Bain Veteran Says 20% Private Equity Returns Have Decades to Run

This article from Bloomberg may be of interest to subscribers. Here is a section:

“The private equity model works,” he said in a Bloomberg TV interview at the World Economic Forum in Davos on Wednesday. “It puts capital to work with experts that really help drive these companies.”

Pagliuca said private equity has “absolutely not” peaked and will still be able to deliver the standard 18% to 20% rate of return in the coming decades.

“We’ve maintained those returns now every decade for 40 years,” he said. “It’s a great business model.”

Buyout firms are readjusting to an environment of higher interest rates that’s making it harder to finance deals and juice returns by loading companies with cheap debt. Valuations have tumbled in both the public and private markets.Rising rates are bringing a reckoning for those firms that invested heavily in speculative technology companies at super-high multiples, according to Pagliuca. Bain has largely steered clear of this market and its portfolio is doing “pretty well,” he said.

There is no doubt that a version of the private equity business model continues perform. The investment practices of the world’s largest sovereign wealth funds, where the holding periods stretch from years to decades is a case in point. They have the financial resources to buy in times of market stress and hold for the long term .There will never be a time when buying low and securing growing cashflows with an infinite holding period will fail.

The more common practice of loading private companies with debt so firms can quickly recoup the cost of the purchase is an other story. The happy coincidence that most aggressive private equity firms prospered at a time when interest rates were falling cannot be ignored. Therefore, this part of the market is likely to benefit from falling yields. Since Treasury yields dropped through 3.5% today, that is likely to favour some strategies.

Brookfield Corp paused today in the region of the 200-day MA.

Blackstone is also encountering resistance as the short-term oversold has been replaced with a short-term overbought condition.

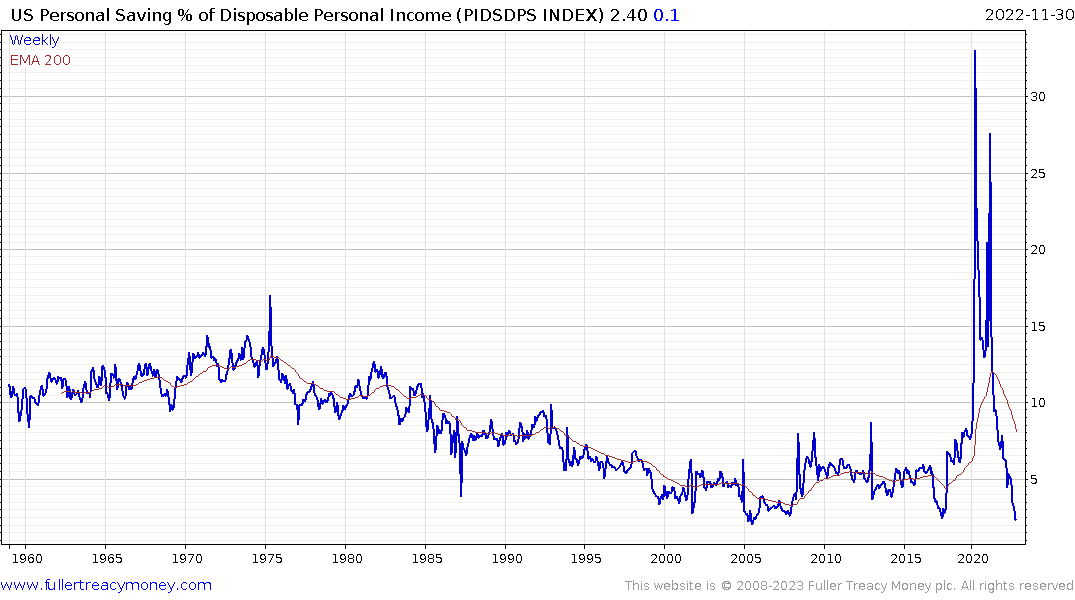

That suggests to me that these companies need rates to fall and stay down to repair the damage sustained from monetary tightening. The personal savings rate as a percentage of disposable income is back to where it stood in 2005. That’s a sign of consumer strength which is obviously not good news for businesses.