Aussie Jumps Most in 2 Months as RBA Drops Reference to Decline

This article by Anooja Debnath and Kevin Buckland for Bloomberg may be of interest to subscribers. Here is a section:

Bank of Tokyo-Mitsubishi’s Hardman said the weakness in commodity prices “is still the key driver.” He added that “whether the RBA has softened their verbal intervention, I don’t think in the grand scheme of things makes a difference.”

The Aussie, kiwi and Canadian dollar have all declined against their U.S. peer this year as a gauge of commodity prices plunged to a 13-year low.

After its previous meeting in July, the RBA had said of the currency that “further depreciation seems likely and necessary.” Tuesday’s statement was the first since early 2014 that didn’t refer to the Aussie as high or needing to fall further.

Kit Juckes, a London-based strategist at Societe Generale SA wrote in a note to clients that the Aussie’s downtrend against the dollar isn’t over, “with Fed/RBA policy set to diverge further in the months ahead, and with the AUD still vulnerable to adverse shocks from the Chinese economy or from global commodity markets.”

The Fed is widely forecast to be the first major central bank to tighten monetary policy this year, with markets pricing in about a 67 percent chance of an interest rate increase in 2015.

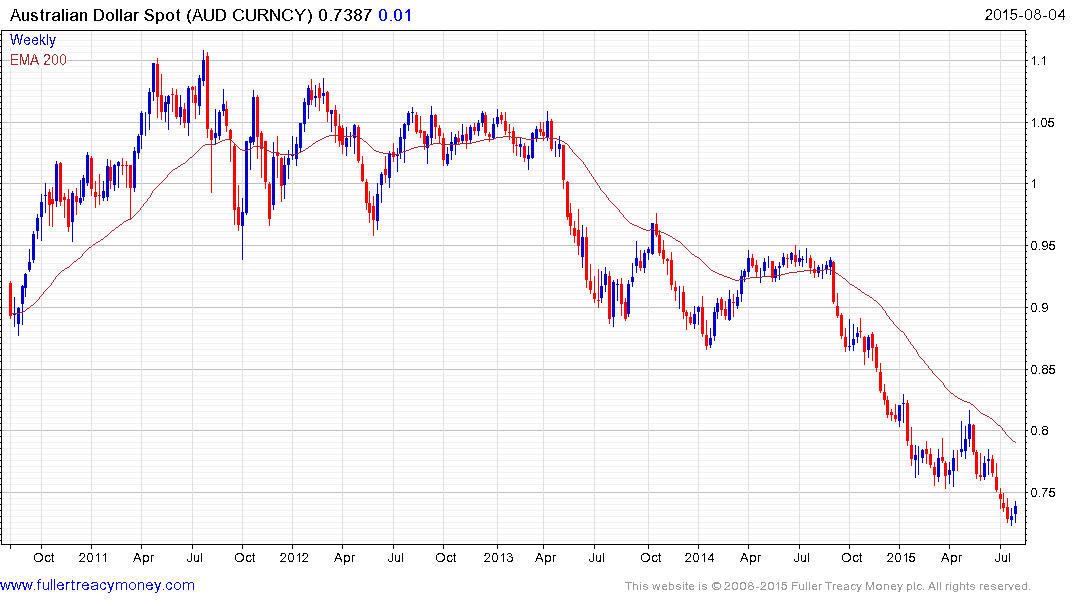

The Australian Dollar is in a well-defined medium-term downtrend but potential for it to unwind the short-term oversold condition relative to the 200-day MA has increased with the RBA’s announcement. A progression of lower rally highs has been evident since 2013 and a sustained move above 80¢ would be required to begin to question the medium-term downward bias.

While in Sydney for The Chart Seminar and a Strategy Session early last year it was evident that the vast majority of delegates had minimal exposure to foreign investments. There are a number of reasons for this not least full franking on dividends which is reserved for companies generating the majority of their revenue from inside Australia. The relative strength of the Australian Dollar over the last decade also made overseas investing less attractive. However it is now open to question whether the relative appeal of overseas markets has the ability to overcome the home bias for the majority of Australian investors.

This total return chart with returns rebased to Australian Dollars comparing the performance of the S&P/ASX 200 with the S&P500 and Europe STOXX 600 highlights the fact that broad Australian correlation with major global benchmarks deteriorated from 2013 which coincides with the Australian Dollar’s completion of its top formation.

