Asian currencies

There are two major issues currently at work in the currency markets. The relative strength of the Dollar and the falling price of oil both represent major changes to the status quo which has prevailed for the last decade.

In the decade from 2000 the majority of Asian and commodity related currencies outperformed the Dollar because the USA needed a weak currency in order to recover from the Tech bust, 9/11 and the credit crisis. By contrast the re-entry of China to the global economy as a major consumer of commodities led to the Supply Inelasticity Meets Rising Demand bull market in commodities.

Higher commodity prices encourage a supply response and a great of deal of money was spent on expansion. Much of this was funded with Dollar loans since interest rates were attractive and the currency weak. As commodity prices contract and the Dollar strengthens pressure is coming to bear on some of the more overleveraged participants.

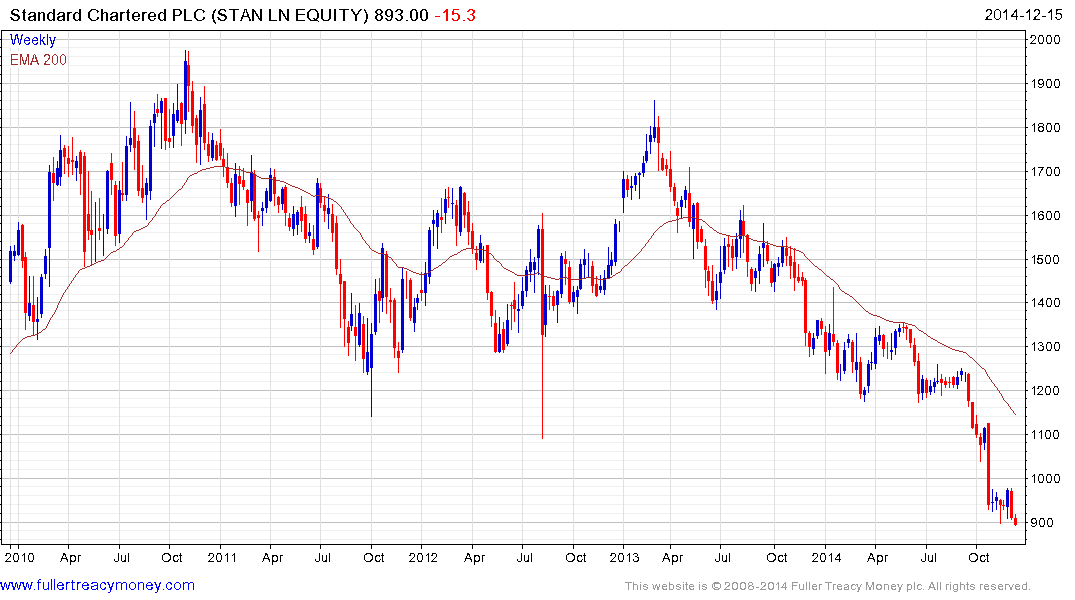

Standard Chartered was among the most adventurous in extending loans to resources companies and its share price, while overextended, continues to trend lower.

The Asia Dollar Index is breaking downwards from a three-year range and a clear upward dynamic will be required to question potential for additional weakness.

Today’s volatility on the Thai stock Index suggests a high degree of emotionality with energy producers pulling back sharply while the banking sector rallied well of its lows.

A number of overextensions are evident on an increasing number of instruments and these represent potentially climactic activity but there is no evidence yet that it has ended.

Back to top