Bank sector Glencore Exposure Is a $100 Billion 'Gorilla', BofA Says

This article by Stephen Morris for Bloomberg may be of interest. Here is a section:

Global financial firms’ estimated $100 billion or more exposure to Glencore Plc may draw more scrutiny as regulatory stress tests approach after the commodity giant’s stock plunge this year, according to Bank of America Corp.

Bank shareholders and regulators may be concerned that Glencore’s debt and trade finance deals, of which a “significant majority” are unsecured, will reveal higher-than-expected risk and require more capital once the lenders are put through U.S. and U.K. stress tests, BofA analysts said Wednesday. Adding an estimated $50 billion of committed lines to the company’s own reported gross debt, the analysts say financial firms’ exposure may be three times larger than Glencore’s reported adjusted net debt of less than $30 billion.

“The banking industry may have significantly more exposure to Glencore than is generally appreciated in the market,” analysts including Alastair Ryan and Michael Helsby said in a note titled “The $100 Billion Gorilla In the Room.” The commodity-price bust and “stress in Glencore’s share price and debt spreads may spur a review by investors, supervisors and bank management,” while “bank shareholders may pressure managements to reduce exposures,” they said.

Loans to the industry have come under scrutiny as the price of oil, copper and other commodities fell to the lowest in 16 years amid weakening demand from China. Glencore, the Swiss producer and trader of commodities led by billionaire Ivan Glasenberg, has pledged to cut debt by $10 billion and revealed more detail about its financing to mollify investors. On Dec. 1, the Bank of England releases its second round of stress tests, in which it has pledged to examine U.K. banks’ commodities exposure.

Glencore spokesman Charles Watenphul declined to comment on the BofA report. Glasenberg told staff last week the company had $13.5 billion of available liquidity and the company “will emerge even stronger.”

Much of the commentary on Glencore has focused on the likelihood of Moody’s downgrading its debt which would result in the company paying higher margin requirements on its extensive trading operations. Right now it is rated the equivalent of BBB by all three major rating agencies but Moody’s gave it a negative outlook on September 18th.

Glencore is a highly leveraged business and has responded in a high beta fashion to the recent steadying in the Continuous Commodity Index and the bounce in oil prices. A process of mean reversion is underway as shorts are pressured. Considering the opacity of its trading activities it would be rash to expect more than that without some support building but a clear downward dynamic would be required to check the current rebound.

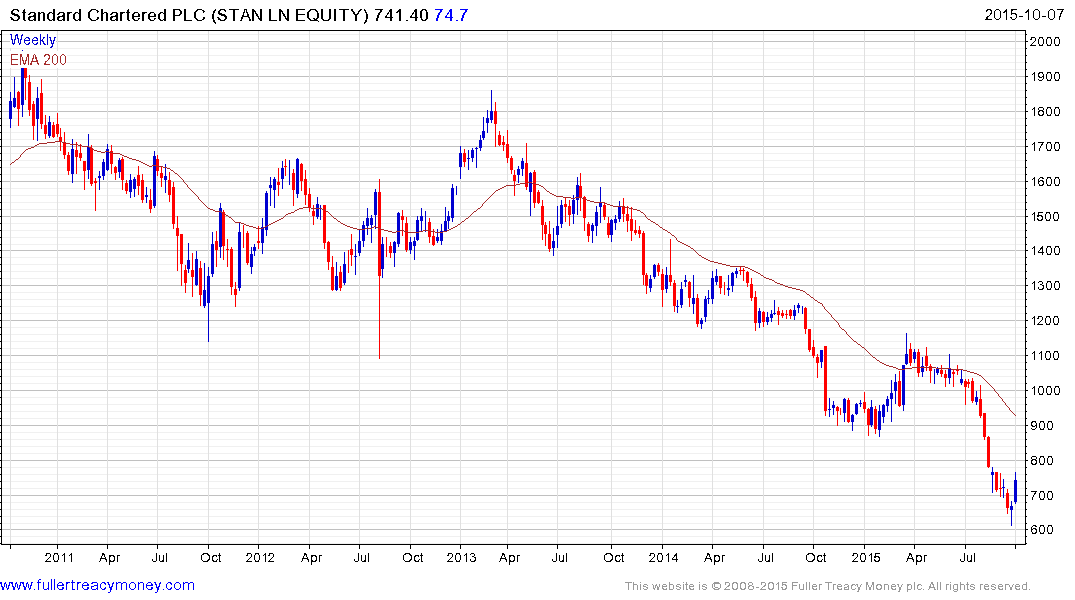

Standard Chartered has substantial exposure to Glencore, also found at least near-term low support and is now also experiencing a short covering rally.

Interestingly Noble Group, which is also a highly leveraged commodity business has not yet rallied. This may be because it has more profound issues that Glencore or perhaps because it is Singapore listed and has not yet caught the attention of International investors.