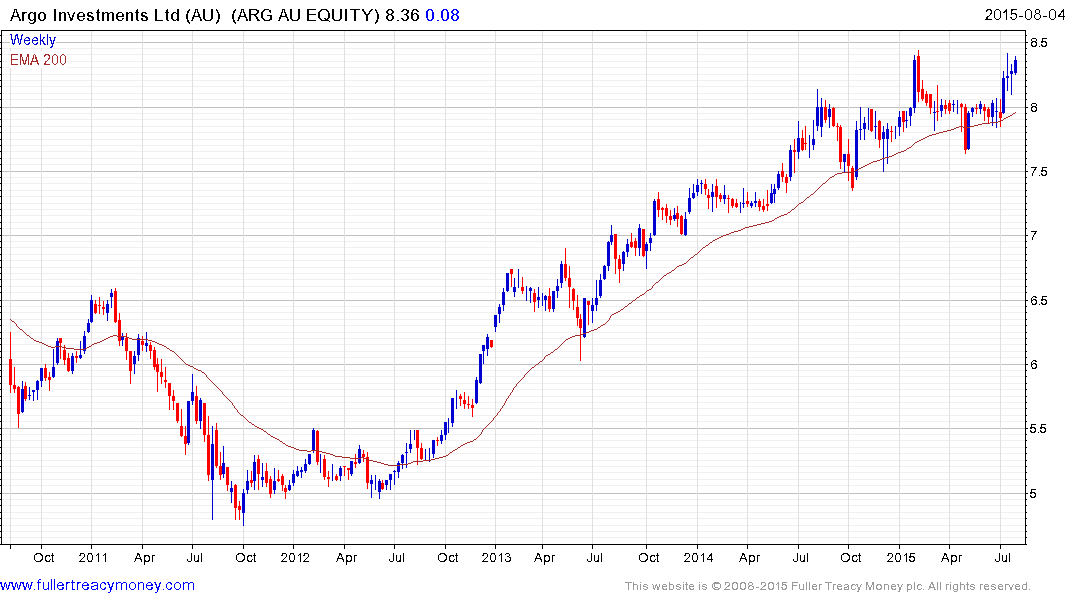

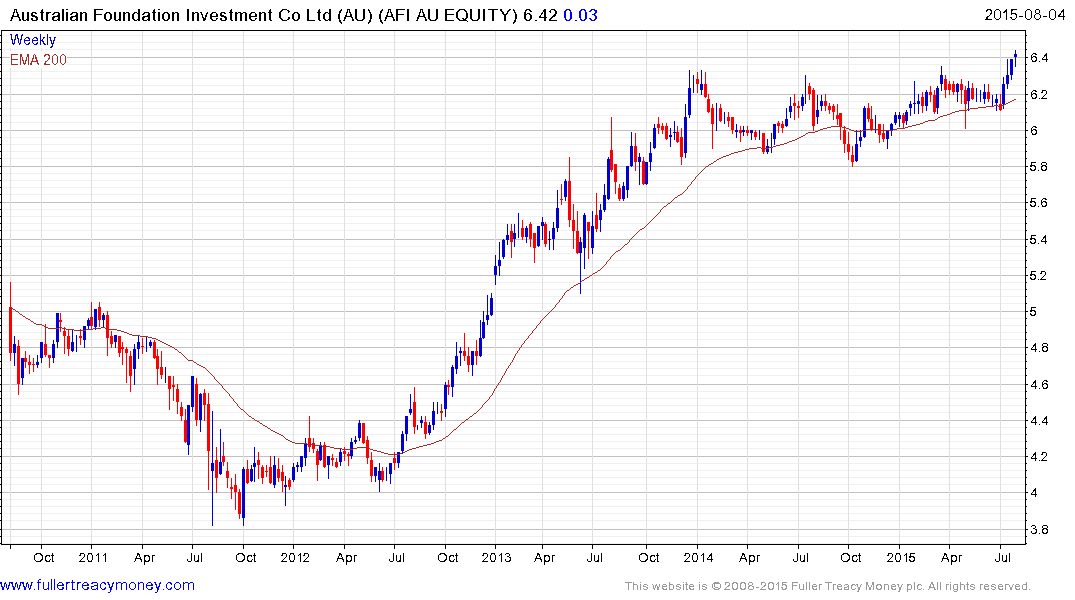

Large domestically focused closed-end funds such as Argo Investments and Australian Foundation Investments are still in form but are trading at premiums to NAV or approximately 10% suggesting a narrow margin for error.

Here is a link to the Australian Dollar denominated Funds section of the Chart Library which has a number of funds offering exposure to overseas markets that may be useful as a contrast.