Australia's Budget Surplus Swells on Jobs, Exports Strength

This article from Bloomberg may be of interest. Here is a section:

The budget surplus, Australia’s first since just before the 2008 global financial crisis derailed the nation’s finances, comes as Chalmers faces pressure to tighten spending further to slow inflation.

And

A survey by JWS Research published in the Australian Financial Review on Tuesday found 75% of those surveyed said cost-of-living was a major issue the government needed to address, ranking its performance to date as below par.

Chalmers reiterated that he expects Australia’s economy will slow significantly in the coming year as higher borrowing costs drag on activity. The RBA forecasts inflation will only return to the top of its target in two years’ time.

Year over year inflation has dropped from 8.4% in December to 5.6% today. That’s a meaningful peak. It’s still well above the pre-pandemic norm but the trend is moving in the right direction.

Australia is in the benign position of exporting key commodities, that are hard to substitute, to some of the world’s most commodity intense economies. That is a significant tailwind to cushion the measures required to get inflation under control. With unemployment at close to record lows and fixed rate mortgages rolling off, the RBA is betting drag on the economy will increase. Here is a section from a recent article:

The historically high share of fixed-rate lending during the pandemic means that a rising cash rate will take slightly longer than usual to pass through to mortgage payments for all borrowers. However, aggregate mortgage payments have still increased substantially because the majority of households have variable-rate loans and most fixed-rate mortgages are fixed for relatively short periods of time (RBA 2023b).

Aside from encountering a large step up in their loan payments, borrowers on fixed rates tend to have newer loans and, on some measures, more risky loan characteristics than borrowers on variable rates. While the differences are not large in aggregate, more vulnerable borrowers (such as those with lower incomes, more leverage and first home buyers) are more exposed to large increases in interest rates and typically have fewer margins of adjustment to their financial situation. They should, therefore, be monitored carefully for signs of emerging stress.

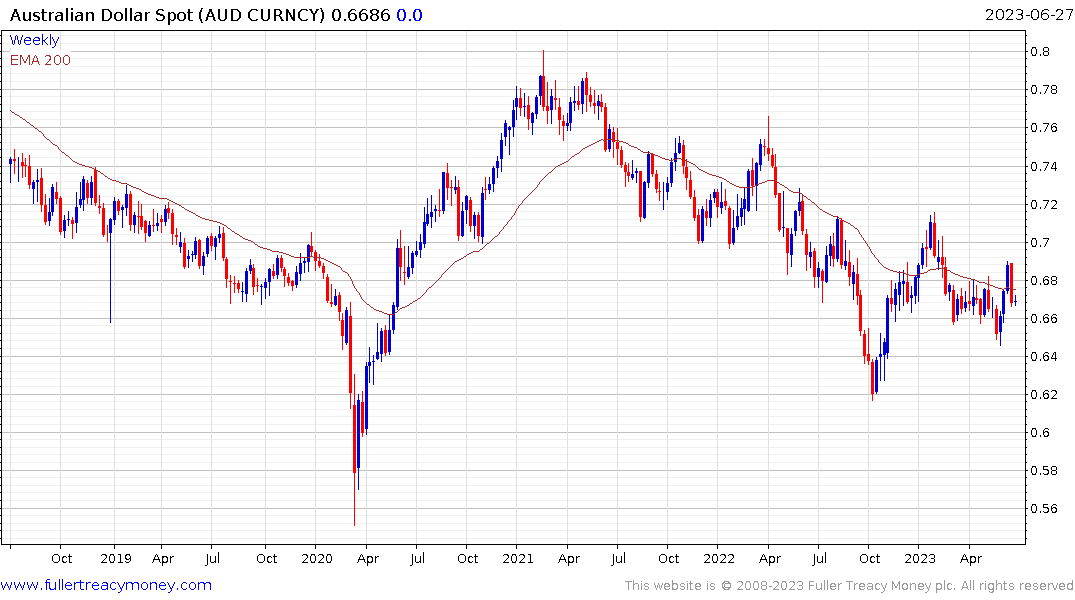

The Australian Dollar is rolling over as commodities ease amid China uncertainty and interest rates are not high enough to encourage a carry trade.

The above paper talks about the delay in the transmission of monetary tightening. That was also a major topic of conversation for the conversation major central bankers had today. Fixed rate loans are a factor in delaying tightening for consumers. So is the sheer volume of cash creating during the pandemic. It takes time for that mountain to be chipped away at. That suggests rates are likely to stay higher for longer before central banks can claim victory. That also highlights the primacy of quantitative tightening in removing liquidity.

Back to top