Aussie Surge Takes Sting Out of Bond Losses for Global Investors

This article by Wes Goodman for Bloomberg may be of interest to subscribers. Here is a section:

The Aussie has risen against its U.S. counterpart and fallen against the yen this year as a flight to quality in the global financial markets sent investors to the perceived safety of Japan’s currency. The trend is running its course, and interest rates will emerge as the main force driving currencies, Sugimoto said. The Australian dollar will rise about 6 percent to 90 yen by year-end, he said.

Traders are increasingly betting RBA chief Glenn Stevens will hold the nation’s benchmark rate at 2 percent as growth quickens. Yields suggest traders expect 16 basis points of interest-rate reductions in the coming six months. It was 28 basis points as recently as March 9.

Australia’s economy expanded 3 percent in the fourth quarter from the year-earlier period, the government reported this month, the fastest pace since the start of 2014.

The Australian economy is heavily influenced by what happens to commodity demand growth in China but those concerns are being outweighed right now by the positive interest rate differential investors enjoy by investing in Australia as well as the commodity rebound currently underway.

The Australian Dollar has base formation completion characteristics against the US Dollar and found support this week at the upper side of the underlying base formation.

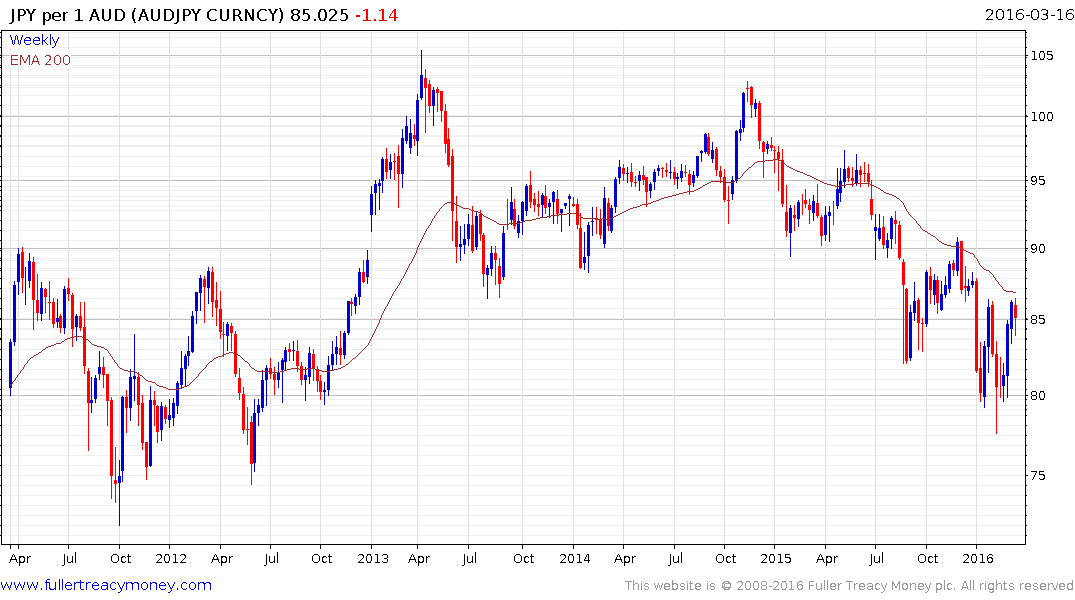

Against the Japanese Yen, it has been consolidating in the region of the 200-day MA and its medium-term progression of lower rally highs. A sustained move above ¥87 would break the downtrend and, as the above articles suggests, could act as a catalyst to unleash additional buying from yield hungry Japanese investors.

The New Zealand Dollar has a slightly higher interest rate (2.25%) than the Australian Dollar but it remains in a yearlong base formation against the US Dollar. A clear downward dynamic would be required to question potential for a successful breakout.