Australia Holds Key Rate as Central Bank Sounds Caution on China

This note by Micheal Heath for Bloomberg may be of interest to subscribers. Here it is in full:

The RBA has kept rates low in expectation the stance will gradually tighten the labor market and spur wage gains sufficiently to drive faster inflation. But outside strong economic growth and increased demand for construction workers amid an infrastructure boom, there are few signs of this emerging.

“The bank’s central forecast for the Australian economy remains unchanged,” Lowe said. “GDP growth is expected to average a bit above 3 percent in 2018 and 2019. This should see some further reduction in spare capacity.”

The RBA maintains its next move is more likely to be up than down; Lowe, since taking the helm in September 2016, has consistently said that an increase will only come once the economy is near full employment and inflation closer to the central bank’s 2-3 percent target midpoint. Markets aren’t pricing in a rate increase for at least another year, according to bets by swaps traders.

Australia’s population hit 25 million this year which highlights how quickly the numbers of migrants reaching the country have risen. That inward flow of migrants coupled with robust demand from China for the country’s primary exports has helped to keep Australia’s growth trajectory on an expansionary path for decades.

More people and a dearth of new supply, coupled with low interest rates have acted as a tailwind for the housing market. Here too China’s influence has been a considerable factor which has helped propel prices to extraordinarily high levels.

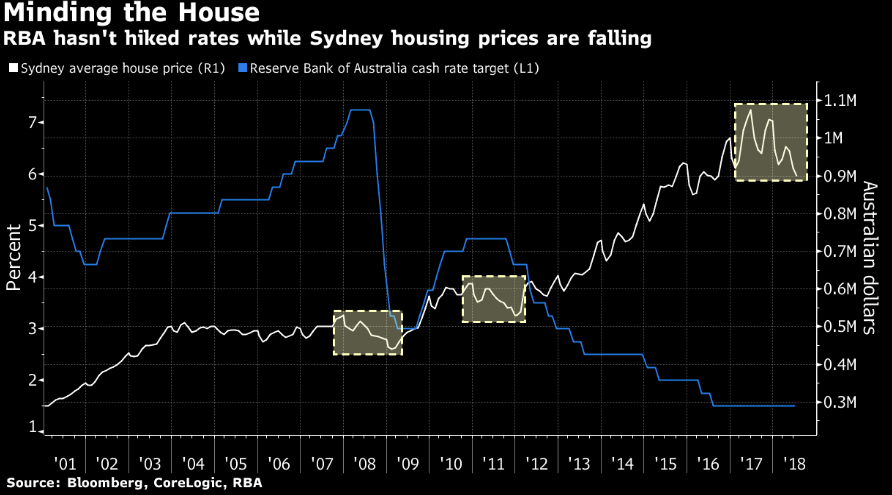

However, the home loan restrictions being imposed by APRA are aimed at reducing leverage. In simple terms if credit is not available at a given price to value ratio then the price will decline to where credit is available. The decline currently underway in property prices are a function of that metric. However, it is also worth considering that this decline is occurring against a background where the central bank is not raising rates.

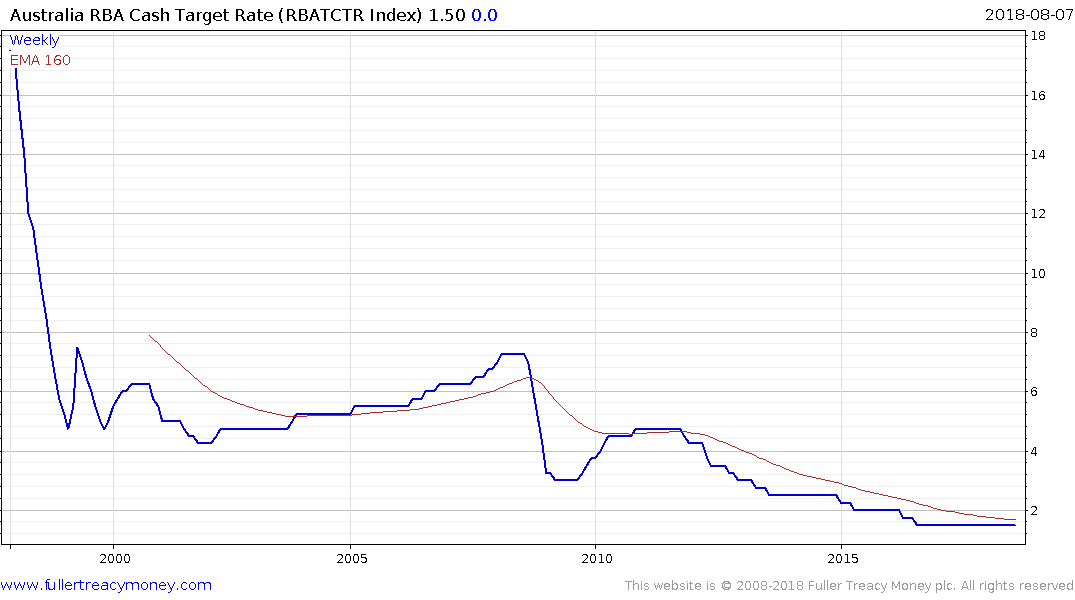

The RBA’s base rate is at 1.5% so the central bank does not have a lot of room to step in a lend further support in the event the economy slows from here.

10-year government bond yields have been ranging below 3% since 2015. A progression of higher reaction lows has been evident over the last year but the yield looks susceptible to a further test of underlying trading. A sustained break below 2.6% would signal a return to demand dominance.

The S&P/ASX 200 is firming within its range and a sustained move below the trend mean would be required to question medium-term scope for continued upside.