Australian dollar soars to two-year high on RBA minutes

This article by Jens Meyer for the Sydney Morning Herald may be of interest to subscribers. Here is a section:

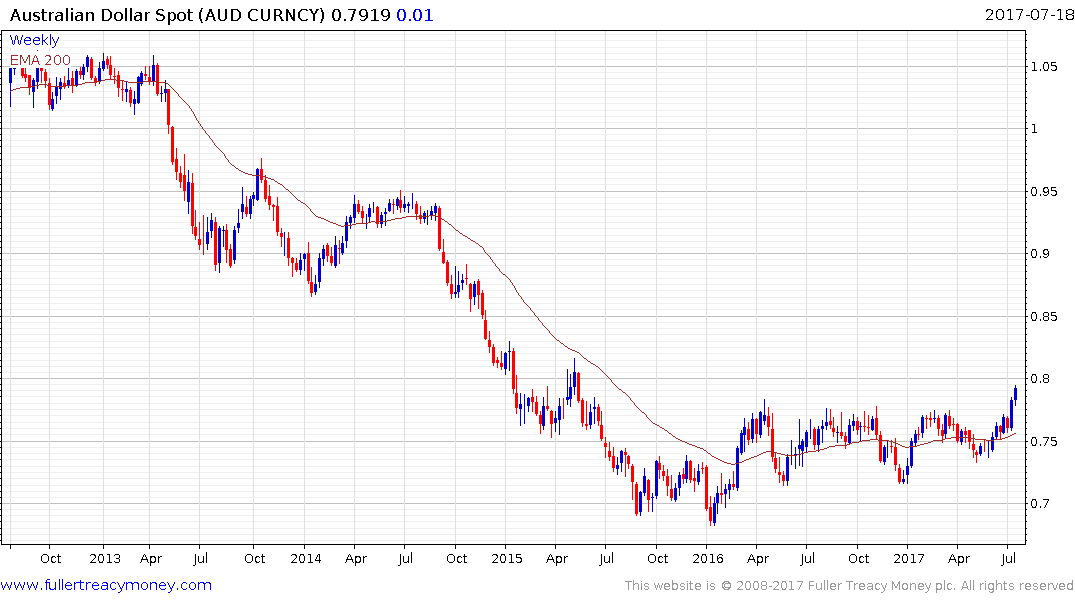

The currency staged a remarkable rally following the release of the RBA's minutes in which the board stuck with its "glass half-full" view of the local economy, repeatedly underlining the "positives" in the outlook. But it also surprised by discussing the level of an appropriate neutral interest rate, which could be seen as a sign the central bank is mulling a rate rise.

Officials revealed that they now believe a cash rate of 3.5 per cent - well above today's 1.5 per cent - would be a rate level that neither stimulates the economy nor holds it back.

In reaction, the Aussie dollar jumped more than 1 US cent to as high as US79.04¢, its highest level since May 2015, after rallying 3 per cent last week.

The RBA is unlikely to be in a hurry to raise rates but the recent bout of strength in the Australian Dollar raises questions for Australian investors. Are they better staying at home or investing abroad? During the commodity boom, and up to the Australian dollar’s peak in 2011, it paid to stay at home. The strength of the currency meant achieving a favourable return overseas was challenging to say the least.

Between 2011 and 2015 it would have been beneficial to eschew the domestic market in favour of overseas investments where the opportunity for capital and currency market appreciation was more favourable. However, with the Australian Dollar now breaking out of an 18-month range the question is whether the pendulum is swinging back in favour of the domestic market from an Australian’s perspective.

