Australia's 4Q CPI Gives More Reason to End Hikes in Feb

This note from Bloomberg may be of interest. Here it is in full:

Australia's surprisingly strong 4Q inflation isn't likely to phase the Reserve Bank of Australia. The headline outcome exceeded consensus estimates, but undershot the central bank's forecasts - and isn't a threat to our view that a February rate hike is likely to be the last of this cycle.

The economy’s inflationary pulse largely reflects temporary shocks, centered on utilities and airfares in 4Q. A number of other categories showed continued signs that pressures are set to subside in 2023. The central bank’s expectation for a lift in wage growth - necessary for inflation to be sustained in the target band - looks increasingly vulnerable given emerging signs of a softening labor market. Click on the Text tab for the full report.

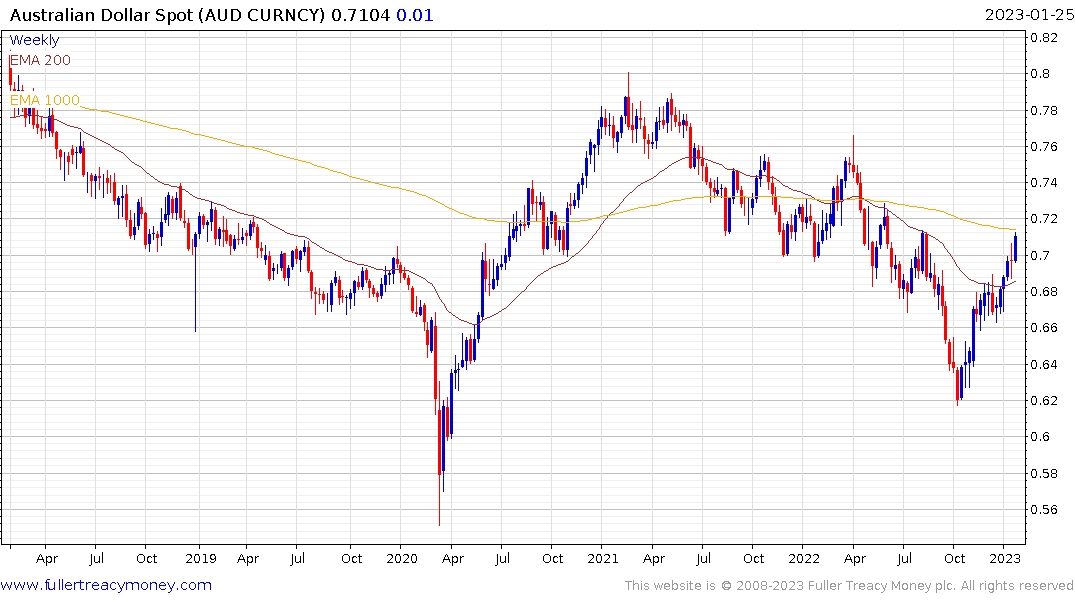

The Australian Dollar has broken the two-year sequence of lower rally highs against the US Dollar. This is the 7th time since 1985 that the Australian Dollar has rebounded from the $0.60 area. The only time it has sustained move below that level was a brief period between 2001 and 2002. I’ll never forget that time because I felt well off from my success in door to door selling in Melbourne and only got £1 for every A$2.60 when I got to London in the spring of 2000.

The Australian 2-year yield rebounded on this news which suggests traders are a little reticent to give up on the inflationary trend just yet. Nevertheless, the trend is less consistent and a sustained move above 3.5% would be required to signal a return to supply dominance beyond the short-term.

The S&P/ASX Materials Index continues to range in the region of the 2008 peak and tested the all-time high this week. There is scope for some consolidation amid the short-term overbought condition but commodity prices remain quite steady amid China’s reopening.