Australia Needs Stimulus to Avoid Recession, Morgan Stanley Says

This article by Mark Mulligan, Jens Meyer for The Sydney Morning Herald may be of interest to subscribers. Here is a section:

Morgan Stanley said in its note on Wednesday that a series of external and internal shocks had forced it to downgrade a more upbeat macro-economic forecast at the beginning of this year.

?Foremost of these was oversupply in bulk commodities such as iron ore, which has driven down the price of Australia's biggest export to near five-year lows, along with "further signs" that China would have to accelerate its own economic rebalancing act away from property and exports.

The bank also singled out the federal government's "alarmist" narrative about a budget emergency, which had dissuaded discretionary consumer spending and private sector capital expenditure. It also accused the government of lacking focus in its infrastructure agenda.

On the property boom, it noted that "the housing recovery has come through even more quickly than we forecast, pulling some growth into 2014 at the expense of 2015". It urged a "delicate mix of jawboning and macro-prudential policies" to cool prices and speculative investment.

Morgan Stanley said all this "puts an already weak labour market at greater risk". Job-shedding from the resources sector and a spluttering "East Coast recovery" would drive the jobless rate from 6.2 per cent now to 6.8 per cent, it said.

As commodity demand growth forecasts undershoot and prices decline, Australia needs a weak currency in order to spur non-resources sections of the economy. Record low interest rates are certainly a help. The recent weakness of the Australian Dollar is an additional benefit for exporters that have seen their competitiveness eroded by the currency’s world beating strength over the last decade.

The Australian Dollar had been ranging above 86¢ for much of last month but broke downwards today to hit a new three-year low. A clear upward dynamic will be required to check momentum, while a sustained move above the 200-day MA would be needed to begin to question medium-term scope for continued weakness.

Among Australia exporters:

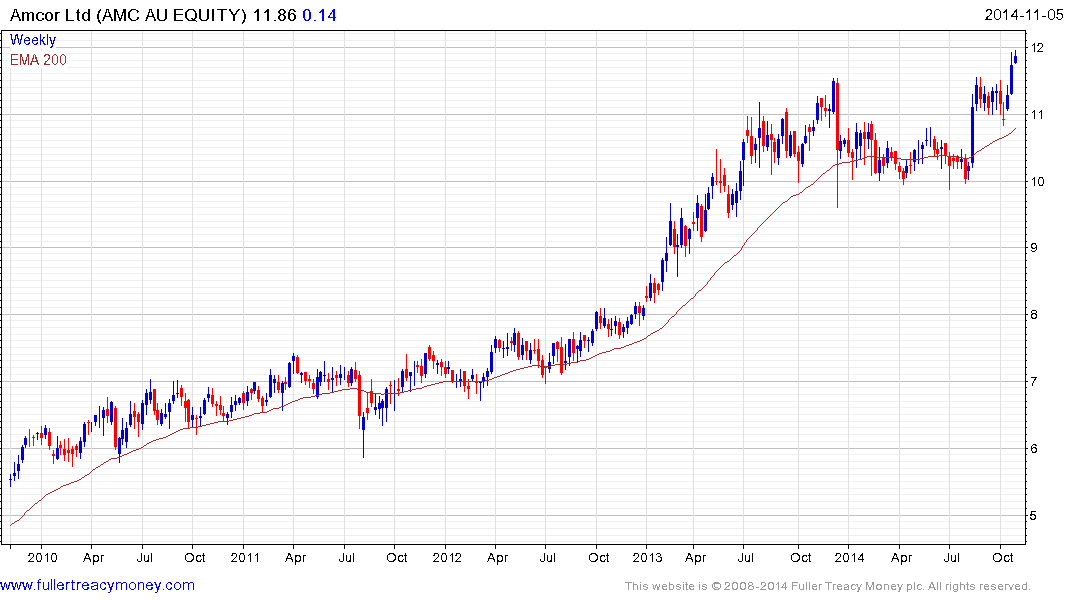

Amcor generates more than 90% of revenues from outside Australia. The share remains in a consistent medium-term uptrend and while somewhat overbought in the short-term a sustained move below the 200-day MA would be required to begin to question medium-term scope for continued upside.

Brambles generates more than 87% of revenue from outside Australia/New Zealand. The share has lost momentum somewhat over the last few months but continues to hold a progression of higher reaction lows.

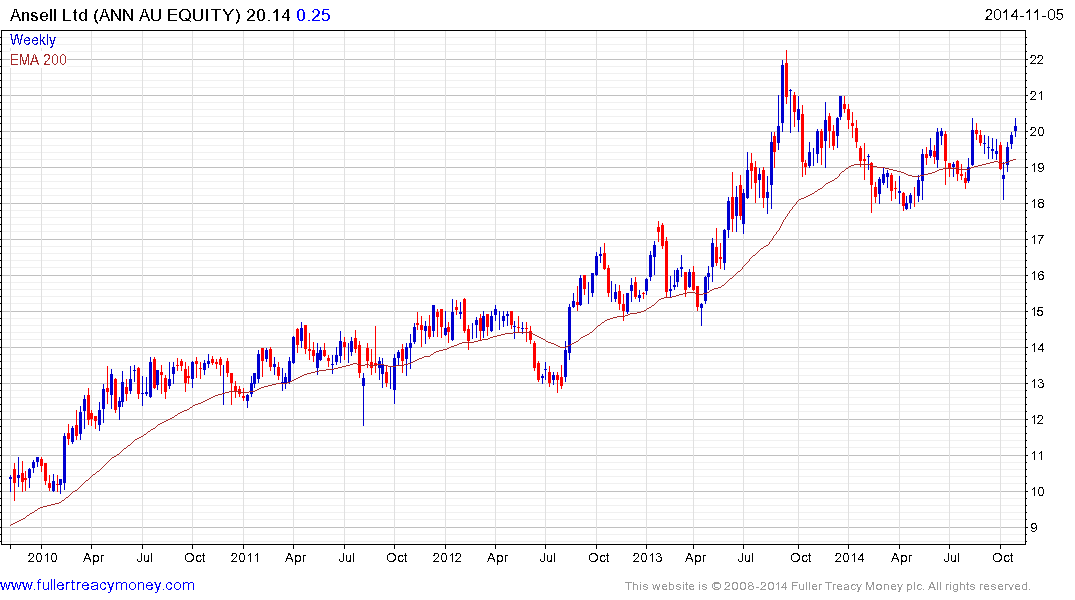

Ansell generates more than 74% of revenue from outside Asia Pacific. The share has been largely ranging above $18 for the last year and a sustained move below that level would be required to question medium-term scope for additional upside.

Cochlear generates more than 96% of revenue outside Asia Pacific but the share is considerably more volatile that the above companies.

A consideration for Australian investors is that these companies should see their consolidated earnings flattered by the weakness of the Australian Dollar. However, the fact that they generate so much of their revenue overseas means that their dividends are not eligible for franking.

Back to top