Asia Bank Primer 2018

This heavyweight 246-page report from Bank of America/Merrill Lynch may be of interest to subscribers. Here is a section:

The H-share Chinese banks’ share prices are driven by a number of factors, mainly including macro economy, policy, liquidity, and capital market performance of their global and the A-share peers.

Macro economy: As banks are widely perceived as proxy on the macro, the share price performance is also reflective of investors’ confidence in China’s economy, not only in the reported GDP numbers, but also in the quality of growth. While the strong rebound in GDP growth from 2008-09 did drive a sharp re-rating in the H-share banks, the continued strong growth in the economy in 2010-11 failed to support the banks’ valuation, as investors were increasingly concerned about the structural problems in the economy. The de-rating continued in 2012-16 on lingering concerns about hard-landing. When investors became more confident in China’s economy in 2017, the banking stock’s valuation rebounded.

Policy and liquidity risks: Chinese banks are still tightly regulated and strongly influenced by government policies (eg, on credit growth, interest rates, capital and provisional requirements, shadow-banking activities). Since 2008, China’s macro policy has been swinging between supporting growth and fighting bubbles. Banks tend to underperform during the tightening cycles, due to the regulatory headwinds and concerns about their balance sheet risks. When policies turn to be more accommodative, marked by a cut in RRR (required reserve rates) or benchmark interest rates, the banks tend to deliver better share-price performance.

Performance of global banks: Given the large market cap of the H-share banks, their share prices are strongly influenced by global liquidity, fund flow, and performance of the global banks. Global financial portfolio managers constantly evaluate the risk-return profile of the Chinese banks against their large-cap global peers. Over the past seven years, the correlation appeared to be quite strong, such as the sell-off in 2011-12 amid the Euro-debt crisis, and the rebound from early2016 to now on the back of the “global synchronized recovery”.

Here is a link to the full report.

Hong Kong interest rates rise with those of the Fed. The Chinese export engine is back in fine fettle with Purchasing Managers Indices trending higher just about everywhere, but especially in Europe which is a major destination for goods. Additionally, Chinese banks trade at significantly lower multiples to their global peers. That is translating into a positive environment for the region’s banks.

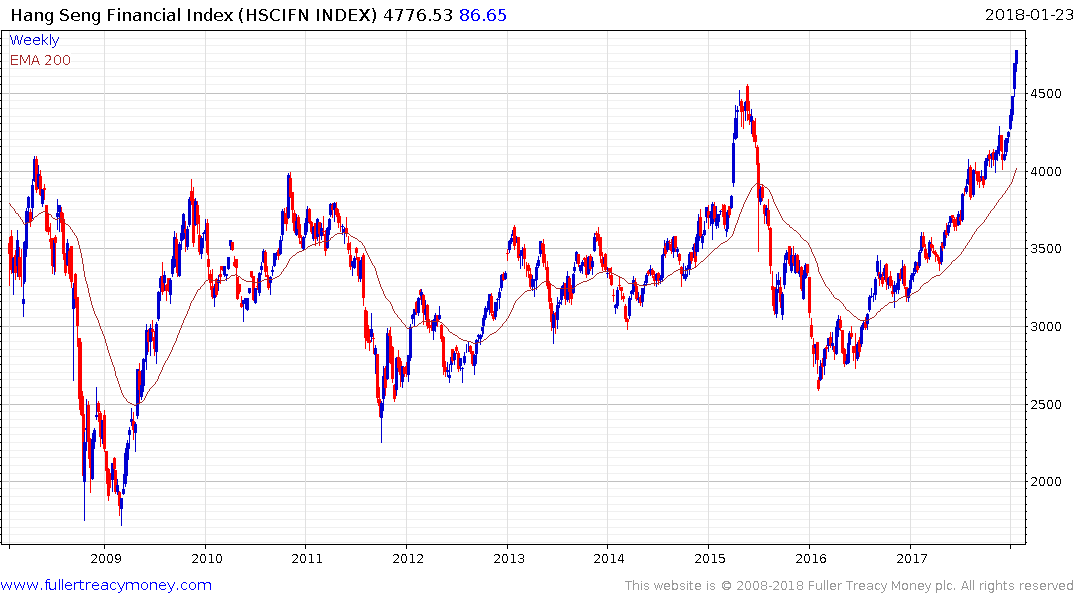

The Hang Seng Financials Index is accelerating towards the 2007 peak near 4875 and a clear downward dynamic will be required to check momentum.

The FTSE China A600 Banks Index broke out to new recovery highs this week to complete a 30-month range.

The Hang Seng surmounted its 2007 peak today as it accelerated away from the 30,000 level. The banks have joined Tencent in propelling the move higher.

This action is symptomatic of the risk-on attitude gripping markets where Hong Kong might be considered a high beta play on US interest rates and Chinese growth. It’s also worth remembering that Hong Kong is prone to boom and bust cycles so clear downward dynamics when they occur cannot be ignored.

Back to top