Asean economies to outperform rest of Asia

This article The Edge in Singapore, quoting a report from Nomura, may be of interest to subscribers. Here is a section:

Southeast Asian countries, with the exception of Thailand and Singapore, have better economic prospects than the rest of Asia, according to Nomura Holdings.

In a Tuesday media briefing, senior Nomura economists and researchers say that the countries they are positive about – Malaysia, the Philippines, and Indonesia -- are strong structurally and have the right policies in place.

Euben Paracuelles, Nomura’s Senior Economist on Southeast Asia, says they have a neutral outlook on Malaysia, but is positive overall noting the sentiments around the country.

“The economy is really quite resilient despite this combination of shocks from low commodity prices, fiscal consolidation [and] the political noise… because there was quite a bit of diversification in the economy in the last couple of decades,” Paracuelles says.

He says Malaysia’s manufacturing sector is doing well because it has a competitive currency and the right product mix that can cater to the current US consumer demand and their recovering housing market.

With manufacturing making up 60% of the export sector, and commodities making up 30%, the manufacturing gains is enough to offset the loss in commodity profits, he adds.

For the Philippines, Paracuelles noted that the new president, Rodrigo Duterte, would “take a very pragmatic approach [for the economy].”He says that it is unlikely for Duterte to reverse the current economic reforms, and the eight-point agenda he released after his win highlighted that policy continuity is key.

China is Asia’s regional heavyweight so when the Renminbi found at least short-term support in the region of the January low on Friday it removed some pressure from its neighbours and competitors to seek weaker currencies to maintain their relative positions.

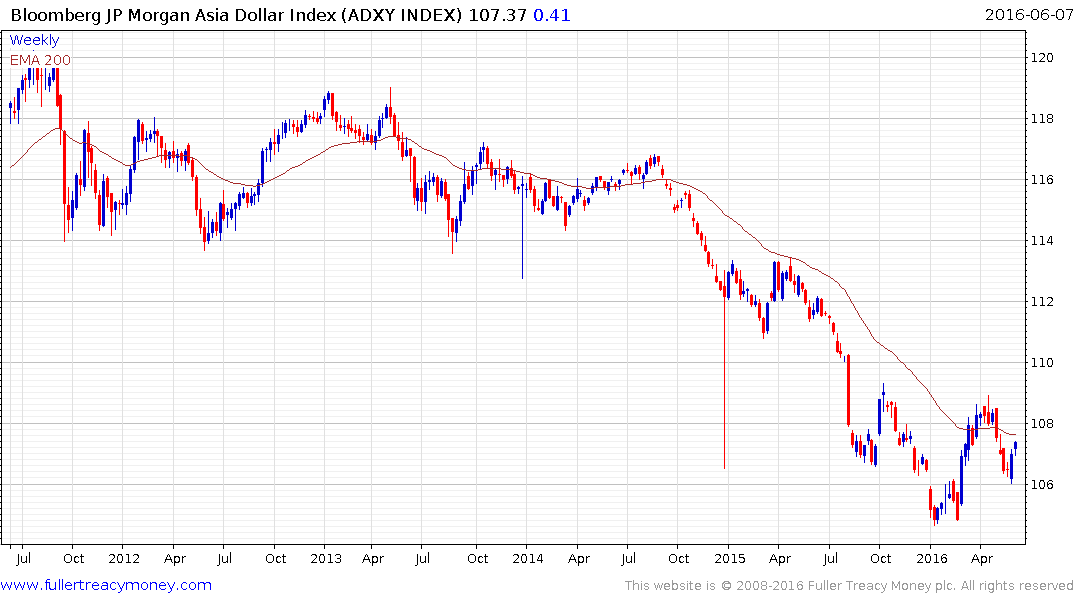

The Asia Dollar Index formed an upside weekly key reversal last week to confirm support above the January low and has followed through to the upside so far this week. A sustained move back below 106 would be required to question potential for additional upside.

Very short-term considerations aside there is a big difference between the Renminbi and the vast majority of ASEAN currencies. The former has really only started to trend lower while the Indonesian Rupiah, for example, almost halved between 2011 and October 2015. When we speak of how much competitiveness can be gained from currency devaluation ASEAN is in a very favourable position.

With currencies appreciating from depressed levels, the nominal performance of country indices will be flattered from the perspective of foreign investors. A measure of how disillusioned investors have been with emerging markets was a comment made at Jeff Gundlach’s talk a couple of weeks ago that everyone was expecting emerging markets to do well in 2015 and that it was a disaster. However what the charts indicate is that while 2015 was a disappointing year, 2016 is looking more favourable as economies begin to benefit from the improved competitiveness they have garnered from currency depreciation.

Indonesia’s Jakarta Composite Index found support three weeks ago in the region of the trend mean and hit a new recover high today.

With a new reform minded president the Philippines Composite Index continues to march back to test the 2015 peak near 8000.

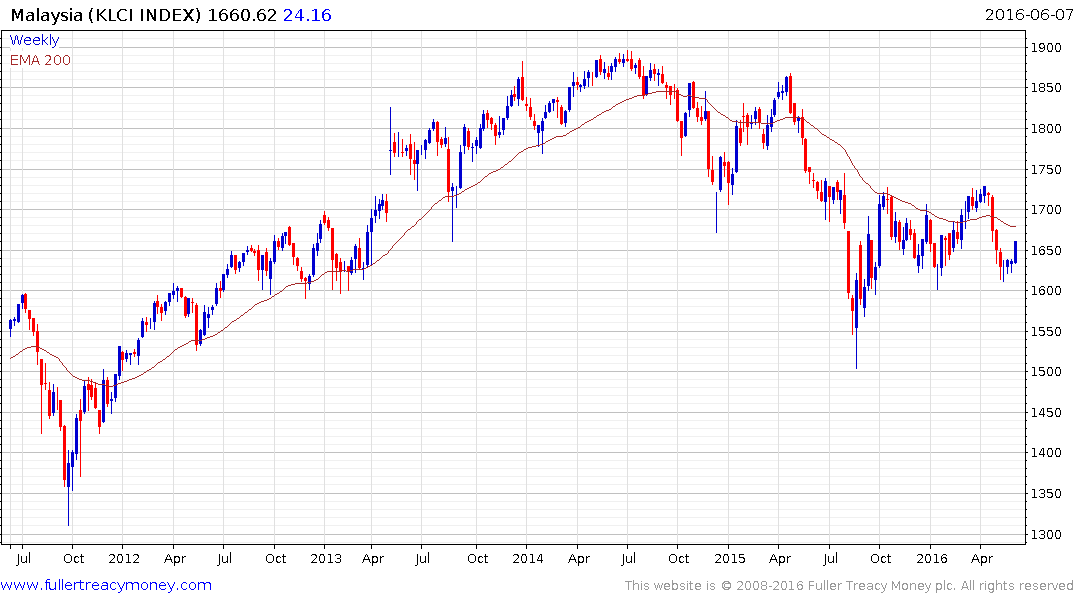

Malaysia’s Kuala Lumpur Composite Index is bouncing from the 1600 area which has provided support on a number of occasions since October.

The Vietnam Index has been ranging for over two years and is now testing the upper side of that congestion area.

The South Korean market has been ranging for almost five years and is currently rallying back towards the upper boundary. A sustained move above 2100 would begin to signal a return to demand dominance beyond the short term.