Australia Doesn't Have the Answers

This article by Satyajit Das for Bloomberg may be of interest to subscribers. Here is a section:

Finally, the system may well fail in its primary objective -- that is, to minimize the need for the government to finance retirement. The typical accumulated balance at retirement age is around A$200,000 for men and around A$110,000 for women. The averages are artificially increased by a small pool of people with large balances, yet they're still well below the A$600,000 to A$700,000 estimated to be necessary for homeowning and debt-free couples to finance their retirements, which may last 20 or more years.

The Australian government will need to cover the shortfall for a large proportion of the population. In fact, it will lose doubly, having already suffered a loss of revenue from the generous tax breaks provided for the schemes (estimated at A$30 billion annually and increasing), which have been used, especially by wealthy individuals, as a way to reduce their tax burden.

Future generations will also be affected adversely, having to finance payments to older generations through higher taxes or additional government debt, reduced wealth transfers from parents, and lower benefits than those awarded to their predecessors.

Australia has gone decades without a recession not least because it has benefitted from the evolution of commodity demand from China, the growth associated with inward migration of a highly educated workforce and the evolution of the services sector. That has allowed it to retain the mantle of a AAA rated credit while much larger economies like the USA and UK have been downgraded.

However, the lack of a building boom to temper the rise in property prices in the country’s major cities has increased household leverage to historically high levels. The financial sector represents 37% of the S&P/ASX 200 which is still high but is less than it occupied a year ago because the materials’ sector continues to stage a recovery. Australia now has one of the highest foreign debt to GDP ratios of any country at 57.5%. That is a title which puts it in the company of countries like Greece, Portugal and New Zealand.

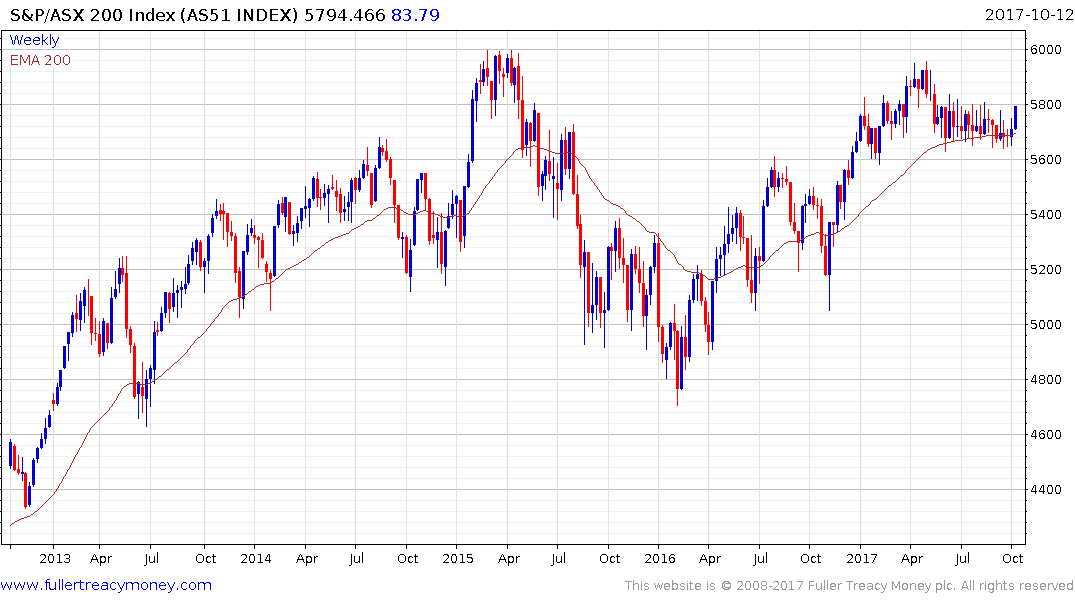

These two almost polar opposite views of the country’s position have likely contributed to the tight rangebound environment which has prevailed on the stock market since May. However, if we take a step back and appreciate the fact the global economy is in a period of synchronized global economic expansion and Australia is a major commodity exporter, the likelihood of the country’s debt problems becoming a troublesome issue imminently is probably not urgent while global commonality lends weight to the argument the market is likely to break upwards.

The S&P/ASX 200 rallied over the last five sessions to test the upper side of its six-month range. A sustained move above 5800 would signal a return to demand dominance beyond the short term.

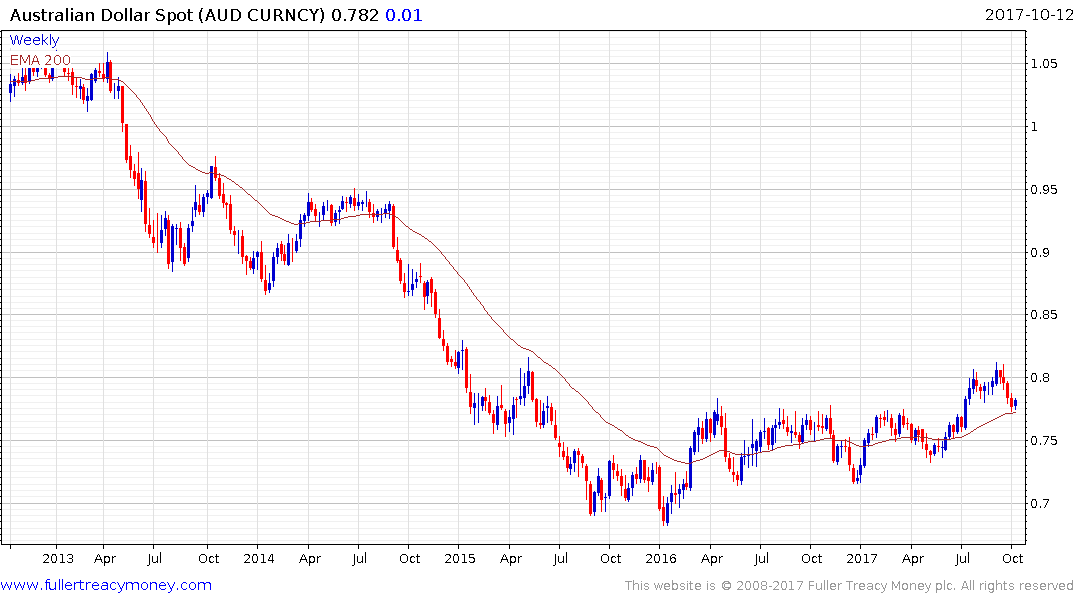

The Australian Dollar is currently bouncing from the region of the trend mean and the upper side of the underlying trading range. A sustained move below 77¢ would be required to question current scope for some additional upside.

Back to top