Asian Currencies Slide After Fed Officials Signal Rate Increase Possible in 2015

This article by Chung Da for the Wall Street Journal may be of interest to subscribers. Here is a section:

The dollar rose overnight to levels reached before last week’s Fed decision to leave interest rates unchanged. Regional Fed presidents Jeffrey Lacker of Richmond, Va., James Bullard of St. Louis and John Williams of San Francisco signaled in speeches that many central-bank objectives had been met and that Thursday’s decision was a close call.

The Wall Street Journal Dollar Index, which measures the dollar against a basket of 16 currencies, rose overnight to its highest level since Sept. 10, at 88.49 overnight. It was last at 88.33.

“The reinstatement of long positions in the U.S. dollar is helping calm Asian stock markets [and] easing Asian currencies,” said Evan Lucas, a strategist at brokerage IG.

The Fed might not be thrilled with the relative strength of the Dollar but other countries need a weaker currency more. Both the ECB and BoJ are still engaged in QE and the Chinese have called a halt to the appreciation of the Renminbi. Elsewhere, commodity related currencies and those of countries sensitive to any loss of competitiveness relative to their major export markets all have an interest in having a weaker currency.

The Dollar Index surged from July 2014 to a medium-term peak near the psychological 100 by March. It has spent the last six months consolidating that move and unwinding the overbought condition relative to the 200-day MA. It bounced back impressively from the August 24th low and a sustained move below 94 would now be required to question medium-term scope for additional upside.

The Asia Dollar Index stabilised following its early August acceleration lower following the Chinese revaluation but will need to hold the low near 107 if support building is to be given the benefit of the doubt.

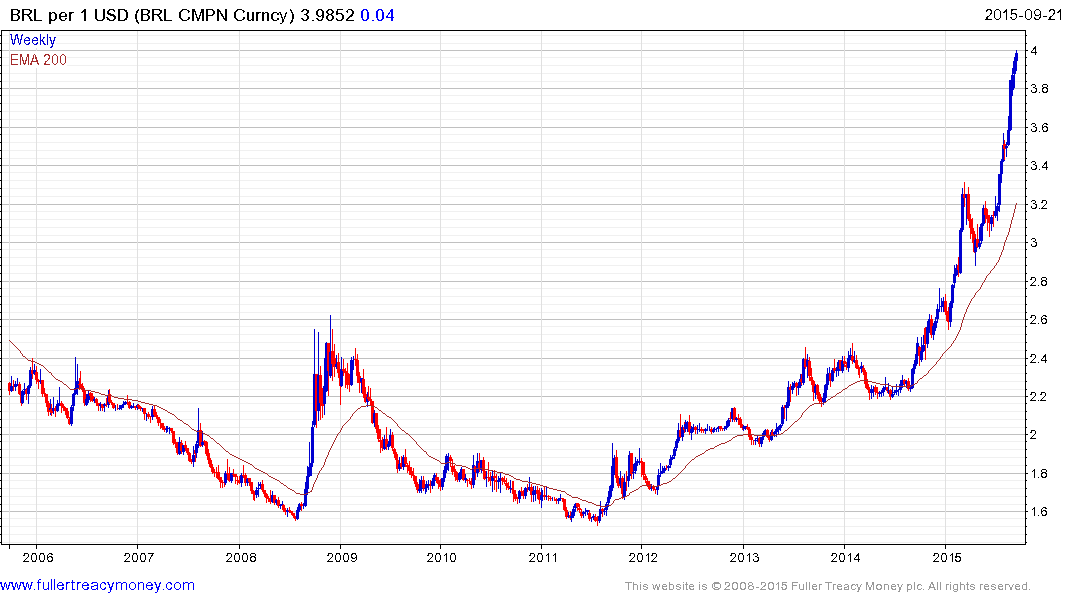

The US Dollar continues to accelerate higher against the Brazilian Real. A catalyst in the form of political change is probably required to restore confidence in the ability of the economy to meet its obligations.

Brazilian 10-year US Dollar denominated bond yields broke out to new recovery highs in July and a clear downward dynamic would be required to question medium-term supply dominance.

Back to top