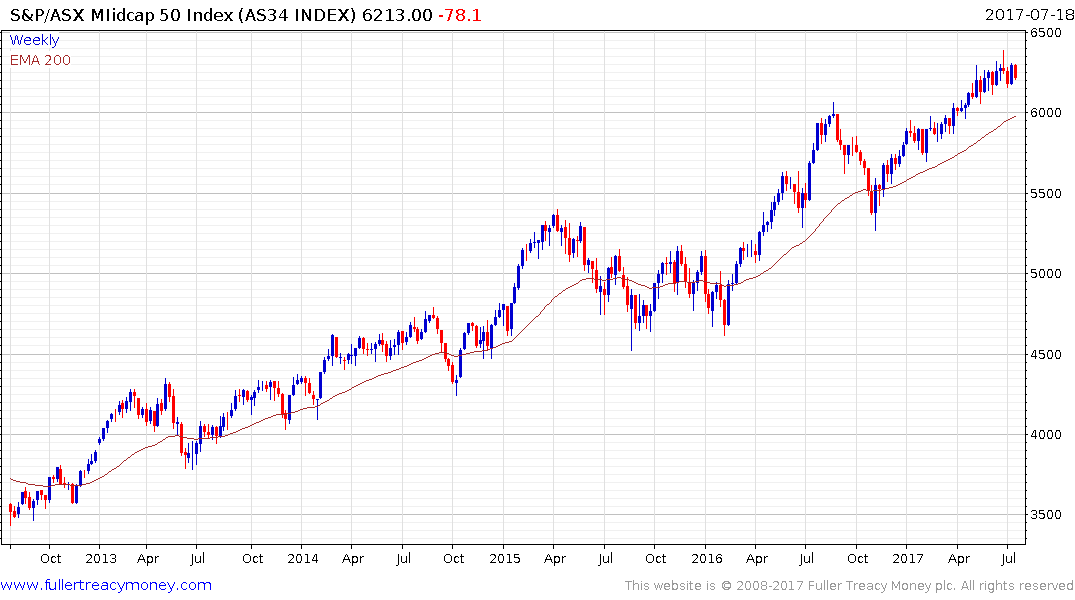

Over the last five years many Australian investors sought succour in the financial sector with its high yields and did not take the opportunity to invest abroad. As the Australian Dollar strengthens it is notable that the banks have not responded favourably. This is at least partly because they are heavily exposed to the interest rate-sensitive residential property market.

The S&P/ASX 200 is heavily weighted by financials and has been trading in the region of the trend mean for the last month. It needs to continue to demonstrate support in this area if potential for additional higher to lateral ranging is to be given the benefit of the doubt.

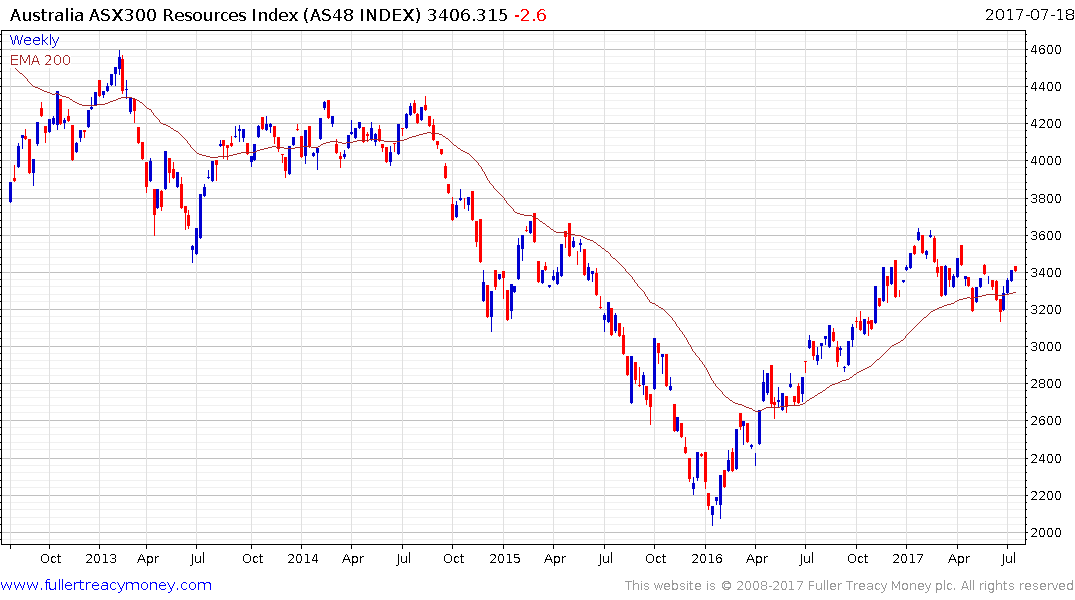

The S&P/ASX 300 Resources Index has firmed from the region of the trend mean but needs to hold the recent low above 300 if recovery potential is to remain credible.

The S&P/ASX Midcap 50 Index is at risk of reverting back towards the mean. Reversions have overshot on just about every occasional pullback since 2012 so an uptick in volatility is possible.

These charts suggest no clear evidence of a rotation is yet observable while the resources sector probably represents the most likely candidate for flows.

Back to top