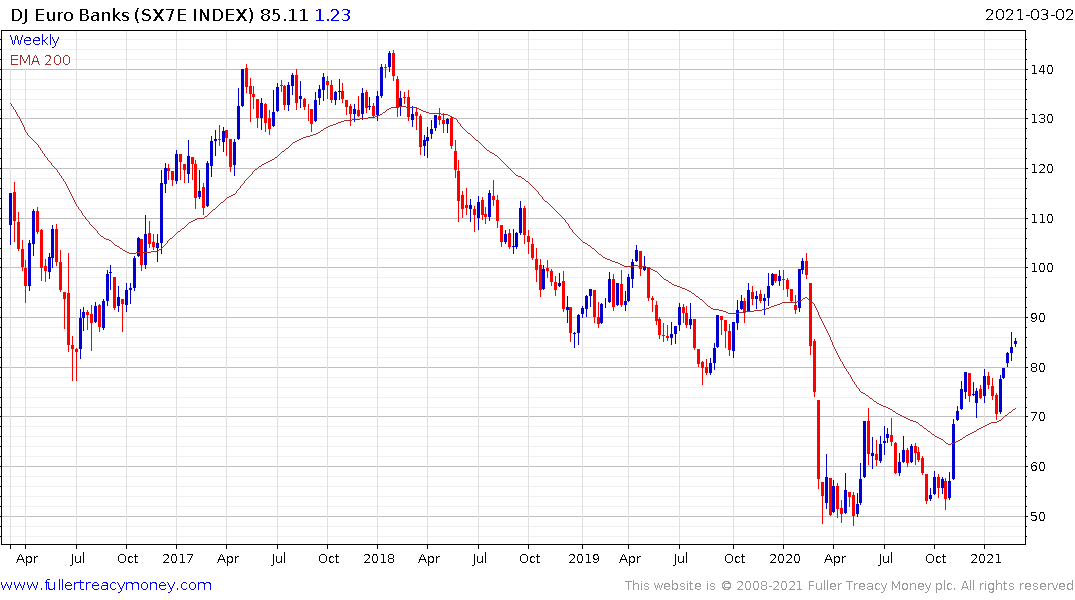

The Euro STOXX Banks Index continues to extend is near-term uptrend.

Meanwhile consumers are faced with a bleak choice. They now have no choice but to speculate in riskier portions of the market because the alternative is to see savings fall in real time. The JP Morgan European Investment Trust focuses on Europe ex-UK stocks and yields 4%.

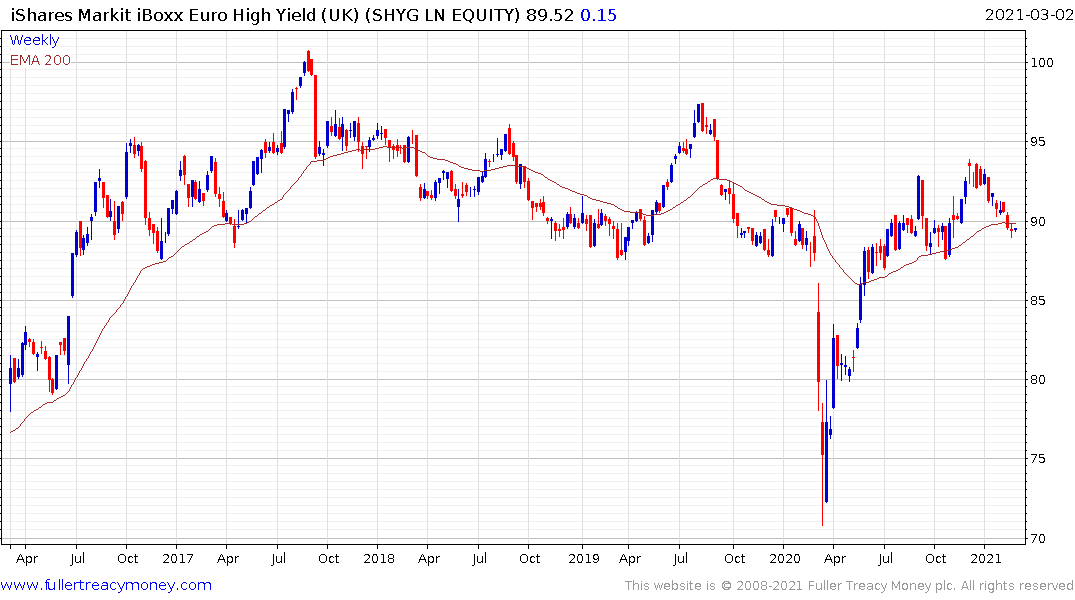

However, if history is any guide mainland Europe investors will continue to show a preference for bonds. That suggests they will either invest in high yield or structured products. The iShares Markit iBoxx Euro High Yield ETF is currently trading in the region of its trend following a powerful rebound from the 2020 lows.

The next alternative is property. If consumers see their deposit accounts shrinking the natural outlet would be to invest in property or other fixed assets. At least you then have an asset than can inflate in prices and with mortgage rates below zero or close to zero the risk interest rate burden is significantly reduced. That suggest there is clear risk of a European property bubble further inflating.