Bank of Japan Decision Will Affect the World

This article from Bloomberg may be of interest to subscribers. Here is a section:

The BOJ has been the last holdout on negative rates, so these tentative signs that it might be buckling will heighten expectations we may be in for more unsettling volatility in 2023. Markets really don't like uncertainty, and even a suggestion that Japan might be forced into letting bond yields soar higher is enough to get risk managers heading for the exit. Fixed income isn’t quite the haven some commentators had convinced themselves it might be in the new year.

BOJ Governor Haruhiko Kuroda was at pains to downplay any implications for official rates, but this sudden move after implacable denials speaks louder. The BOJ did increase its QE bond buying ammunition to 9 trillion yen ($68 billion) per month from 7.3 trillion yen — all to defend its new line in the sand, the 0.5% 10-year yield. But this is merely a symbolic delaying tactic. Kuroda steps down in April, so Tuesday’s decision increases the expectation that his replacement will usher in further monetary tightening. This is no longer an impenetrable negative interest rate fortress. It might make foreign speculators meditate on the perils of shorting both Japanese government bonds and the yen simultaneously.

Bull markets thrive on liquidity. The Bank of Japan’s efforts to depress the 10-year yield and devalue the Yen were a significant source of liquidity that is now dissipating. There has been scant evidence that the Yen carry trade has done anything to support markets over the last six months but the removal of support is certainly being felt.

The Dollar broke emphatically lower today to extend a decline through the 200-day MA. Any suggestion the currency was finding support in the region of the 200-day MA has been dispelled.

Gold responded favourably and popped back above the psychological $1800 level.

Gold responded favourably and popped back above the psychological $1800 level.

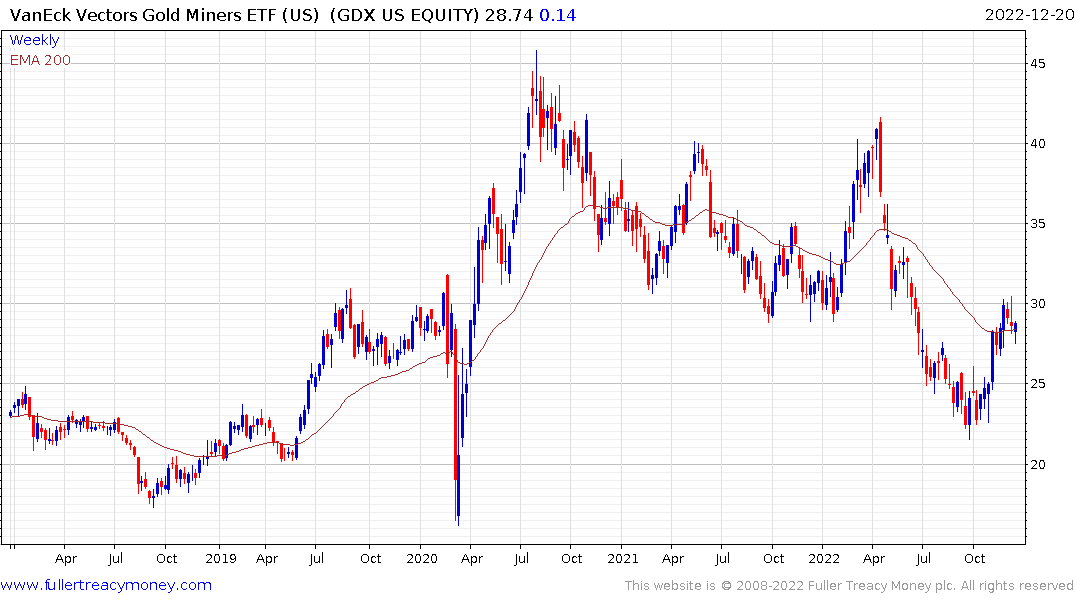

The Van Eck Gold Miners ETF is also firming as it bounces from the region of the 200-day MA.

Silver continues to extend its rebound and continues to hold the short-term sequence of higher reaction lows.

Silver continues to extend its rebound and continues to hold the short-term sequence of higher reaction lows.

Broadly, the restriction to global liquidity puts additional downward pressure on sovereign bonds. US 10-year Treasuries followed JGB yields higher, confirming support in the region of the June peak.

Broadly, the restriction to global liquidity puts additional downward pressure on sovereign bonds. US 10-year Treasuries followed JGB yields higher, confirming support in the region of the June peak.

The belly in the yield curve is now being corrected which suggests continued upward pressure on Japanese yields.

The belly in the yield curve is now being corrected which suggests continued upward pressure on Japanese yields.