AsiaPac 2015: 10 questions for equity investors

Thanks to a subscriber for this report from Goldman Sachs which may be of interest to subscribers. Here is a section:

Intra-regional differentiation has been a theme for the past two years with flat regional indices (MXAPJ) but substantial market and sector disparity beneath the headline. In fact, the dispersion in returns (as measured by coefficient of variation) during 2013-14 has been the greatest in the last decade. We think intra-regional differentiation may continue in 2015, given potentially divergent growth paths between the US and other parts of the world and the differing impact of lower oil prices and higher US rates on Asian markets/sectors.

?Wide dispersion creates alpha opportunities and focusing on specific parts of the region may generate better returns than a simple beta strategy of owning the MXAPJ index. We have reviewed the 30 largest country-sectors and highlight several ideas, not all of which we recommend pursuing currently, but which we think are worth monitoring for potential entry points. Areas we like now include reform beneficiaries in China and India, India software and internet, Taiwan tech and IOT plays. We may reenter Macau gaming and Korean mega caps towards mid-2015 if we see clearer signs of a turn in the earnings cycle.

Here is a link to the full report.

The introduction of competitive currency market devaluations to the Asian region with the advent of the BoJ’s QE program resulted in wide variations in the performance of Asian stock markets. For the first time in almost a decade concerted currency market appreciation versus the Dollar was no longer a surety. The halving of oil prices over the last six months is likely to prove an equally important catalyst considering the fact so many Asian countries are among the world’s largest potential growth market markets for oil demand.

The MSCI Asia Ex Japan Index is a market cap weighted index and shares a similar pattern to the Hang Seng, although it has lagged of late. It has held a progression of higher reaction lows since 2012 and a sustained move below 450 would be required to question medium-term scope for additional upside.

The Hong Kong listed H-Share Index has among the lowest valuations in the world and is currently testing the upper side of a three-year range and has potential to outperform once it breaks out.

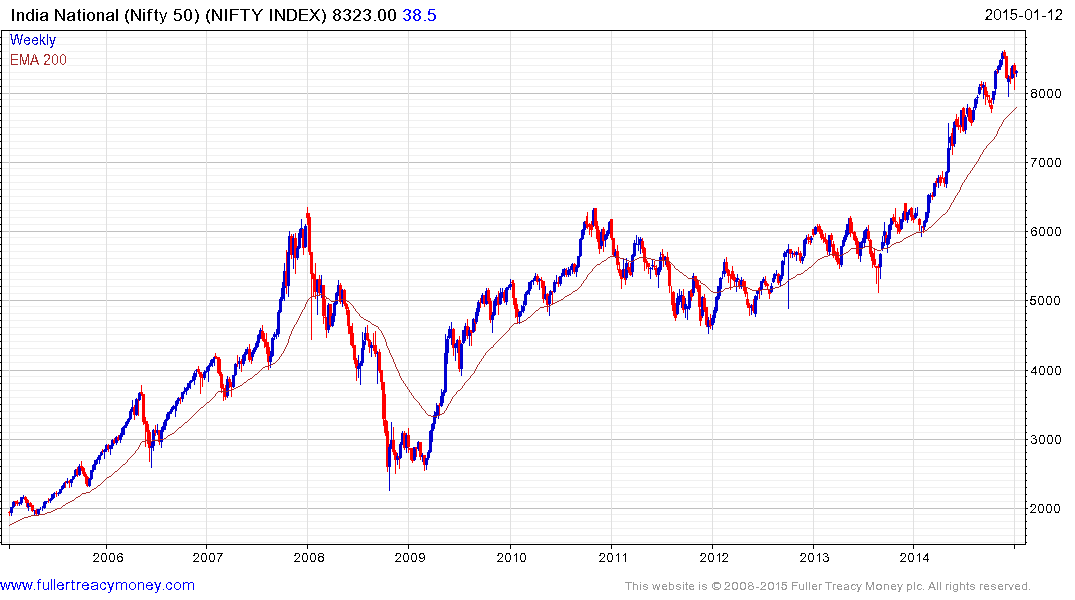

The pace of the Indian market’s advance has moderated following its explosive breakout last year and a break in the progression of higher reaction lows, currently near 8000, would be required to question the consistency of the medium-term advance. From the perspective of a foreign investor, India is in a rather favourable position since its currency was devalued in 2013 and has been reasonably steady since. Additionally, few countries benefit more from weak oil prices.

Back to top