Bank Rout Rages On With Fed Cut Wagers Mounting

This article from Bloomberg may be of interest. Here is a section:

In such a stressful scenario, some lenders have been trying to assuage investors — with little to no avail.

PacWest Bancorp tumbled 43% even after saying core deposits have increased since March and confirming it’s in talks with several potential investors. Western Alliance also pared losses, but was down 31% despite its denial that the firm is exploring strategic options including a possible sale of all or part of its business.

“Obviously a rough day today — we’re having the latest flare-up in what is slowly becoming a crisis of confidence in the regional-banking sector here in the United States,” said Jim Smigiel, chief investment officer at SEI. “We have recommended additional cash allocations out of equities for our clients.”

That said, Smigiel and a myriad of market observers don’t see the parallels being made in what we’re going through today versus the 2008 financial crisis.

“Some of the differences are obvious — that was a credit crisis, this is not a credit crisis,” he noted. “This is more of an asset-ability-management issue and, of course, some of the ancillary effects of hiking interest rates 500 basis points in a very, very short period of time. But it doesn’t take away from the fact that this is the market testing the weakest hands in the sector and really continuing to do that as we’re seeing today.”

Jay Powell’s statement yesterday, that he sees a line being drawn under the banking crisis, sounds tone deaf today. The mismatches between the draw-down in “safe” assets versus the pressure from tightening credit conditions, and the future of higher loan loss provisions, continue to plague the banking sector.

The Regional Banks ETF closed well off the low today suggesting a low of near-term significance, amid a short-term oversold condition. The contraction of government bond yields is a form of solace for the banking sector even if it also means the chances of a recession are being priced in more aggressively.

The Regional Banks ETF closed well off the low today suggesting a low of near-term significance, amid a short-term oversold condition. The contraction of government bond yields is a form of solace for the banking sector even if it also means the chances of a recession are being priced in more aggressively.

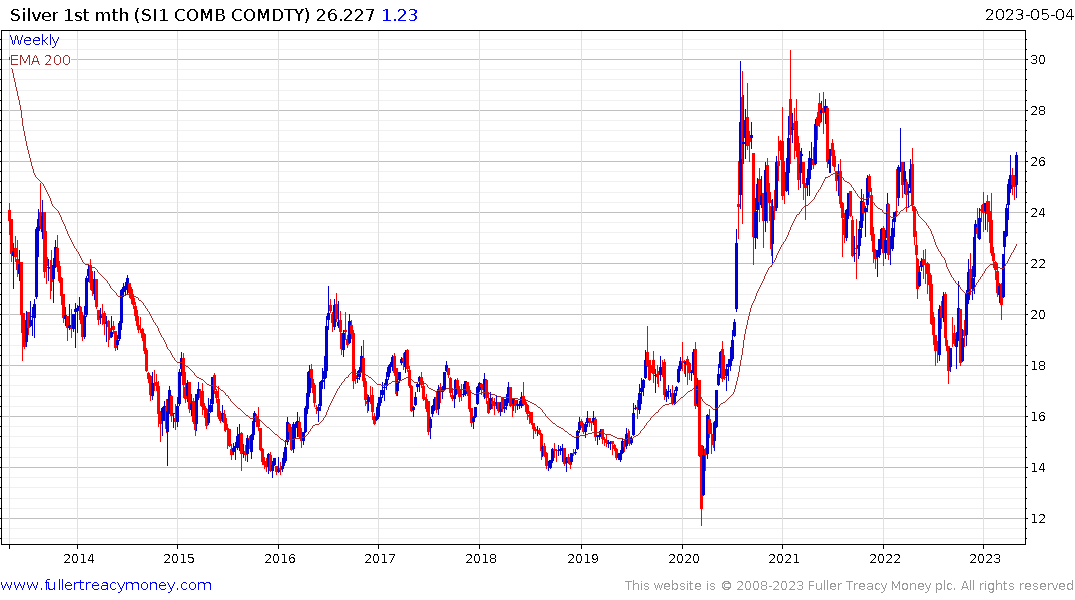

It’s worth highlighting that while risk-off plays like gold or the VIX did not hold their gains today, silver did. The price closed at the upper side of the daily range to breakout of the three-week range. The endgame is debasement of the dollar and precious metals are reflecting that reality.