Australia as China's Canary Means World Watching RBA's Heartbeat

This article by Michael Heath for Bloomberg may be of interest to subscribers. Here is a section:

“Of most interest will be any comments regarding recent financial market turbulence in relation to China and emerging-market driven worries and in particular whether this suggests a strengthened easing bias,” said Shane Oliver, head of investment strategy at Sydney-based AMP Capital Investors Ltd. “My view remains that the probabilities are skewed towards the RBA having to cut rates again at some point.”

The stock market rout in China threatens not only Australian exports but also a fresh slump in confidence among consumers and businesses Down Under.

Company profits fell in the second quarter for the fifth time in a row, the longest stretch of declines for at least two decades, according to data released Monday by the Australian Bureau of Statistics. Firms are forecasting a 23 percent drop in investment in the fiscal year that began July 1, little changed from the 25 percent reduction they estimated three months ago, a government report last Thursday showed.

The Australian Dollar is perhaps the greatest arbiter of the effect the decline in commodity prices has had on the economy. The inability of Chinese demand to meet exaggerated expectations has been a headwind for the mining sector as new supply has reached market. So far the major producers have sacrificed profits for market share and there is no sign just yet that this has ended.

The rate completed a Type-3 top in 2013, encountered resistance in the region of the lower side of the overhead range in 2014, and has been trending lower side. It is currently quite oversold relative to the 200-day MA but a clear upward dynamic would be required to check momentum while a sustained move above the 200-day MA would be needed to question the medium-term downward bias.

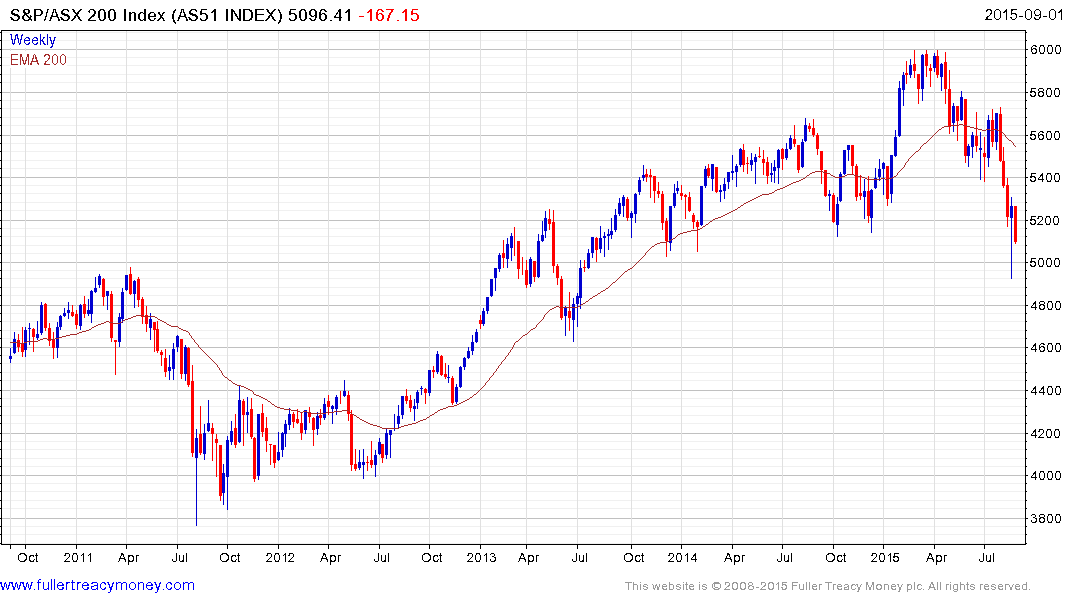

The S&P/ASX 200 Index encountered resistance in the region of 6000 from March and dropped over the course of the last few months to test the 5000 level. Last week’s bounce pressured some short positions but the real test of whether demand is returning to dominance will be in the ability of the last week’s low to hold during the current sell off.