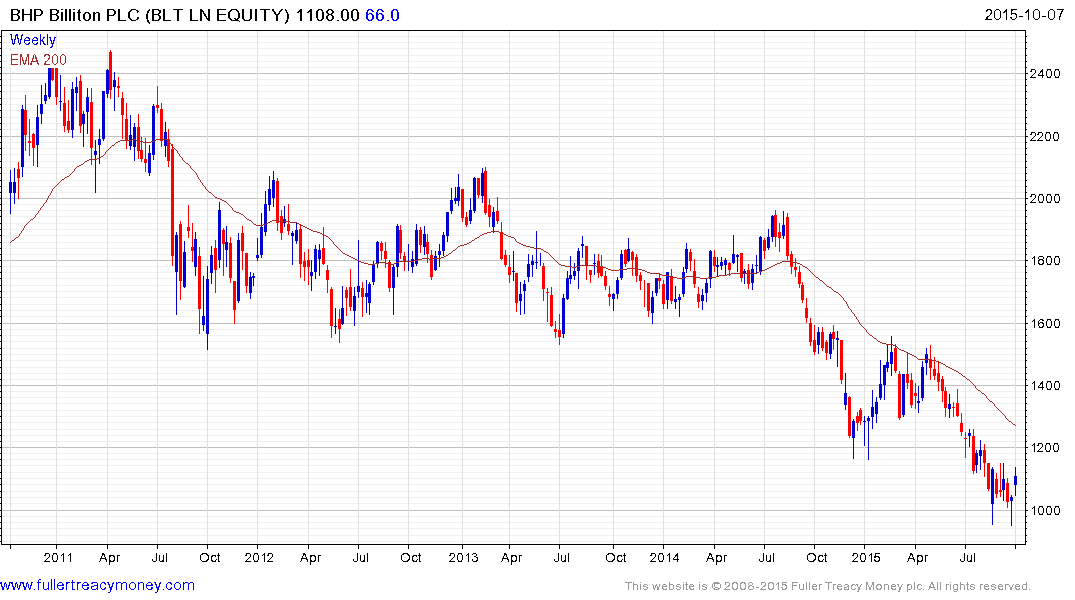

While the industrial metal mining sector has been through a significant correction Glencore represents an extreme reaction. BHP Billiton halved in the last year but continues to find support in the region of the psychological 1000p level.

Rio Tinto is bouncing from above the psychological 2000p level and will need to sustain a move above the trend mean to signal a return to demand dominance beyond the short-term bounce.

Clicking through a considerable number of mining shares this morning perhaps the most obvious conclusion is that none are making new lows. Mean reversionary rallies are by far the most common chart pattern among those that had been trending lower. Once these have run their course, the big question will be how successfully mining shares find support above their respective lows. Considering how overextended they were on the downside they will have ample room to consolidate.

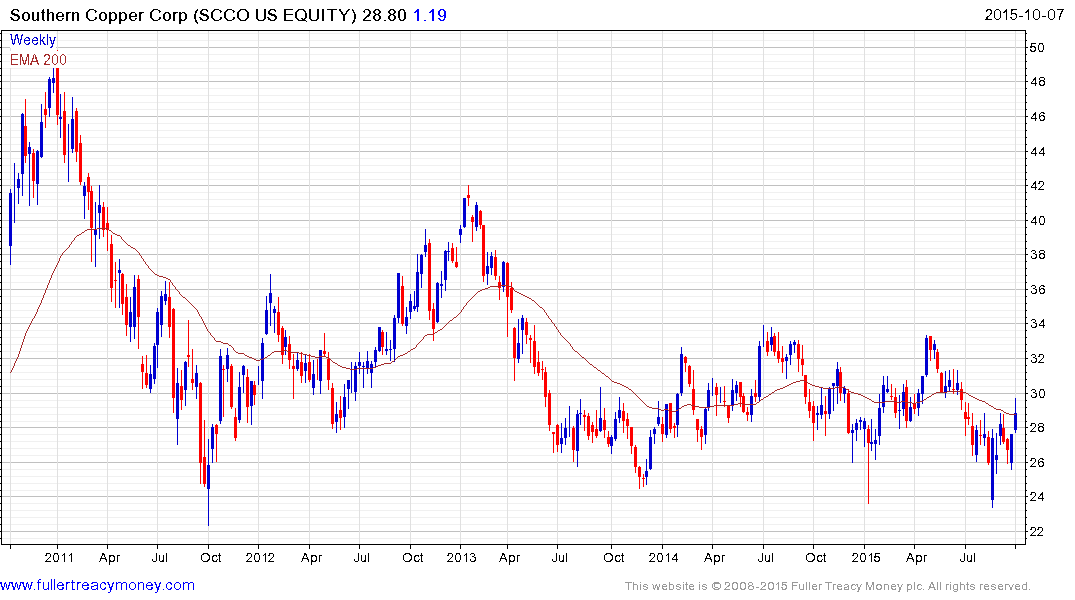

Elsewhere, Southern Copper has been largely rangebound for four years and is currently bouncing from the lower boundary. A sustained move above $35 would signal a return to demand dominance beyond the short term.

Vedanta has been ranging for most of this year and as a result has better defined base formation characteristics when compared to those that have accelerated lower. The relative performance of copper miners is of course dependent on the continued resilience of copper prices.