Avocado prices hit record after bad weather dents supply

This article by Alan Beattie for the Financial Times may be of interest to subscribers. Here is a section:

The US market, the largest consumer of avocados, is facing a 50-60 per cent decline in Californian output from average levels, because of bad weather, while its main source of imports, Mexico, is expecting a 20 per cent fall in production, says Óscar Martínez at Reyes Gutiérrez, a Spanish avocado importer and distributor.

“The US needs to get extra avocados, and Peru is expected to divert their supplies attracted by their high prices,” he adds.

Avocado trees tend to alternate between “on” years, producing a bumper crop, and “off” years, where the tree recovers from the stress of the previous year’s large production.

In Mexico, the world’s largest producer and exporter of avocados, the off-year has coincided with bad weather, sending the market soaring.

Prices for Mexican Hass avocado have more than doubled since the start of the year, with a 10kg box of avocados jumping to 550 pesos ($26).

Supplies from other producers have also been hit. “Lower output is also expected for the US and Peru where the harvest has been delayed due to heavy rains and flooding,” says Jara Zicha, analyst at Mintec.

My daughters informed me last night that we need to buy more avocadoes because they want to start bringing them to school for lunch. There is already evidence of prices rising with the bags we usually buy going from 8 fruit to 5 in the last couple of months.

The trends of eating healthier fats and the evolving tastes of China’s middle classes have represented a windfall for nut, seed and berry growers with prices multiplying in the last decade.

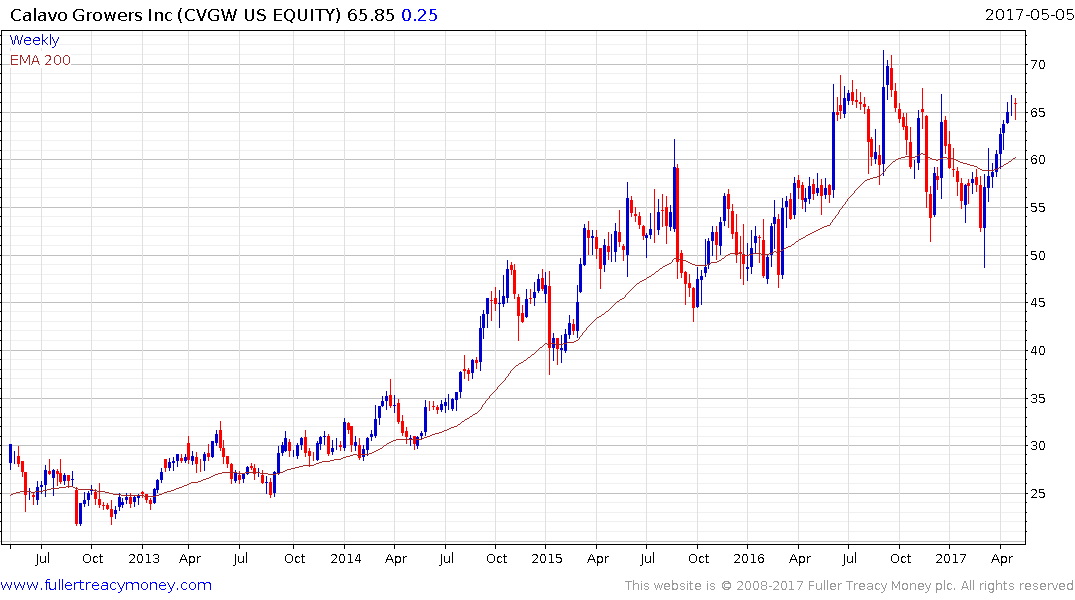

Calavo Growers is among the largest listed avocado companies and bounced impressively from the region of the trend mean and the psychological $50 area in March. It will need to hold that area if medium-term scope for additional upside is to be given the benefit of the doubt.

London listed Camellia has a number of businesses but focuses on agriculture, primarily tea, macadamia nuts and avocados. The share has been ranging mostly below 11,000p since 2011 but has held that level since the beginning of the year and a sustained move below 10,000p would be required to question medium-term scope for a successful upward break.