Asian Markets 2017

Thanks to a subscriber for this report from HSBC which may be of interest. Here is a section on Indonesia:

We are positive on Indonesia in the regional context. We continue to regard Indonesia as one of the prominent structural growth stories in the region and the recent equity market correction is a good buying opportunity. The combination of a tax amnesty, a build out of much-needed infrastructure and the roll-out of a healthcare scheme should support growth going into the New Year. With regards to the tax amnesty programme and repatriation, approximately 29% of funds have been repatriated to Indonesia by the end of November, implying that more is to come

These repatriated funds will be put to work in 2017, allowing for funding of government infrastructure projects. Looking ahead, the equity market’s performance may hinge on a stronger earnings outlook and continuation of the positive earnings revision ratio trend

Some have pointed at rising political risk following demonstrations against the Jakarta mayor, a Christian who had made some comments on Islam. While this might have little to do with government policies, the mayor is a close ally of President Joko Widodo. The removal of the mayor in upcoming elections in February could have an impact on support for the president and his policies.

Based on the macro-environment, we see consensus forecast for 11% EPS growth for 2017 as quite reasonable. We are expecting a pick-up in economic activity due to greater and more efficient fiscal spending, stronger commodity prices and resilient consumer spending

Infrastructure investment remains a key theme for the market, as Indonesia looks to modernise its road-rail network. In addition, our banks’ analysts expect the asset quality concerns to peak out by end 2016, which means credit cost should at the very least stabilize in 2017. This should benefit Indonesian banks.

Here is a link to the full report.

Widodo has not been blessed with Modi’s large majority and as a result has had a more difficult route to implementing reform and cleaning up cronyism. Nevertheless progress has been made and the currency stabilised from last year.

The weakness of the currency boosted the nominal performance of the stock market which has been largely rangebound since 2013. Foreign currency funds offer a truer perspective on the performance of the market when the Rupiah is accounted for.

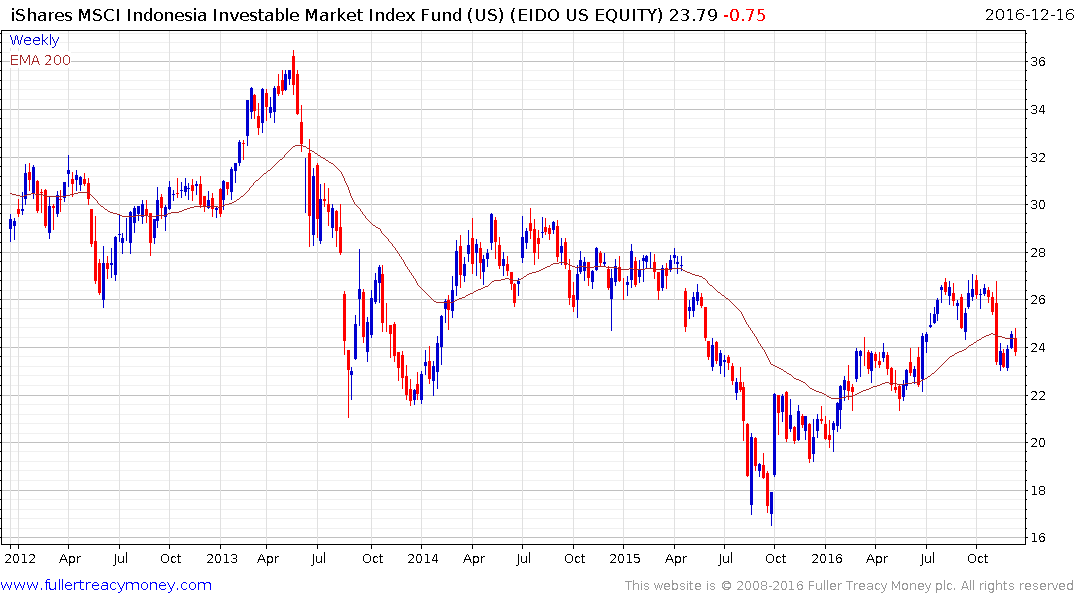

The iShares MSCI Indonesia ETF has held a progression of higher reaction lows since late 2015 but that sequence is now being testing following the sharp pullback in the aftermath of the US Presidential Election.

The Dollar surged higher against the Rupiah from early November and found support in the region of the trend mean this week. This looks like a bullish consolidation and a sustained move below the 200-day MA would be required to question potential for additional Dollar dominance. That is likely to act as a headwind for foreign investors in the country.